September 2023 Net Worth Update (+£2935.51)

This month was a long one, I feel like I achieved a lot of what I wanted to, and made some dents in my financial goals.

There is a lot below, including a total breakdown of my assets and liabilities, and my side hustles / projects that I am hoping will accelerate my towards retirement.

Want this sent straight to your email each month? Sign up below:

If you are new here, I track my net worth each month to shame me into keeping my spending and investing habits on track.

So far it has worked pretty well.

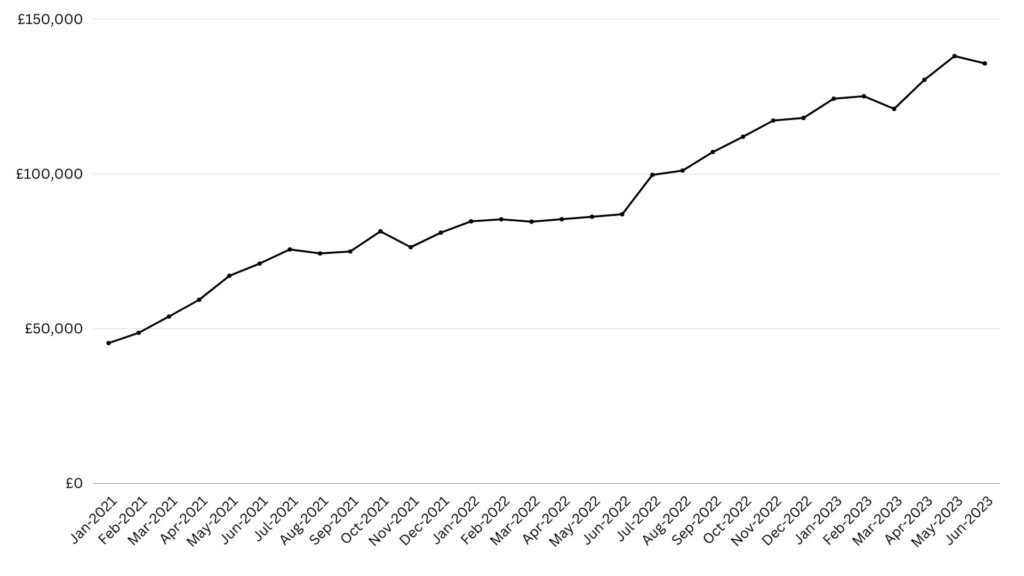

For September I reached £139,859 which is £2935.51 (2%) up since last month. Things are beginning to snowball… hopefully they remain this way as the economy dips.

It’s broken down as follows:

Home Equity: £120,263 – house prices were flat, but I pay off around £600 in debt each month so this is a new ATH number (but not the highest house price). I expect this to come down a little in the future due to pressure on house prices, although because I bought at the lower end of the market I should be relatively isolated from this.

Balance Sheet:

RSUs (Vesting in 2023): £5,000

Shares in FreeTrade: £371

Savings: £2760 (Chip Easy Access at 4.84% and Natwest Digital Saver at 6%)

Trading212: £2,225

Pension: £14,700

Monzo Current Account: £1000

Debt: £6459

Moving forward I am considering upping my contributions to pension. I am likely to go into the 40% tax bracket this year, and my bonus (which is the main reason my NW has had a bump this year) was eaten alive by student loans.

Using salary sacrifice some of this money into my pension would seem the wise decision now I am on a fairly even keel. You can read my article on avoiding student loan repayments here: Does Salary Sacrifice Reduce Student Loan? With Video Explanation.

My current debt is the only thing I am worried about. I expect to surpass cash/stocks/savings of £6459 in the next couple of months, and it is fixed at 1.64% so I am not too worried. But for peace of mind, something I am optimising for a lot at the moment, this could be worth doing.

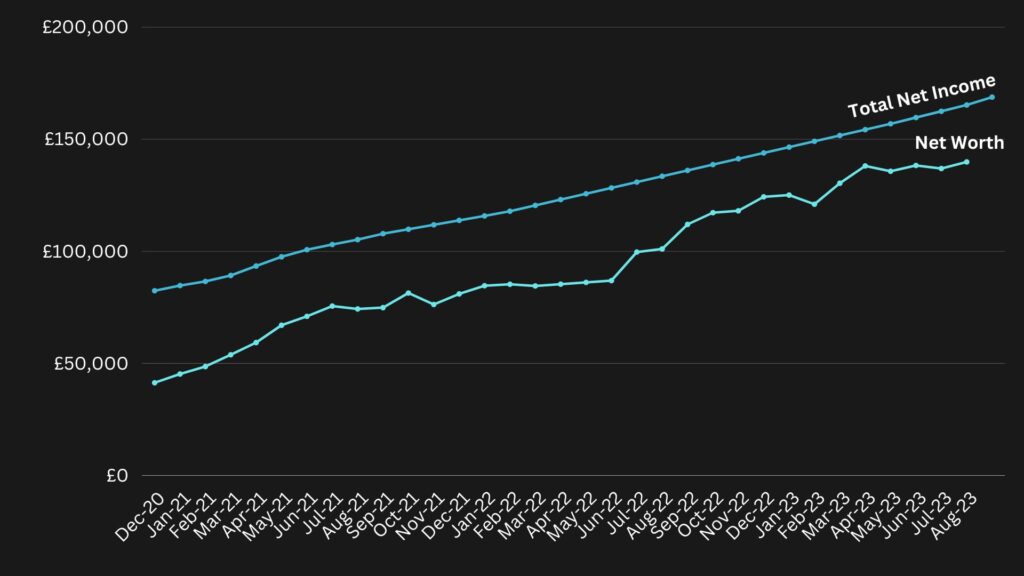

I shared a post on my twitter about the below chart:

“Why Earning Isn’t Enough – INVEST NOW,” I decided to tackle a topic that’s been on my mind.

I shared the below chart that compares total net income to my net worth, something I’ve made a point to track meticulously since I started this financial journey.

What’s interesting is my growing confidence that my net worth is on the brink of surpassing my income, which is a significant milestone. It’s like the financial equivalent of saving 100% of my earnings over the past two years, all while disregarding day-to-day expenses.

Despite the unpredictable financial challenges we’ve all faced over the past couple of years, I’m proud to say that I’ve stayed committed to my investment strategies and remained focused on my financial goals.

There’s a saying that the initial 100k is the hardest to accumulate, and you can actually see this in the accelerating trend within my chart. Now, I’m eagerly waiting for that curve to turn parabolic, a moment I’m sure many of us anticipate.

Currently, I’m standing at 71% of my net income in my net asset column, although I must admit I’m not entirely certain when I’ll reach that significant milestone.

Side Hustles:

Blog 1 – this one, mostly left alone! Didn’t produce much income.

Blog 2: Spent many hours, now ranking for 11 keywords in Google, albeit a fair way down the list. Made its first cent the other day, (total $0.06 so far!).

This is just getting started, I am working hard and plan to grow it into a minimum $1,000 dollars per month business by this time next year. I am tweeting about it, and you can follow me here.

YouTube Channels:

YouTube 1: SEO focused – 3 videos + 1 subscriber (brand new) 7 views

Wildlife Niche Channel: 25k views, total 74 subscribers (mostly shorts)

Personal Finance – 39 Subscribers (+5) and 471 views (mainly long-form)

Example video, you are welcome to subscribe if you’d like!

Definitely spreading myself too thin but they all focus on different things, and don’t really want to mess up my algo with different content at the moment. The SEO stuff is quick to make, just doing short updates about my income etc.