Best UK Savings Account August 2023

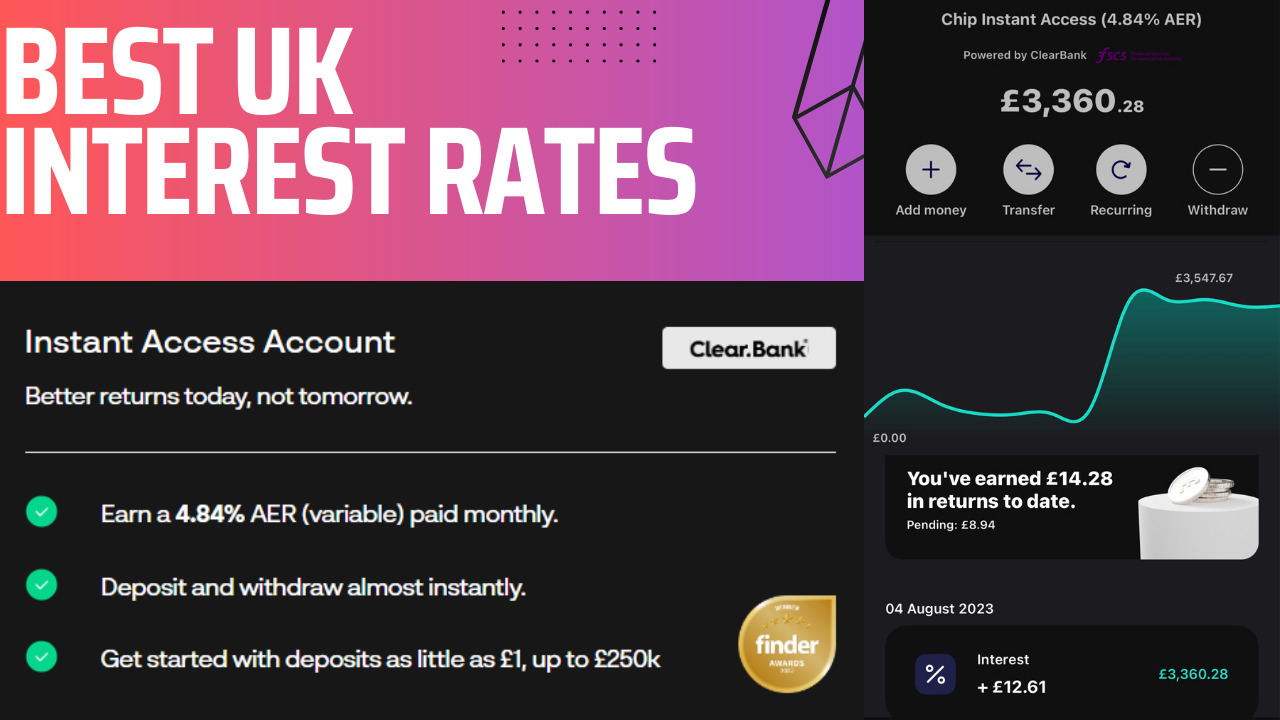

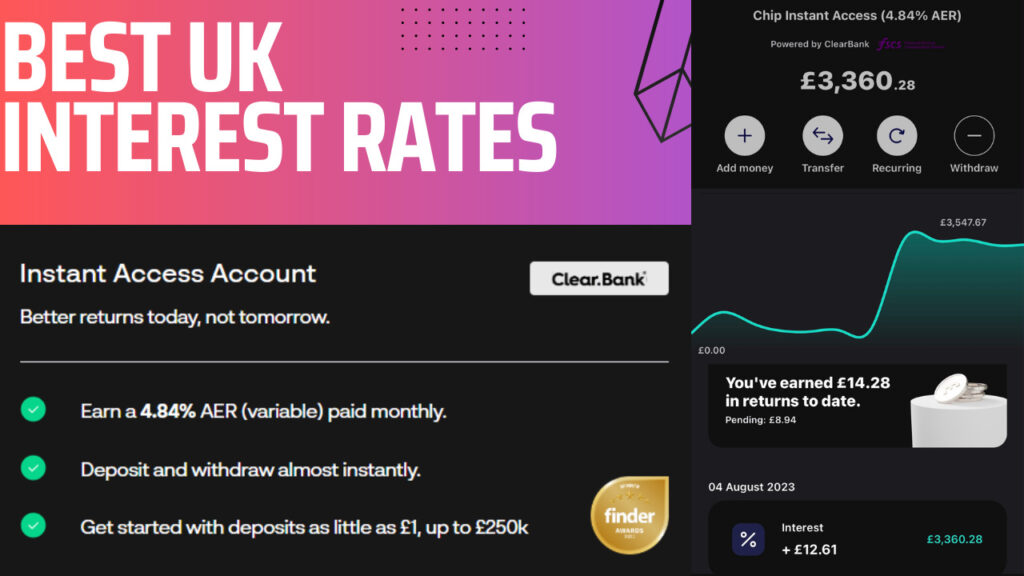

Welcome back to the channel. I have a quick update on interest rates in the UK. The best interest rate I’ve found for easy access money is with CHIP, a mobile-only savings account.

To use CHIP, you’ll need a smartphone or a similar device. If you lack one, there will be an alternative option, which I’ll cover in article.

However, most people nowadays possess a mobile account, and CHIP is among the best. They promptly adjust their interest rates on this account in response to changes in the bank base rate. While not always the absolute best, they are usually very close. Furthermore, CHIP offers unlimited withdrawals and deposits up to £250,000. This is a significant advantage compared to many other accounts available on platforms like MoneySuperMarket. Some of these accounts only allow withdrawals once or twice a year.

So, if you’re looking for a place to keep your money easily accessible and want the flexibility to dip into it throughout the year—whether it’s for oversaving, upcoming mortgage payments, or simply managing your funds—CHIP is the top choice.

In terms of maximizing your returns, the best option I’ve discovered is the Digital Saver account with NatWest Bank. You can deposit up to £5,000 and earn a 6% interest rate. The catch is that you can only deposit £150 per month. I usually contribute this amount on payday.

Any remaining savings go into my CHIP account. Currently, the interest rates on both accounts are quite close. Initially, when I started investing in the 6% account, the interest rate was significantly higher than what CHIP offered. While this might change in the future, at present, the 6% account remains the best choice.

I suggest considering this option for your savings strategy. It provides monthly payouts, allowing for compounding. I currently have around £900 in this account, which amounts to six months’ worth of paychecks.

This earns me around £5 or £6 per month, though exact figures escape me at the moment since I haven’t been paid this month yet. Payouts begin the month after your initial deposit.

Though I can’t provide financial advice, I can share how I manage my accounts. I use the 6% account for my emergency fund and CHIP for funds needed in the short term. Note that CHIP still offers quick access to funds, so it can also serve as an emergency fund.

Once you have these two foundations established, you can start considering investments. However, until you’ve secured these aspects, my recommendation—especially given the current situation—is to prioritize these two steps.