Does Salary Sacrifice Reduce Student Loan? With Video Explanation.

In recent years, salary sacrifice schemes have become increasingly popular among UK employees as a means of reducing their tax liabilities and increasing their take-home pay. One question that often arises is whether participating in a salary sacrifice scheme can have an impact on student loan repayments. In this blog post, we will explore the relationship between salary sacrifice and student loan repayments.

The Short Answer is YES! Therefore, if you plan to never repay your loan like most graduates in the UK, you should consider using salary sacrifice to invest the money on your pension, or car allowance etc.

If this article does not answer your question, I have finally created a frequently asked questions for salary sacrifice that you visit here this talks about the impact on benefits, pensions, maternity pay and many other things.

Salary Sacrifice: What is it? And How does it Work?

Salary sacrifice, also known as a ‘salary exchange’ or ‘pay sacrifice’, is a legal arrangement between an employee and their employer. In this agreement, the employee agrees to give up, or ‘sacrifice’, a part of their pre-tax salary in exchange for certain non-cash benefits.

The benefits that can be included in a salary sacrifice scheme are wide-ranging and can be tailored to the needs and preferences of the employee. Here are a few examples:

- Pension Contributions: This is one of the most common uses of salary sacrifice. The employee agrees to a lower salary, and the employer contributes the difference to the employee’s pension pot. This can have significant tax advantages, as both the employee and employer can save on National Insurance contributions.

- Mobile Phones: Some employers offer mobile phones as part of a salary sacrifice scheme. The cost of the phone is deducted from the employee’s pre-tax salary, potentially offering savings on income tax and National Insurance.

- Season Tickets for Commuting: If you commute to work by train or bus, a season ticket can be a significant expense. Some employers offer season tickets as part of a salary sacrifice scheme, which can make commuting more affordable.

- Childcare Vouchers: For employees with young children, childcare can be a significant expense. Some employers offer childcare vouchers as part of a salary sacrifice scheme, which can help make childcare more affordable.

The key advantage of a salary sacrifice scheme is its potential tax efficiency. Because the benefits are deducted from the employee’s salary before tax, the employee pays less income tax and National Insurance. Similarly, the employer also pays less in National Insurance contributions.

Firstly, it’s important to understand how student loan repayments work in the UK. Currently, UK students who take out a student loan to pay for their university education start to repay the loan once they start earning a certain amount of money. The repayment threshold is currently £27,295 per annum for Plan 2 student loans (introduced after September 2012), and 9% of earnings above this threshold are deducted automatically from the borrower’s salary through the PAYE (Pay As You Earn) system.

Now, let’s look at how salary sacrifice works. Salary sacrifice is a scheme where an employee agrees to exchange part of their salary for a non-cash benefit, such as a company car, childcare vouchers, or a pension contribution. The benefit is paid for by the reduction in the employee’s salary, which means they pay less income tax and national insurance contributions.

So, can participating in a salary sacrifice scheme reduce your student loan repayments? Yes, if it reduces your gross pay (which I think all SS schemes should do). Let’s look at a couple of examples:

Example 1: No Salary Sacrifice – £50,000 salary, £2998 take home pay, £170 in student loan repayments

Example 2: Salary Sacrifice – £50,000 salary – Sacrificing £500 per month – Take home £2703, £125 in student loan repayments

- You’ve lost about £200 in take home pay, but contributed £500 to your pension (via Salary Sacrifice), and you are paying £45 less per month in student loan repayments.

- You’ve essentially invested the saving on student loans to go into a pension plan that should be growing. Overall this could be a much more efficient plan towards wealth.

Whether you want to reduce your payments or not is a financial decision you need to make. One could put all the excess money into a pension and live on an artificially low salary for many years to avoid repayments, in the hope it is wiped off after 25-30 years. Below a certain threshold you can also keep interest rates on it low.

It’s also worth noting that salary sacrifice schemes can have an impact on other aspects of your finances. For example, if you choose to sacrifice part of your salary towards a pension contribution, you will pay less income tax and national insurance contributions, but your pension contributions will also reduce your taxable income. This means that your overall tax bill will be lower, but your pension contributions will not be counted towards your gross salary for student loan repayment purposes.

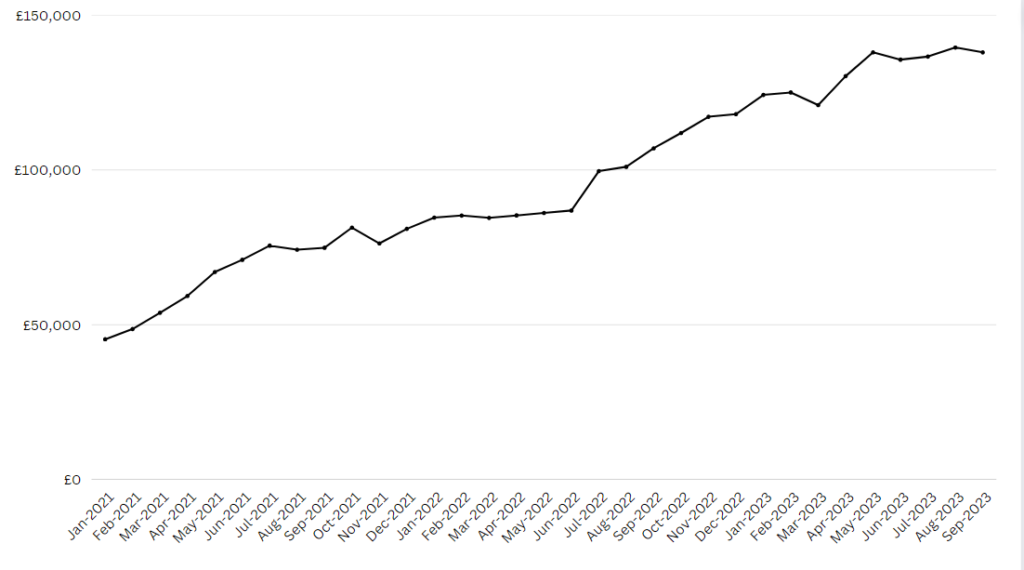

This blog is dedicated to helping people achieve financial independence, read on below to find out how I am doing with my journey too!

- Net Worth Update December 2024

Finished the year without much of a bang, in total I reached £138,949.26 which is about a £1472 increase from last month, and an increase of 14k year on year from December 2022.

Want to follow my journey, get all my updates each month:

For those that are new here. I am Seaward, a 28-year-old living in the UK. Trying to be independently wealthy ASAP so I can focus on the things that bring me more joy. I still have a lot of fun and am not super frugal. Optimizing tax savings, and income rather than being frugal all the time.

Home equity still makes up the vast proportion of my net worth but it has been coming down in recent months. It currently stands at 83.77% (down from 90% at the end of December 2022). The single biggest factor in my net worth has been house price fluctuations. So with them declining slightly (on paper) this year, I am pretty happy that my net worth has improved and steadied over the last few months.

The biggest developments, for the first time in a while, have come from my income increases. It’s hard to track exactly but next year I should make a net income of at least £40k in 2024 which is equivalent to around a £60k gross salary (despite my actual income being around £48k). This is because I “rent a room” to my girlfriend who now lives with me. She gets very cheap rent, and this helps me save more (she also saves more now than she did in rented accommodation – her “rent” is very light for the area!).

The above excludes income from bonuses and RSUs, which should be around £5k gross this year. Bonuses are rare at the moment.

This ALSO excludes income from savings, dividends, blogging etc. Currently, these are minimal (around £100 a year), but I hope to balloon this to be worth at least one day of “normal” work. I’ve been trying a lot of things this year, and plan to sit down and focus on one or two that have worked well for me. This blog is really about documentation rather than any “real” money. Although I have heard of finance bloggers making a lot of money, I’m not sure anyone wants to hear from me.

Combining some of my finances with my partner, and talking to her about them, has been a revelation. You can read more about this topic here: FIRE Update – December 2022 – £124k – (Joint Finances and Life Changes) Working together makes the whole game of life a lot easier. It can be done as a single person, but the system is set up for a team of 2 or more.

Goals for 2024:

For 2024, I want to get this number to £166k, around a 20% increase. Even with house prices staying static, this should be achievable. I want to compound at close to 20% for as long as I can. I didn’t manage it this year, unfortunately (11%).

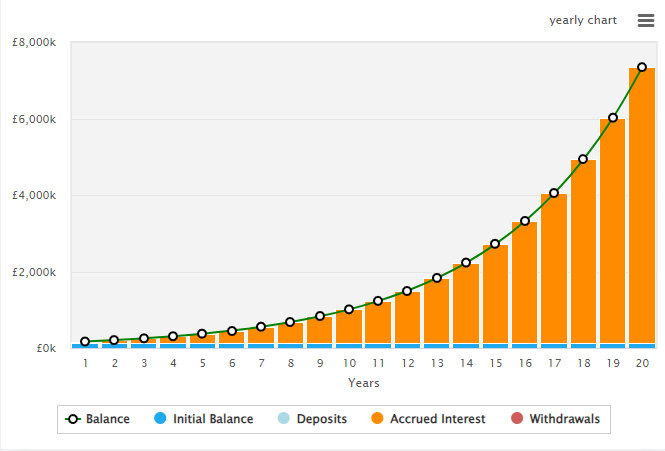

But if I can, I can follow the below chart:

Returning 20% a year is going to be tough in the future when I can’t just save my way there. House prices are unlikely to rise at that kind of rate, so I need the rest of my assets to compound fast or save/earn a lot more. Realistically it’ll be a combination of them all. They say the second 100k is easier than the first, but those people were living in a bull market.

My main concern is the cost of my mortgage going up with interest rates as they are. I could lose 200-300 a month in net cash. That’d hinder my life significantly.

Signing off for 2023. Good luck to all my readers in 2024. May they be healthy and prosperous for you and your loved ones.

Want to follow my journey, more blog posts below:

- Net Worth Update – November £137,387.68 (-0.5%)

Not the prettiest of months, I had to write down my RSUs (which also vest next week and I will be paying tax on!), due to my company being at a 5 year low. Bit of a tough one as I was hoping these RSUs would give me the cash buffer I could do with at the moment. My net worth has been stagnant for the past few months, but given the decline in stocks and house prices I think I have down well to cling on. When the bull market returns I expect to do very well.

Life: There has been a lot going on in my life with the birth of my first nephew and various drama. I ran my first half marathon in a time of 1.55 which is reasonable I think… not quite the 1:45 I wanted but I definitely did not train enough for it. My mental health has been “ok” but not marvelous. Mostly because I hurt my foot and could not run. It’s amazing the effect of not being able to do the thing you rely on for your mental health. All my other habits didn’t happen nearly as often as they should have done once I stopped running. I need to diversify the tools I use for my mental health, mediation, singing anything really.

Portfolio: £3450

I changed my strategy for my Trading212 investing account as I decided I wanted to be much more ambitious in this portfolio. My risk tolerance is very high, and I have plenty of exposure to S&P in my pension (I changed from the Scottish Widows North American Fund to an actual S&P one, I hadn’t realized the fees were so high on the former (0.8%!) which will save me a lot in the long-run.

I bought two quite ambitious and risky stocks this month (and consolidated all my investments into these two) Oxford Nanopore – I bought just after they were mentioned in Apple’s M3 chip launch hoping for a bit of a trade. I’m up about 6% in a week but I think that is from sentiment turning around within sequencing. PacBio massively outperformed expectations so the sector has turned, momentarily at least, bullish. The second company I bought this month is Oxford Biodynamics Plc as they roll out their new prostate cancer test in the US and UK. Currently neither are profitable, but the amount of growth potential (and actual revenue sales) is outstanding. I’m very much looking forward to seeing how they fair.

Rest of the balance sheet looks like this:

- Pension: £15500

- Crypto: £700 (staked Ethereum)

- Savings £1884 (NatWest Digital Saver and Santander 5%)

- Home Equity: £118,000

- RSUs vesting 2023 – £2800 (subject to tax on vest)

- Stocks – £3450 and £371 left in FreeTrade (via Crowdcube)

My girlfriend and I have reached an agreement for me to focus on my side hustle at certain times of the week, and she is going to help hold me accountable. I’m still debating which of them I want to go “all-in” on but I’m seeing some good traction on Google for one in my professional and local niche, which I think would be well worth fleshing out.

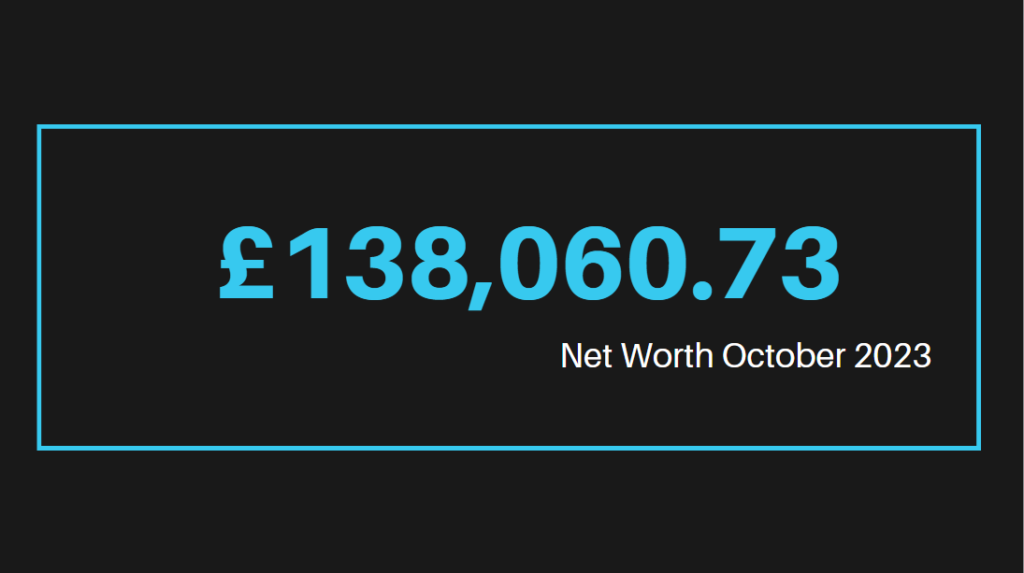

- Net Worth Update – £138K – Oct ’23 (Down £1,573.49)

If you are new here I update this blog with my net worth each month, tracking my progress to financial independence. Like many chasing FIRE (Financial Independence Retire Early) I mostly chasing this so I can focus my times on things that I love.

To see how I got started you can look at all my net worth posts here: https://growingmoneytrees.org/net-worth/

The closer you are to being non-reliant on your day job the more risks you can take, the more skills you can learn, or art you can produce. I love this idea. Whilst I am still trying to do as many thing as I love whilst I am young, I like to look at my life through incremental progress and the net worth number is a good way to do this.

If you’d like to follow along you can follow my newsletter here:

October:

This is really for the month of September, I do the reflection at the start of the month. I can’t quite remember when this got pushed but anyway!

I thought I would have made a bit more progress this month, and to be fair, I would have done if it wasn’t for house prices starting to crash. As I track based on the median price on Zoopla (I know, these are almost always too high), I had to write down my equity by £3k this month. Without which I would have increased my net worth by (quite typical) £1.5k.

Hey – If you want to read some oldies to see how I got started, then click below:

Property:

I’m quite glad that my net worth is becoming less reliant on my property price. Property value really does not give me much, and I am more than happy for them all to crash by 30%, it makes no different to me. If it makes life easier for all then I am happy. I know there are plenty of people with much less equity who will be hit, badly, so there is no good answer. It’s all a bit of shambles at the moment. Currently my equity is: £117k – which still makes up 85.38% of my net worth – ridiculously high I know! But it used to be 99% 3 years ago, so I feel this is pretty good progress.

Balance Sheet:

- RSUs: £4,500 (down £500) – only those vesting this year

- Monzo: £1000 – flat I only keep living expenses here

- FreeTrade Shares: Remain at £371

- Savings : £1915 (split between Santander 5% easy access, and NatWest Digital Saver – £150 per month)

- Trading212 – £3448 (started dripping savings into here at £5 a day, and a £150 a month)

- Pension: £15,500 – Around £500 a month going in here (going up next month) from myself and employer, could probably afford to put a bit more here, but there is some much uncertainty at work I’m keen to keep more powder dry

- Debt: -£6319 – fixed at 1.7%

Income:

- Ezoic (blogging): $3.24

- NatWest: £5.67

- Medium: £0.21 (just started!)

- Chip: £2.45 (now moved to Santander)

- Stock Income: £3.90

- Other: $7.67

- Total: £19.23

Not a bad month, starting to generate some cash from a few different places. I’m not actively investing for income but a few of my stocks happened to pay out this month. I’ve literally just altered my portfolio whilst writing this to mostly focus on bullish plays, and very few of them. Below is the pie:

I am bullish on all of these, Microsoft and Costco are my “Safe Bets” that should keep the portfolio going upwards. The others are bets on big things, Coinbase ($COIN) is cheap, Nvidia is not. Tesla is somewhere in the middle. I will have about £2k in this when market opens, and will be adding min. £5 a day to it (might up to £10). And my UK portfolio made up of City Pub Group (My Justification is Here: Last Time This Stock Was Tipped It Went Up 40%) and Games Workshop (GAW). I buy weekly (£25 a week). Total investment per month is £250. Which currently seems sensible but will see what the next few weeks brings us.

Niche Sites:

Google brought in an update on Google Search which changed how people find pages in Google. It was a big move. So far it seems like “actual” business and people who are genuinely interested in their topic are doing well.

This blog is a perfect example, I get a little bit of traffic from Google and other search (around 100 per month). So far I have increased my rankings rather than dropped down. But my other site that is simply a project to try and make money has faired very poorly (from 50 impressions a day to 0). I thought I had written quality content but alas I had not!

Overall a solid month, if you read this far you might want to consider getting this monthly update sent to your email address by signing up below:

Keep Reading for Previous Months Updates:

- September 2023 Net Worth Update (+£2935.51)

This month was a long one, I feel like I achieved a lot of what I wanted to, and made some dents in my financial goals.

There is a lot below, including a total breakdown of my assets and liabilities, and my side hustles / projects that I am hoping will accelerate my towards retirement.

Want this sent straight to your email each month? Sign up below:

If you are new here, I track my net worth each month to shame me into keeping my spending and investing habits on track.

So far it has worked pretty well.

For September I reached £139,859 which is £2935.51 (2%) up since last month. Things are beginning to snowball… hopefully they remain this way as the economy dips.

Tracking My Net Worth

It’s broken down as follows:

Home Equity: £120,263 – house prices were flat, but I pay off around £600 in debt each month so this is a new ATH number (but not the highest house price). I expect this to come down a little in the future due to pressure on house prices, although because I bought at the lower end of the market I should be relatively isolated from this.

Balance Sheet:

RSUs (Vesting in 2023): £5,000

Shares in FreeTrade: £371

Savings: £2760 (Chip Easy Access at 4.84% and Natwest Digital Saver at 6%)

Trading212: £2,225

Pension: £14,700

Monzo Current Account: £1000

Debt: £6459

Moving forward I am considering upping my contributions to pension. I am likely to go into the 40% tax bracket this year, and my bonus (which is the main reason my NW has had a bump this year) was eaten alive by student loans.

Using salary sacrifice some of this money into my pension would seem the wise decision now I am on a fairly even keel. You can read my article on avoiding student loan repayments here: Does Salary Sacrifice Reduce Student Loan? With Video Explanation.

My current debt is the only thing I am worried about. I expect to surpass cash/stocks/savings of £6459 in the next couple of months, and it is fixed at 1.64% so I am not too worried. But for peace of mind, something I am optimising for a lot at the moment, this could be worth doing.

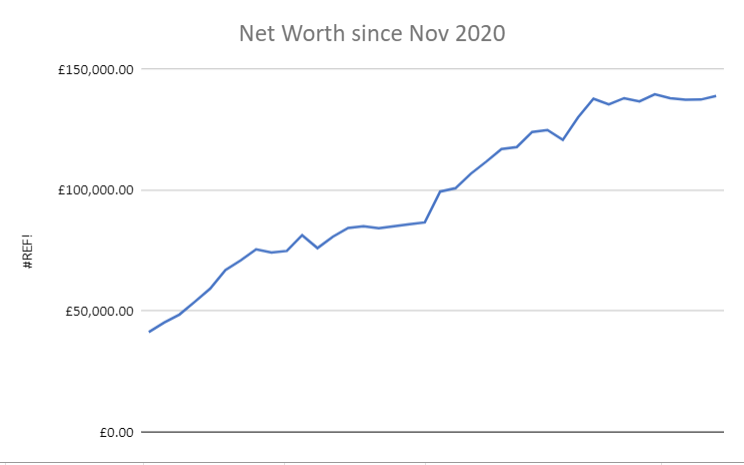

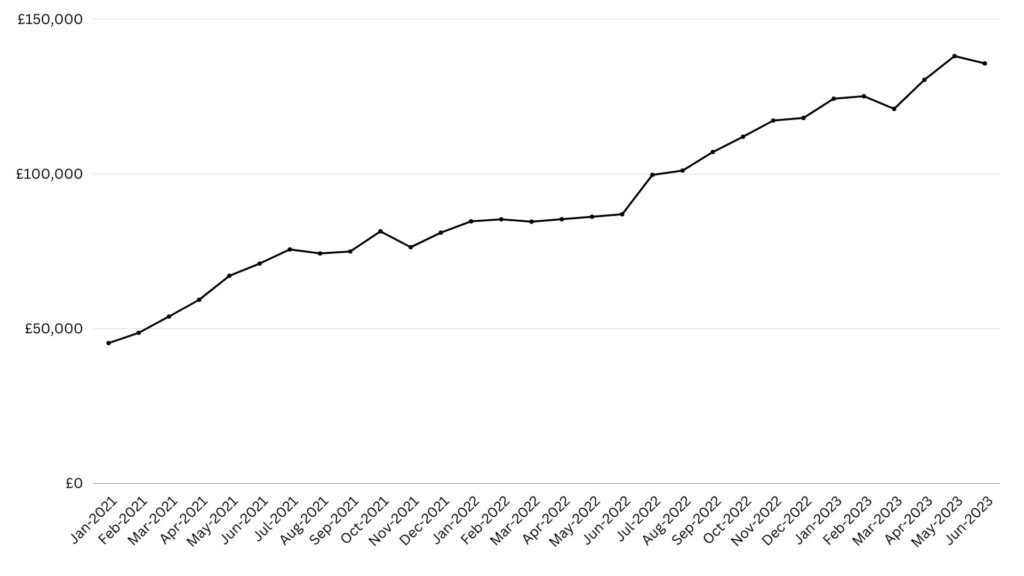

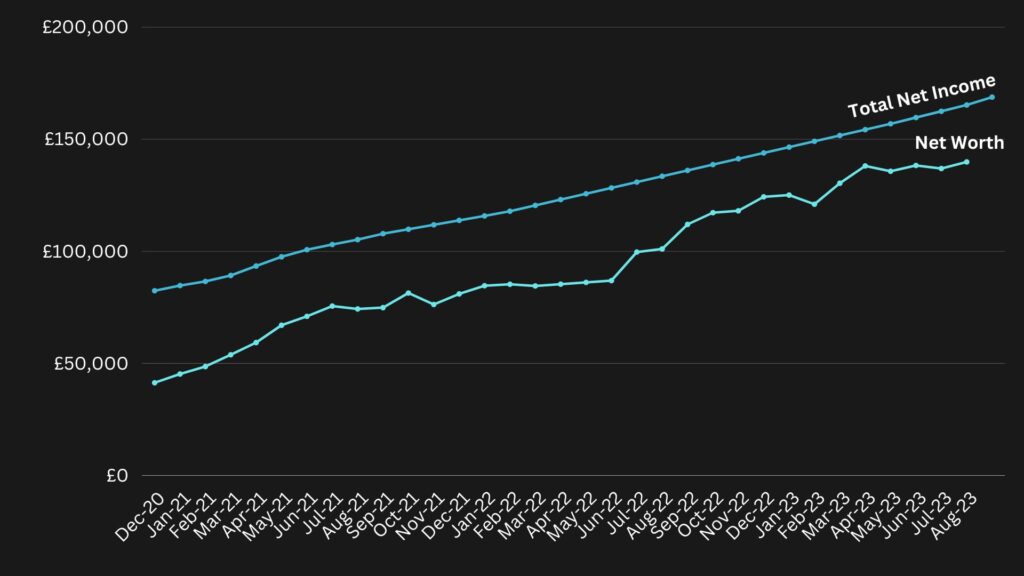

I shared a post on my twitter about the below chart:

“Why Earning Isn’t Enough – INVEST NOW,” I decided to tackle a topic that’s been on my mind.

I shared the below chart that compares total net income to my net worth, something I’ve made a point to track meticulously since I started this financial journey.

Tracking My Net Worth vs Total Net Income What’s interesting is my growing confidence that my net worth is on the brink of surpassing my income, which is a significant milestone. It’s like the financial equivalent of saving 100% of my earnings over the past two years, all while disregarding day-to-day expenses.

Despite the unpredictable financial challenges we’ve all faced over the past couple of years, I’m proud to say that I’ve stayed committed to my investment strategies and remained focused on my financial goals.

There’s a saying that the initial 100k is the hardest to accumulate, and you can actually see this in the accelerating trend within my chart. Now, I’m eagerly waiting for that curve to turn parabolic, a moment I’m sure many of us anticipate.

Currently, I’m standing at 71% of my net income in my net asset column, although I must admit I’m not entirely certain when I’ll reach that significant milestone.

Side Hustles:

Blog 1 – this one, mostly left alone! Didn’t produce much income.

Blog 2: Spent many hours, now ranking for 11 keywords in Google, albeit a fair way down the list. Made its first cent the other day, (total $0.06 so far!).

This is just getting started, I am working hard and plan to grow it into a minimum $1,000 dollars per month business by this time next year. I am tweeting about it, and you can follow me here.

YouTube Channels:

YouTube 1: SEO focused – 3 videos + 1 subscriber (brand new) 7 views

Wildlife Niche Channel: 25k views, total 74 subscribers (mostly shorts)Personal Finance – 39 Subscribers (+5) and 471 views (mainly long-form)

Example video, you are welcome to subscribe if you’d like!

Undervalued Stocks UK Definitely spreading myself too thin but they all focus on different things, and don’t really want to mess up my algo with different content at the moment. The SEO stuff is quick to make, just doing short updates about my income etc.

- August Net Worth Update: £136,923 (Down by £1,362.49)

Hello, everyone! As we welcome a new month, it’s time to update you all on my financial journey. Even though August has seen a slight dip in my net worth, it has been a month full of learning and strategies for future growth. I am starting to see various side hustles tick up, albeit very slowly! Currently income from other sources is at £29 per month, I expect this to go up with the increase in savings rate. I’d like to get to the point where 30% of my income is from an outside source. Eventually of course, it’d be good to get a to 100% but baby steps and all that!

Uncertainty at work has finally been realized in layoffs within my team, I don’t yet know if I will have a job but either way I know I need to get smart about what I do with my spare time. I am building a few different things at the moment but ultimately I need to find what works and go deep on that. I love writing and would like to do much more of it. I think a personal writing style is going to become very important with rise of AI writers. I think the dust around this will settle eventually.

I’ve noticed a lot of Niche Site writers have switched or focused on travel sites, it makes sense given the climate. It’s very hard to replicate a good travel site with AI. Excellent content is king and we all need to be more cognizant of that. Whether I have the skill to compete in this arena is another thing entirely.

Here Is How it is Broken Down

Cash: £600

My cash position is lower then normal, but my and my partner have started setting aside our joint disposable income at the start of the month, so I am hoping this will pay dividends in the long run. Anything we don’t spend will go into our joint Monzo savings point. Which yields are 3.74% a little less than chip but the amounts are so small at the moment it’s not worth the complication of mixing them. Not until Chip brings out a joint savings account, now that would be great!

Shares: £371

The shares have been somewhat stagnant this month, but I am optimistic about their future growth. I am monitoring the markets closely for better opportunities to increase my holdings. These are just shares in FreeTrade via crowd funding. I now only hold pension funds and will be dripping into a vanguard fund in due course.

RSUs vesting in 2023: £5,000

Restricted stock units (RSUs) vesting next year will add a substantial amount to my net worth. This is something I am looking forward to as it will give a significant boost to my overall financial health. I am currently in talks around redundancy so it’s hard to say whether these will be forfeit or not. The package on offer is decent but I don’t expect to actually lose my job.

Savings: £4,254

My savings have been doing well this month. I have been disciplined in putting aside a portion of my income and reducing unnecessary expenses. This strategy is essential for my FIRE (Financial Independence, Retire Early) journey.

Pension: £14,263

My pension fund is an integral part of my retirement strategy. Its steady growth is a good sign for the future. I recently left FreeTrade and moved all my money to my workplace pension, this combined figure will be what is combined at the end of the week. It’ll be nice to have all my pension in one place, and start to accelerate my contributions. Currently, given my work environment, I am being more cautious than perhaps I would need to be normally, I want to ensure that I have as much cash on hand for opportunities (and in case I need it to survive!). My pension will need to be topped up, I am turning 28 this October and the amount in my pension is much less than it should be. I actually did have more but did some bold bets in my SIPP that did not quite playout. Lesson Learned! I can accelerate this fast as I am likely going to enter the top-rate of tax this year, meaning any additions will be even more tax efficient.

Home Equity: £119,649

My home equity continues to be my most significant asset. Even with fluctuations in the housing market, I am confident in its long-term value. I am very glad I bought at the start of the pandemic, you will notice from the graph above this has been a large contributor (for reference I put down £40,000 3 years ago). The compounded returns on money invested are significant even as interest rates climb. I bought a house that was one of the cheapest on the street and house hacked my spare room for a couple of years, I have various articles on this you can find here: House Hacking: A Global Guide

Household Debt: £6,600

We have a slight increase in my household debt this month due to some unexpected expenses. However, this debt is fixed at 1.64% interest so it’s not worth paying back (better to stick the same money into my savings account).

In total, my net worth is £136,923 for August 2023, which is a decrease of £1,362.49 compared to the previous month.