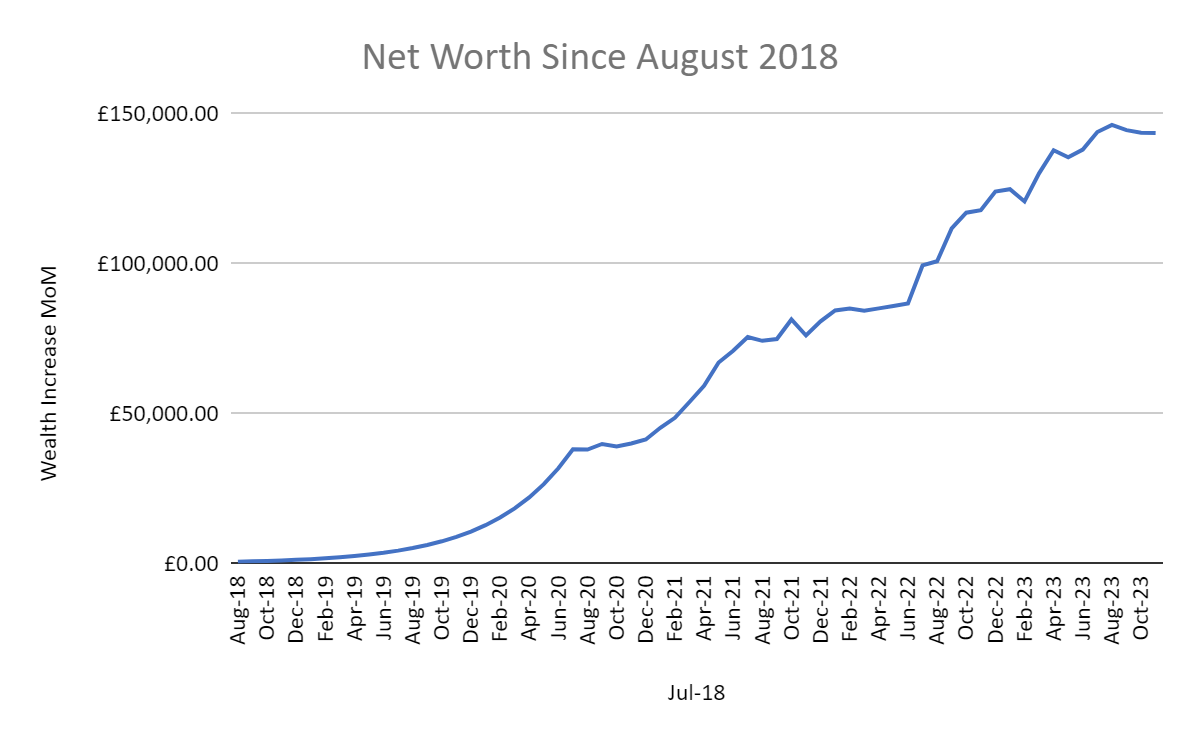

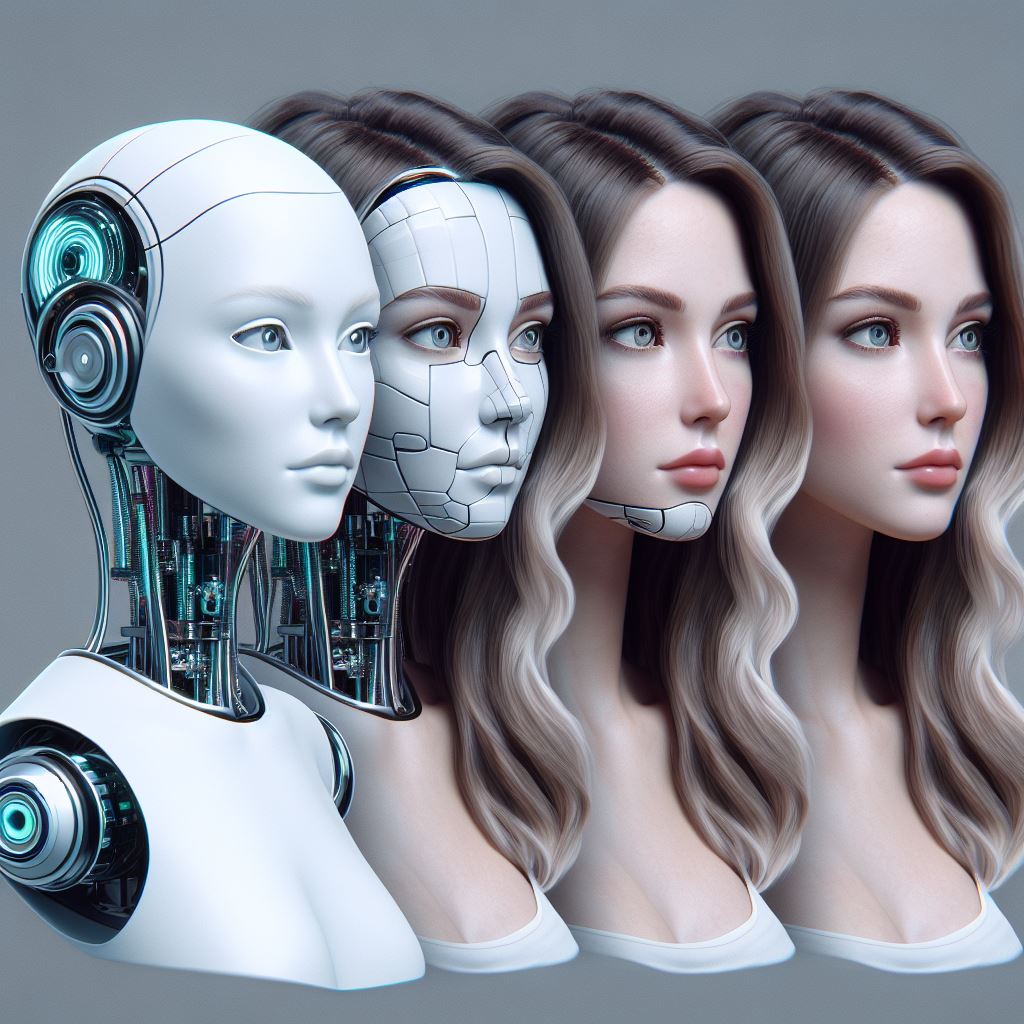

Imagine generating revenue for years to come, just by uploading 30 minutes of audio online. Imagine being early to YouTube or TikTok? This could be the opportunity you’ve been waiting for!

On the 12th February 2024 (about an hour ago at time of writing), ElevenLabs released the below statement, allowing people to make passive income from licensing their voice:

You read that right. If you clone your voice using their software, every time someone uses/licenses your voice you get a cut of the revenue generated.

Although this might come across as scary to some in the industry, it could be quite the reverse. For the best voice actors out there, they could make a lot of side income simply by cloning their old material and letting people use it.

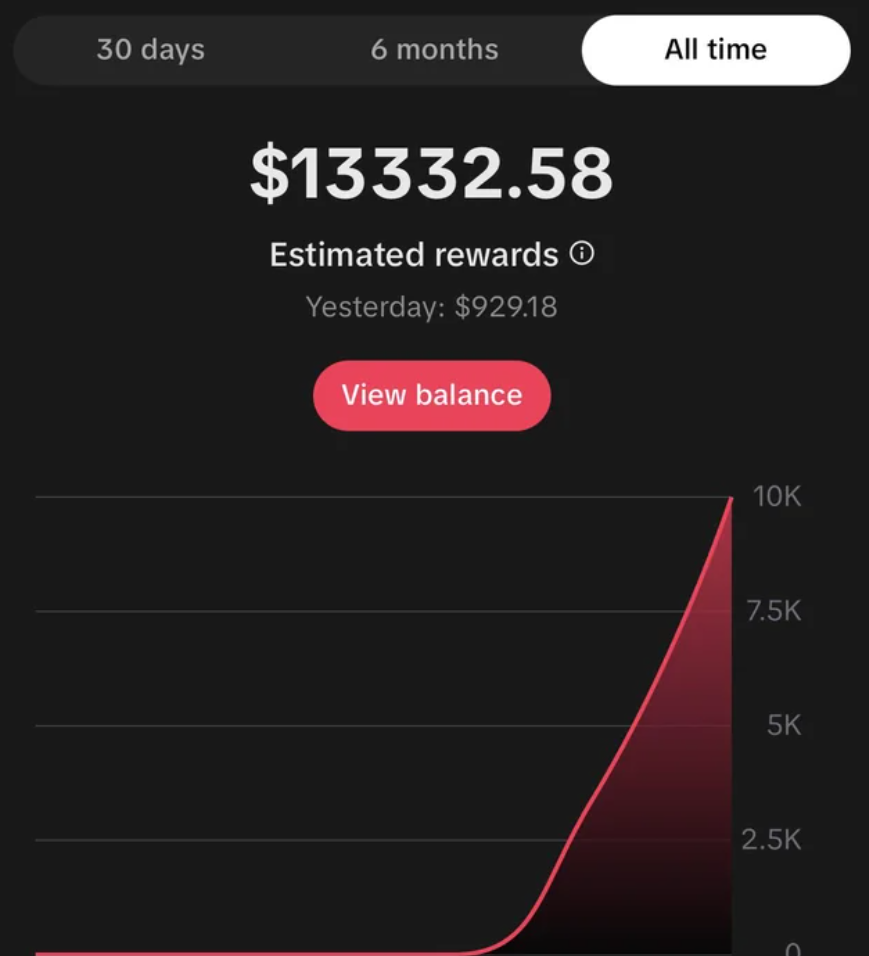

We don’t currently know how much they are paying, but the business charges between 10–20$ a month so is not short of cash to throw at creators. I would expect them to start paying the big creators a lot of money to get more people onto the platform, just like TikTok started doing with the creator fund. It is also a chance to gain exposure and get paid for at the same.

If you want to get started simply click here

To understand the process, read on below.

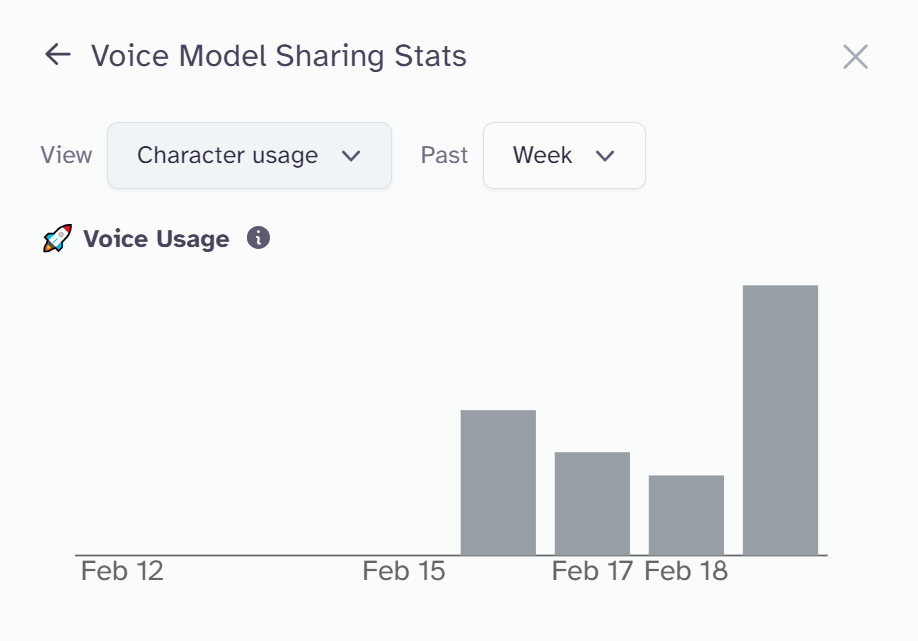

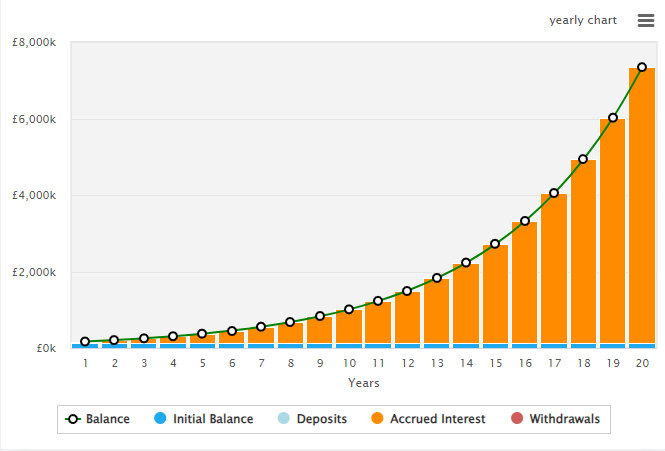

Above is where your voices will be shown, you can see some of them have over 100k uses, and this is very early on in the platforms history. But they are doing all the right things and rewarding people.

What do you need to get started?

- Subscription to Elevenlabs. Unfortunately, you need to pay for one, rather than the free version (although I recommend trying out the free version first to get used to it). You need the “Creator” tier otherwise you simply won’t be able to access this, but you only need this for the first month (from what I can gather).

- Pretty good mic, most have one these days, but a Blue Yeti or something similar is a good place to start, possibly a pop filter

- 30 minutes MIN of audio recorded, I just used audacity and the current book I am using. Elevenlabs recommends up to 3 hours of content to get the best results. The more the better basically!

- Allow you voice to be used, there will be a button to add to the marketplace

- Connect your stripe account — and wait to get paid.

There is nothing active about this. You are unique, and the more unique your voice the better. I think getting onto the platform early could have big upside potential. Imagine generating revennue for years to come!

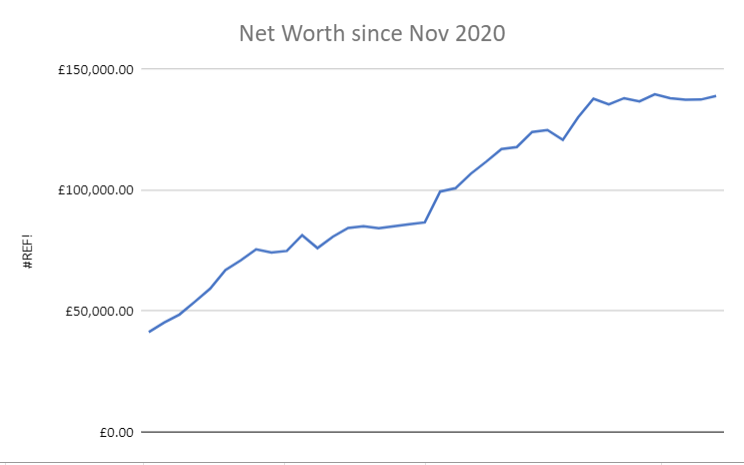

How Much Money My Faceless YouTube Has Made in 90 Days

Some people are making $1000s a day on these channels, so I thought I would give it a try.

Excuse the thumbnail, but below may be a useful guide for cloning other people’s voices — you can also make plenty of money there! Follow along for more money making tips.