SIPP vs Lifetime ISA – Where Should I Put My Money?

When it comes to deciding between a pension and a Lifetime ISA, there are several factors you should consider. To make an informed decision, you need to understand the differences between these two options as well as your financial goals and current situation.

Subscribe to our newsletter!

A SIPP, or self-invested personal pension, is a type of pension plan that enables you to select your own investments. You contribute to your SIPP, and the money is invested on your behalf. Your savings grow tax-free until you reach retirement age, and you can withdraw your savings as regular income. And you cant take 25% of the money tax-free at retirement age. You could also simply use your workplace pension place to achieve the same affect. This is well worth doing, especially if they match your contributions!

On the other hand, a Lifetime ISA is a savings account designed to help you save for your first home or retirement. You can contribute up to £4,000 per year, and the government will add a 25% bonus to your contributions, up to a maximum of £1,000 per year. The savings in a Lifetime ISA grow tax-free, and you can withdraw them without penalty when you reach age 60 or when you use them to buy your first home.

When choosing between a SIPP and a Lifetime ISA, you need to consider your financial goals. A SIPP may be more appropriate if you want to access your pension savings at an earlier age, while a Lifetime ISA may be better for saving for a first-time home purchase.

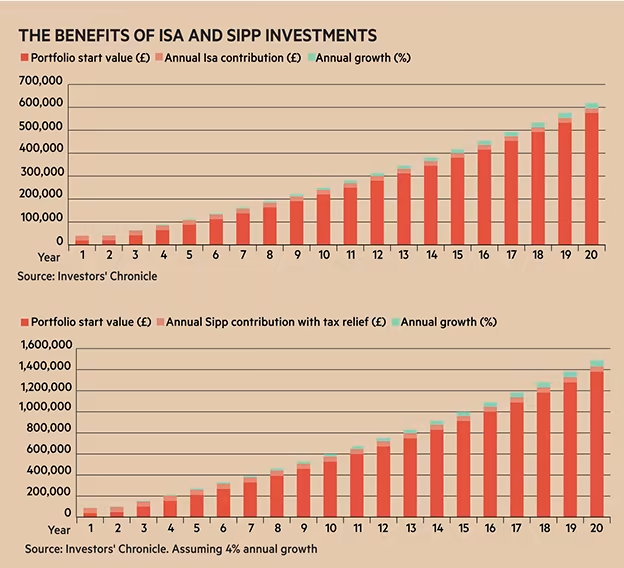

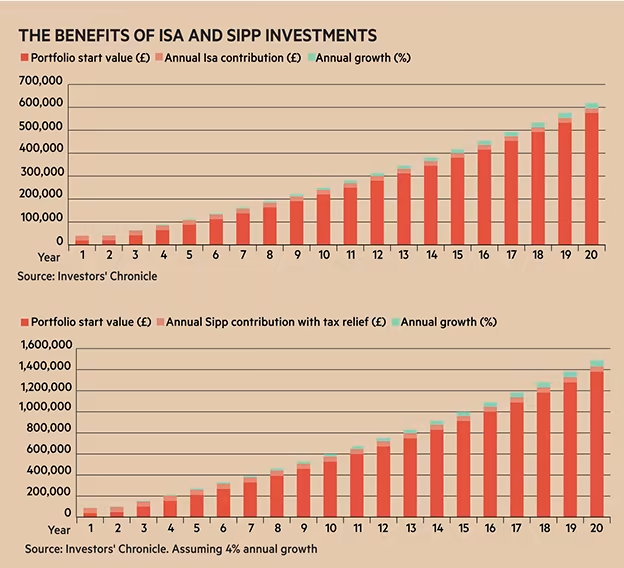

Another consideration is the annual contribution limit. A Lifetime ISA has a maximum annual contribution limit of £4,000, while a SIPP has a higher annual contribution limit of £40,000. A SIPP also offers a wider range of investment options, giving you more control over where your money is invested. However, a Lifetime ISA provides a 25% government bonus on contributions, up to a maximum of £1,000 per year.

Your tax situation is also a factor to consider. With a SIPP, your contributions are tax-free, which can be advantageous for higher-rate taxpayers. With a Lifetime ISA, your contributions are made with after-tax income, but you receive a 25% government bonus on your contributions. It’s the same thing in a different format. I should also note that a SIPP / Pension becomes twice as attractive as you get into the upper tax-bracket since you are getting far more tax-relief on your money (40-45% vs 25% that you’d get as a bonus going into your Lifetime ISA). For more information about reducing tax liability you read our FAQs on Salary Sacrifice Here

Keep in mind that a Lifetime ISA has restrictions on withdrawing your money. If you withdraw your savings for any reason other than a first-time home purchase or retirement, you will incur a penalty of 25% of the amount withdrawn. On the other hand, a SIPP allows you to access your savings from age 55 onwards, with the first 25% of your savings being tax-free.

How Many Lifetime ISAs Can You Have?

Similar to Stocks and Shares ISAs, you can have more than one Lifetime ISA. However, the important thing to note is that you can only contribute to one Lifetime ISA per tax year. This can be good if a new provider comes out with a better lifetime ISA (lower fees, higher savings rate, or access to a much wider selection of stocks and shares). Once money is added for that tax year, you cannot add to that Lifetime ISA again.

Are All Lifetime ISAs the Same?

Not at all, they are have the same foundation but they differentiate based on fees, customer service, and investment options. Below I have written a short overview but I will write a longer version in due course. This gives you an idea of how not all lifetime ISAs are the same.

Top Five Lifetime ISA Providers

- Hargreaves Lansdown: With a strong reputation in the financial services industry, Hargreaves Lansdown offers a Lifetime ISA that stands out for its accessibility. Their platform is intuitive, and the availability of a high-quality mobile app makes account management convenient, even on the go. They offer a wide variety of investments for their Lifetime ISA, making it suitable for diverse investment strategies. However, potential savers should be aware of their platform fees, which might be high for some users. Customer service is another strength of Hargreaves Lansdown, with responsive and knowledgeable support teams.

- Nutmeg: Nutmeg has made its name in the robo-advisor space, providing a fully managed Lifetime ISA with automatic investments based on your chosen risk level. They offer a broad range of risk profiles to suit different investment preferences, making them a great choice for both conservative and aggressive investors. Their platform is user-friendly, with a sleek design and easy navigation. The main drawback is their management fee, which may be higher compared to other providers.

- AJ Bell: AJ Bell’s Lifetime ISA stands out for its self-investment feature, allowing users to manage their own portfolios. Their platform is straightforward and user-friendly, designed to help you navigate the investment process with ease. They have a reasonable platform charge, however, keep an eye on trading fees which can add up if you trade frequently. In terms of customer service, AJ Bell is known for its dedicated support team.

- Moneybox: If you’re new to investing, Moneybox offers an excellent starting point with its user-friendly app. Their unique feature allows you to round up purchases and invest the ‘spare change’, making saving a seamless part of everyday spending. However, their fees might be high if you’re only investing small amounts. Their customer service reputation is generally positive, with responsive support via the app.

- Skipton Building Society: Skipton is a top choice for a cash Lifetime ISA, offering one of the highest interest rates in the market. They have a robust reputation for customer service, with their support teams often receiving high praise. However, their digital services are somewhat limited compared to other providers, with less emphasis on app-based account management.

- Foresters Friendly Society: Offering a Lifetime ISA with a focus on ethical investments, Foresters Friendly Society has a strong history of performance and regular bonuses. They have yet to develop a robust digital offering, which may affect accessibility, particularly for tech-savvy savers. If you want to have a positive impact on your LISA

- The Share Centre: Known for their wide variety of investment options, The Share Centre offers a user-friendly platform, making investment management straightforward. However, dealing charges and an annual account fee should be factored into the cost equation.

- Newcastle Building Society: Renowned for their competitive interest rates and excellent customer service, Newcastle Building Society provides a solid option for a cash Lifetime ISA. However, they lack a mobile app, which may affect on-the-go account management.

- OneFamily: Offering a managed approach to investing in stocks and shares, OneFamily is an attractive choice for those who prefer hands-off investing. However, their customer service rating isn’t the highest, something potential investors might want to consider.

- Paragon Bank: Paragon Bank’s cash ISA comes with an attractive interest rate and strong reputation for customer service. However, like several other providers, they lack a mobile app, which could affect accessibility for some users.

My Thoughts on SIPP vs Lifetime ISA:

I personally believe that the lifetime ISA is a great vehicle of long-term investing, for those that value liquidity. Yes, you pay a fee if you take money out of the ISA, (works out at around 6%), but if you were taking out this money to, for example, start a business it gives you many more options than a pension.

It also has a final psychological factor, the penalty aspect of the Lifetime ISA may actually lead to higher results. People are less likely to dip into something that has fees for taking money out of, and therefore are more likely to stick with their long-term investment goals. I think this is a factor that a lot of people do not consider. You may also want to look at things like salary sacrifice and the impact on your student loan repayments for example.

Ultimately, the best choice for you depends on your individual circumstances and financial goals. It may be helpful to consult a financial advisor who can assist you in determining which option is most suitable for you. They can also assist you in evaluating your overall financial plan and investment strategy. If you are an upper-rate tax-payer and can afford to do both, the lifetime ISA is a great secondary pension.

Subscribe to our newsletter!