How I Am Saving in this Cost of Living Crisis

Excuse the tone, I wrote this on my morning mental health walk.

In recent times, the cost of living crisis has become I’ve been pondering on this issue, considering how I can help others navigate through this challenging period. Although I’m in a relatively secure position, I’ve felt the squeeze. The ability to save, once a given, has now become a luxury that seems to be slipping away. This leaves even those of us in seemingly safe spots vulnerable to the winds of change.

- How Much Passive Income I Made From Cloning My Voice on ElevenLabs (1st 48HOURS)

- Make Money By Cloning Your Voice.

- Does Salary Sacrifice affect My Mortgage?

- How to Make 10k on TikTok in 100 Days (A Detailed Guide):

- 60 Days of Making Money with my Faceless YouTube Account & AI.

More Like this:

When my company announced impending layoffs, I found myself unable to approach the situation from a position of power. This is the crux of the problem. The financial instability that comes with such a crisis hampers our ability to take risks in life. Instead of being able to confidently say, “I can manage without this job,” we find ourselves pleading, “Please keep me, do you have any jobs, what can I do?”

My money is tied up in my house, and with interest rates rising, the cost of maintaining my home is also increasing. Consequently, my ability to save and prepare for significant life events is diminishing. This article aims to explore the strategies I’m employing to deal with this situation.

The first significant change in my life was moving my girlfriend in with me. She contributes £400 to the house, which essentially covers most of the bills. This arrangement leaves her with a better ability to manage her expenses, given that she earns less than me (although catching me up!). We agreed on this setup because I didn’t want her to feel like she was subsidising my living or that she couldn’t make herself at home. We now have a joint account, into which we each deposit around £400 at the start of the month. This fund covers all our joint expenses, simplifying our financial management.

We’ve also started selling our clothing on Vinted. So far, we’ve made about £200. Regardless of who makes the sale, we both contribute an equal amount to our savings goal. This way, we’re saving together towards a specific goal, like a holiday.

At the end of each month, we have a certain amount of money that we need to put into our savings. We do this on payday. After all my bills are paid, I try to put as much as I can into my emergency fund.

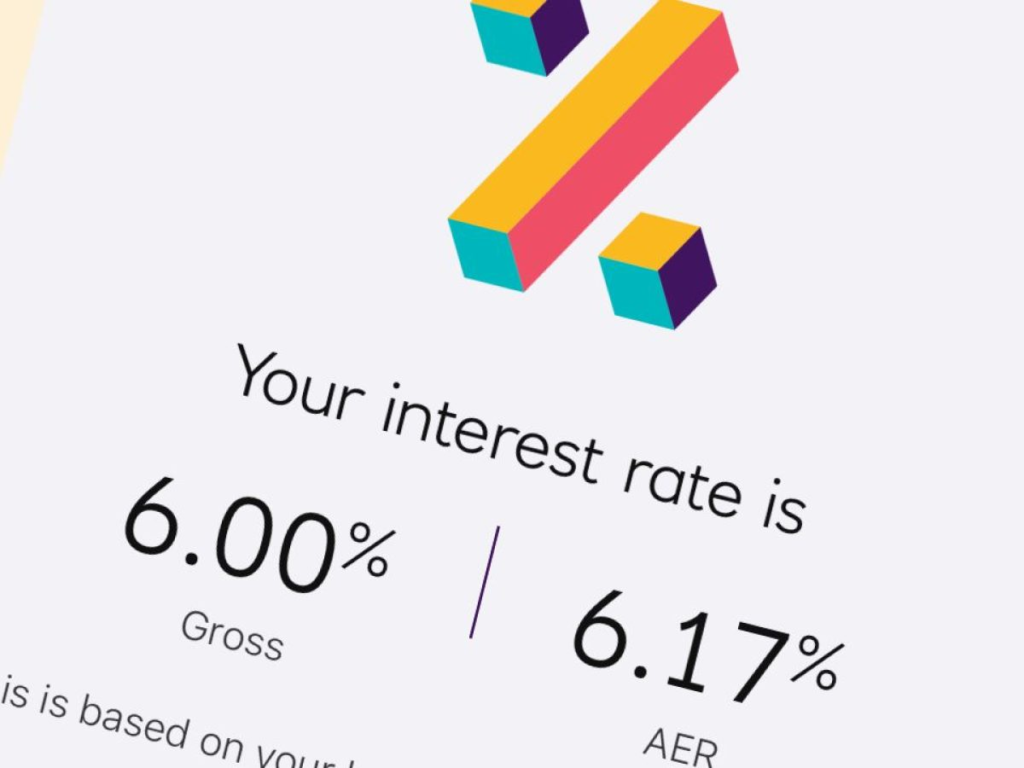

With interest rates rising, I’m currently focusing on building up my cash reserves. I’m putting my money into two places. The first is the digital saver with NatWest, which currently offers an interest rate of 6.17%. I’ve been doing this for a few months, and it’s now yielding around £3 or £4 a month. This covers nearly half of a bill like Netflix or Spotify.

The second place is Chip, an easy access savings account that pays out about 4.51% interest. This pays me around £10 a month, which covers another bill. These two places are already covering my bills while I’m building up my savings, which is reassuring.

I have to say Chip has been the best savings account for the past 6 months, and probably before that too. I did myself a disservice not getting on it sooner.

My plan now is to try and keep these cash reserves intact, live off my salary, and plough as much money as I can into these savings until I have six months of net pay. It’s important to remember that when building an emergency fund, you’re aiming for six months of net pay, not gross pay.

Once I reach this goal, I’ll feel comfortable enough to get back into the market. I still have exposure to the market through my pension (around 10% of my net worth, you can read more about t his here: June 2023 Update – £138k – And Why I Am Moving Away From FreeTrade), so I don’t feel like I’m missing out on anything by not investing the small sums I have outside.

I hope you found this insight into my personal journey through the cost of living crisis interesting. This article was written based on a voice note I made while going on a walk. It’s a new approach I’m trying, and I hope you enjoy it. Remember, we’re all in this together, and sharing our experiences and strategies can help us navigate these challenging times.

- How Much Passive Income I Made From Cloning My Voice on ElevenLabs (1st 48HOURS)This is one of the rare “actually passive” income streams, it won’t make you rich but it could just help you generate some free cash or Beer Money. I posted an article last week discussing the change ElevenLabs (an AI text-to-voice software) made to their system allowing anyone to make money by cloning their voice. This is… Read more: How Much Passive Income I Made From Cloning My Voice on ElevenLabs (1st 48HOURS)

- Make Money By Cloning Your Voice.Imagine generating revenue for years to come, just by uploading 30 minutes of audio online. Imagine being early to YouTube or TikTok? This could be the opportunity you’ve been waiting for!

- Does Salary Sacrifice affect My Mortgage?The short answer is, no, your salary sacrifice scheme should not affect your mortgage application. So long as the lender you are applying for takes into account your “gross” income (before deductions), rather than your net income, you shouldn’t need to worry. It’s been noted that Santander in the UK will look at net income… Read more: Does Salary Sacrifice affect My Mortgage?

- How to Make 10k on TikTok in 100 Days (A Detailed Guide):Disclaimer: This method is presented as a possibility and may not guarantee results. Success on TikTok depends on various factors, including content quality, consistency, niche selection, and luck. Be mindful of platform guidelines and responsible business practices. You’ve seen those folks making ridiculous money on TikTok, those screenshots are everywhere. You sit and work your… Read more: How to Make 10k on TikTok in 100 Days (A Detailed Guide):

- 60 Days of Making Money with my Faceless YouTube Account & AI.Some people are making $1000s a day on these channels, so I thought I would give it a try. The idea is that you don’t have to show your voice, and use stock videos and similar to produce content. If you’ve looked into making money with AI then you’ve probably seen these Faceless YouTube channels… Read more: 60 Days of Making Money with my Faceless YouTube Account & AI.