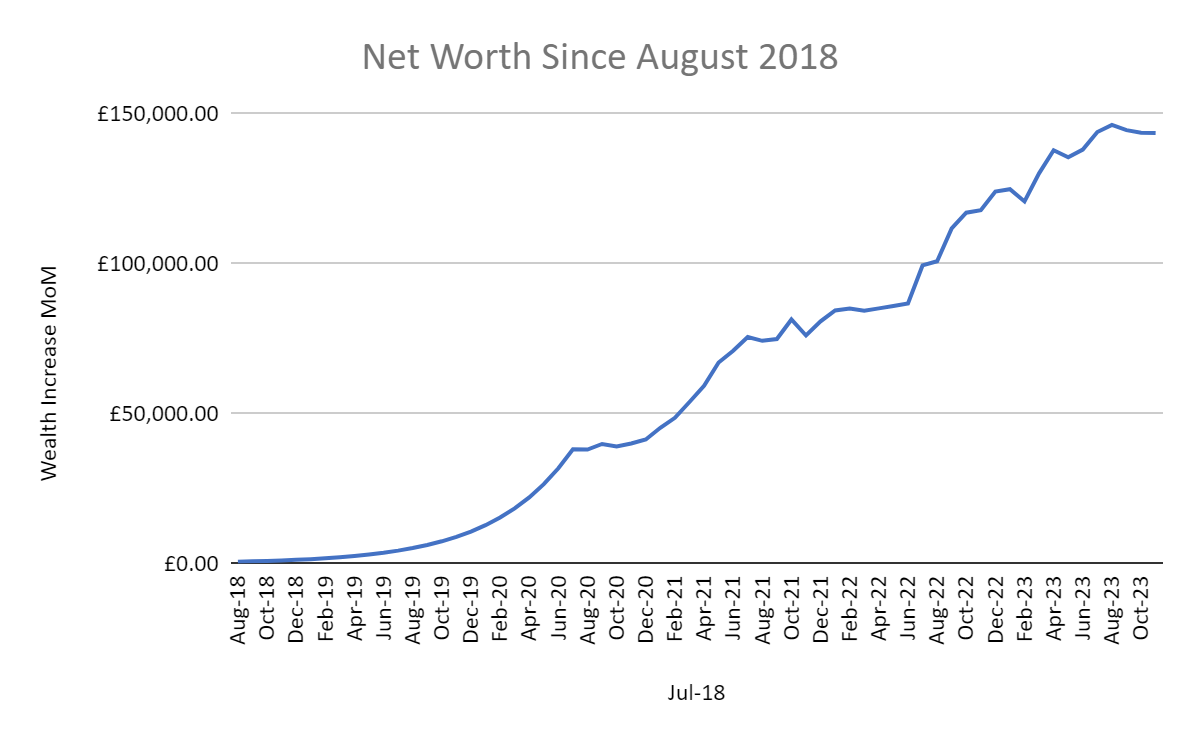

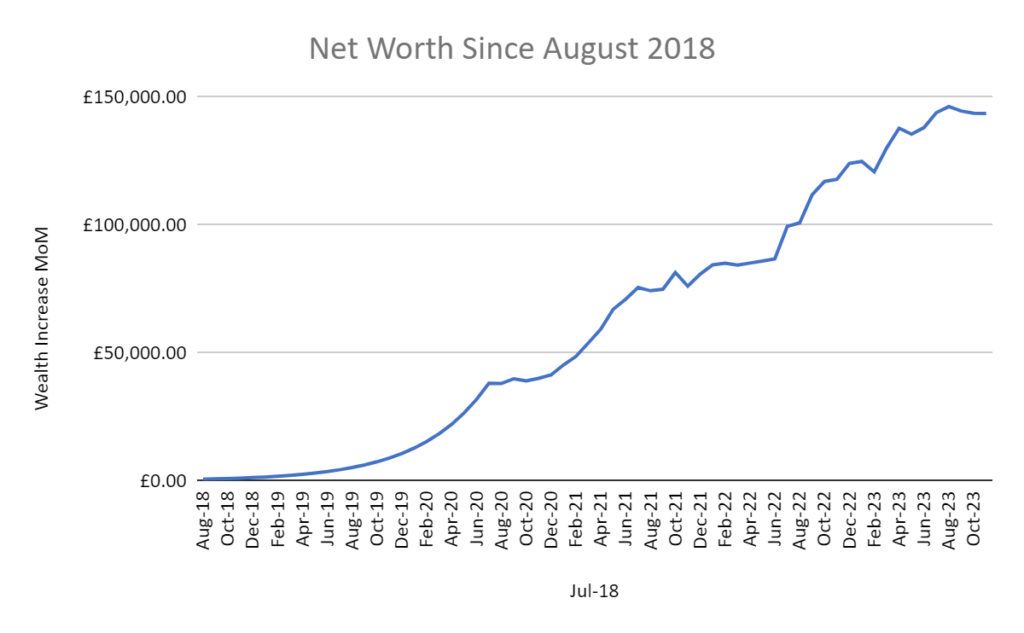

Net Worth Update: January 2024 – £148,729.00 (+£3.8k)

Hell of a month, around a £3.8k increase on last month. Key factors were increase in pension (US markets had a very good Dec/Jan), increase in salary from December an increase in house prices (+£2k).

Having been a bit stagnant for a while, I finally feel I am starting to make progress again. This was a sizeable increase from month to month.

Unfortunately my mortgage fix is due up in August, so any pay increases are going to be eaten up by them.

- Net Worth Update December 2024

- Net Worth Update – November £137,387.68 (-0.5%)

- Net Worth Update – £138K – Oct ’23 (Down £1,573.49)

- September 2023 Net Worth Update (+£2935.51)

- August Net Worth Update: £136,923 (Down by £1,362.49)

Emergency Fund:

More importantly, my savings have got to £2.7k which is the highest they have been in a long-time. I am working towards a cash buffer of £12k – which I’ve estimated to be a strong 6 month emergency fund. This will likely take me at least a year, but I don’t plan to add anything to ISAs or Investments until at least 3 months (6k) is reached. I was going to top this up from an investment I made earlier in the year but that has not paid off and I will have to wait a bit longer (I believe it will come good).

Debt:

Aside from the mortgage (£203k – 21 years), I still have an outstanding £5.7k debt that I’ve been considering paying off when I have the money. However it is fixed at 1.5% so the money is better used elsewhere. I will consider paying it off with excess cash once my emergency fund is at least 3 months necessities. Worth noting past £10k in savings I will have to pay tax on savings interest as I am now a higher-rate tax payer. It would likely make more sense to throw this money at the mortgage, but this is more for piece of mind than anything else.

Side Hustle Income:

I’ve made about £30 this month in all other income sources, but I am working on cash generating ideas that I can scale over the next 6 months. I want to do something in the finance niche, but not really got anywhere yet.

Made my first few affiliate sales, put currently only pennies being made from them. Hoping to generate more in recurring revenue in the near future, so I can maximise the £1000 allowance at a minimum.

Holidays:

I’m going on a big holiday at the end of March, so trying to figure out the best way to manage my cashflow to ensure that I will enjoy myself (and my partner won’t hate me for penny pinching!), but that I can still get the best bang for buck.

We’ve both agree we want to make more money on the side, and save more. Mostly by cutting down on takeaways and eating out. Just cooking food from Aldi has added hundreds of pounds to our budget.