Today, I’m aiming to secure a millionaire future for my nephew, who’ll be born in October. I tweeted about it yesterday and thought it deserved further discussion. So here we go!

My plan? To select a stock, ETF, or portfolio of shares now, which he can cash out either at 18 or 21, as deemed appropriate by his more sensible parents. It’s really a twist on the old “buy them a bottle of whiskey that they can have when they turn 18” kind of vibe.

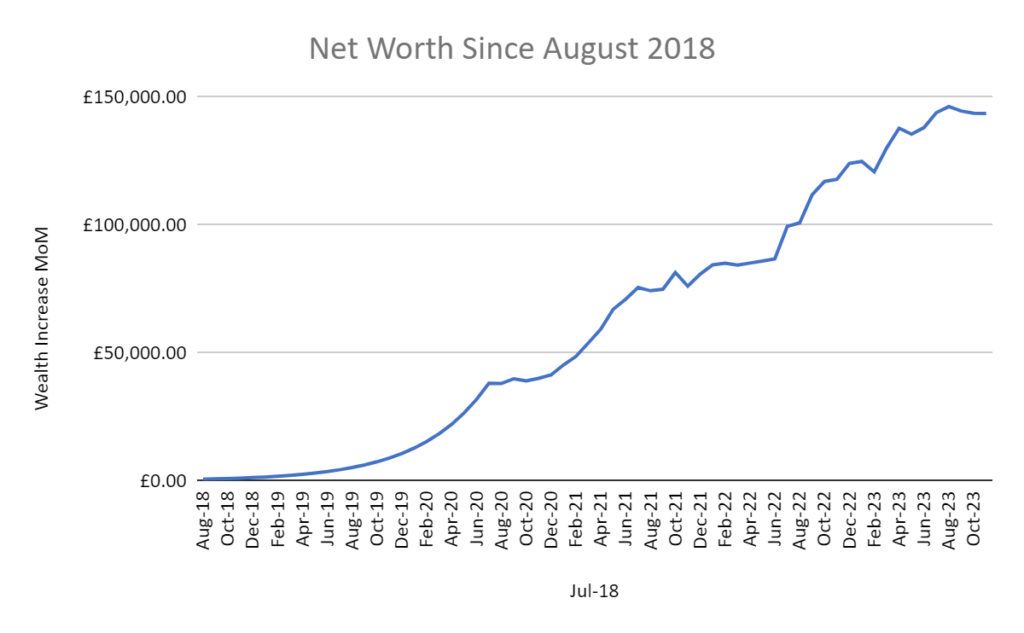

- Net Worth Update December 2024

- Net Worth Update – November £137,387.68 (-0.5%)

- Net Worth Update – £138K – Oct ’23 (Down £1,573.49)

- September 2023 Net Worth Update (+£2935.51)

- August Net Worth Update: £136,923 (Down by £1,362.49)

This is my “fun uncle” investment challenge. Some might find it quirky, but I see it as a fun challenge. The more I thought about it the more I thought it is actually quite difficult.

It is a good representation of long-term investing as once I commit, there’s no altering the investment approach for 18 years!

It will be interesting to see if this will yield better results than my regular portfolio, where I often tweak and adjust (buy and sell too much and incur too many fees hence why I left FreeTrade (June 2023 Update – £138k – And Why I Am Moving Away From FreeTrade)

In my YouTube video, I looked at the below ideas, although of course there are almost too many to count.

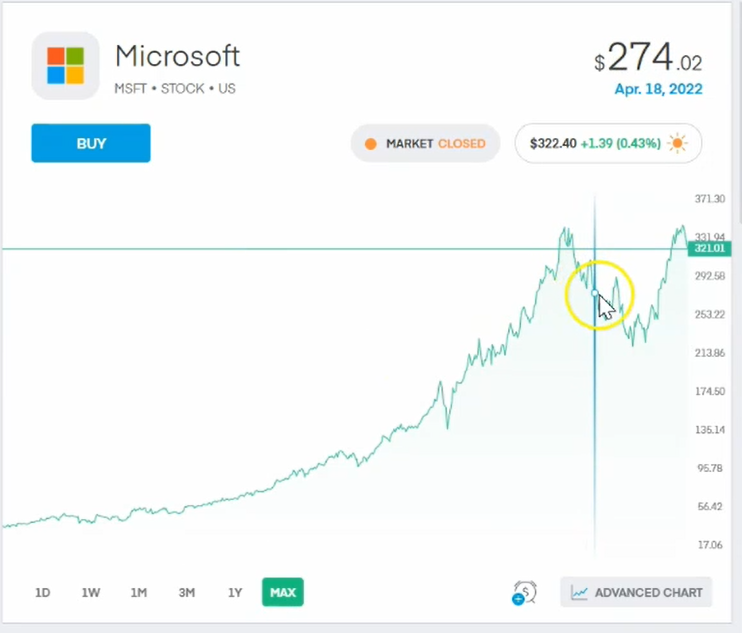

- Microsoft: They’ve been consistent performers, adapting well with tech shifts. Historically, they’ve grown at rates between 10-20%. On Dividendmax.com, Microsoft’s dividend history is commendable. If I use Market Beat’s tools for future dividend calculations, the projections, though approximate, seem promising.

2. S&P 500 ETF: A staple, it has averaged a 10% compound annual growth over the last 30 years, assuming dividend reinvestment.

3. QQQ ETF: A broad tech-focused ETF, it has achieved an impressive 14% average over the last 30 years.

4. NVIDIA: A wild card, its annualized growth rate over five years has been a whopping 44%. While such high growth may not sustain for 18 years, even a conservative estimate of 15-20% growth places it as an enticing option.

I’ve still not made a final decision, this article was really to get my creative juices flowing and get me thinking about the various ways I could approach this. Does anyone have any ideas?