How to get paid every single week of the year?

These 12 stocks ensure a consistent cash flow. In this article, I’ll reveal the 12 stocks in my dividend stock portfolio, explain how this strategy works, and show you how to use it to generate cash.

For two weekly dividend stocks that actually pay each month: These TWO Dividend ETFs Pay Weekly

Imagine knowing that you have cash flow coming into your account every single week. This is money you can rely on to pay the bills or simply to give you a little peace of mind.

The 12 stocks I’m about to share with you today can generate a 6.2% average dividend yield. That’s three times the yield on the overall stock market. Let’s get started.

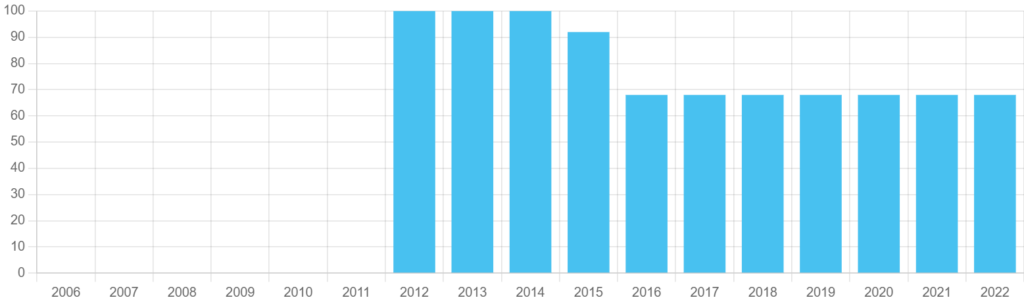

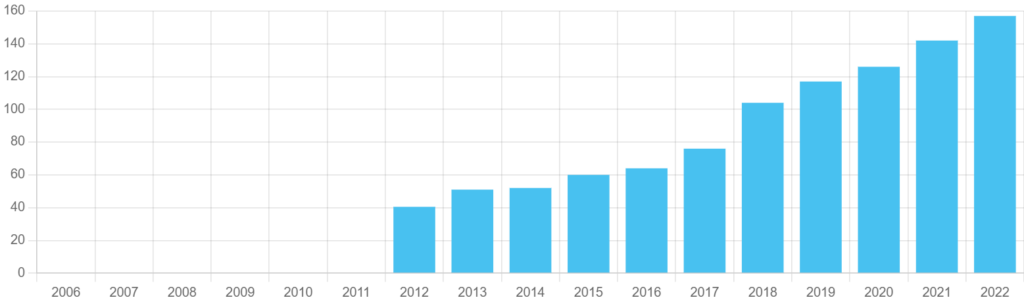

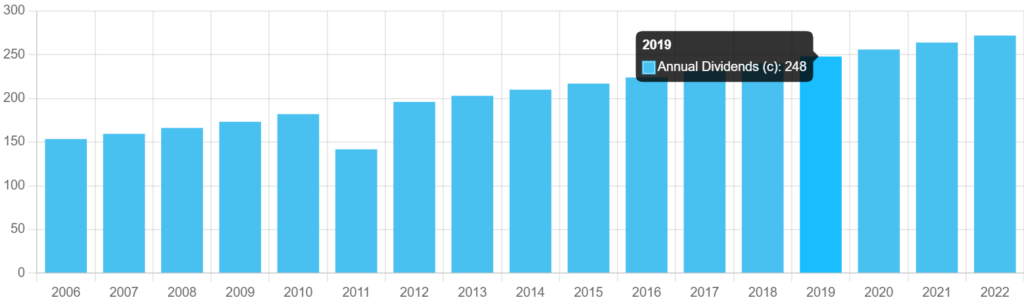

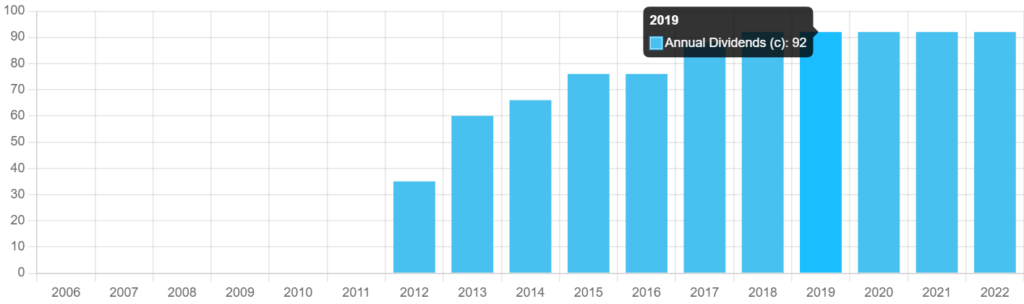

Below is a slideshow you can use to see all the historical dividend yields for each company:

JPM – JP Morgan

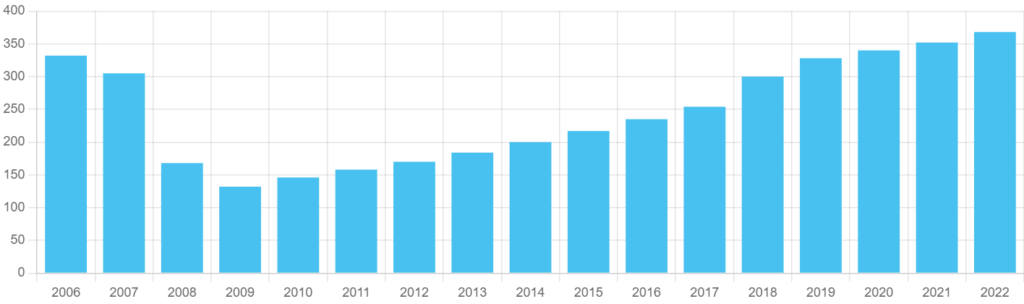

JP Morgan, our first dividend stock, is one of the world’s largest financial companies. Despite its lower dividend yield of 3.15% compared to other stocks on this list, JP Morgan stands out for its valuation and stability. It manages over 3 trillion in assets in its wealth management segment and booked 12.2 billion in revenue in the first quarter in consumer banking alone.

One key aspect of this dividend list is its diversity across various sectors and industries. The pitfall of dividend investing is that if you solely chase the stocks with the highest dividend yield, you’re likely to end up with stocks concentrated in a few industries like real estate, business development corporations, and energy. This could leave your portfolio and dividends vulnerable to a crash if anything adverse happens to those particular industries.

Therefore, even though stocks in some of these industries, like traditional banks, may not offer the highest yield, it’s crucial to include a few of them for dividend safety and diversification.

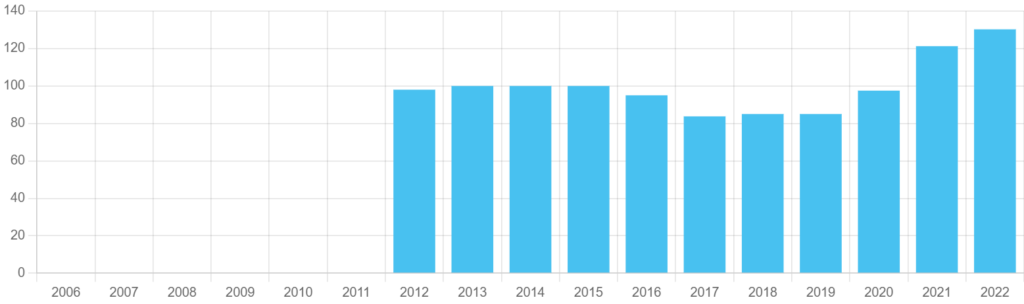

To illustrate, JP Morgan has doubled its dividend over the past five years and typically goes ex-dividend in the first week of January, April, July, and October. This information is readily available and I’ll guide you on how to find it.

Global Net Lease – GNL

Global Net Lease (GNL) stands out among real estate investment trusts (REITs) due to its diversified international portfolio. While most REITs primarily focus on the US, GNL boasts over 309 properties, spanning more than 39 million square feet across the US, Canada, and Europe.

The properties maintain an impressive 99% occupancy rate, which is significantly high. This is spread across 138 tenants in 51 different industries, providing the much-needed diversification not only geographically but also across various sectors. This ensures that a crisis in any one industry won’t significantly impact the portfolio.

A noteworthy aspect of GNL is that 54% of its portfolio is in the industrial and distribution segment, a rapidly growing market in real estate. Additionally, the office property segment is expected to perform better as we move past the pandemic.

GNL typically pays its dividend in the second week of January, April, July, and October. This strategy of selecting stocks that pay dividends in specific weeks of specific months helps create a calendar that ensures cash flow every week.

With the average analyst price target for Global Net Lease at $18 a share, there’s a potential for a 21% upside on top of the dividend. This makes GNL one of my top picks for long-term cash flow.

Gladstone Commercial Corporation – GOOD

Gladstone Commercial Corporation, with the ticker symbol GOOD, is a popular choice not only for its impressive 6.6% dividend yield but also for its monthly payout schedule. This means you’ll receive a dividend every third week of the month, ensuring a steady flow of income.

With Gladstone and another monthly payer on our list, you’ll be receiving double dividend checks in two weeks of each month. Gladstone owns over 15 million square feet across 122 properties in 28 states in the US. The leases are spread across 106 tenants in 19 industries, providing excellent diversification.

The company has maintained a high occupancy rate of 96.6%, and the average lease term of seven and a half years provides stability even in the face of a severe recession. While the average analyst price target is only about 12% higher, it’s worth noting that this comes on top of a solid dividend and a stable cash flow, making Gladstone a reliable stock for consistent income.

ConAgra Brands – CEG

ConAgra Brands, with the ticker symbol CEG, has been on our radar for years, and it’s back again for its 3.5% dividend yield. As a leader in the frozen foods and snack categories, ConAgra holds significant market share positions in several top brands.

Shares of food companies, including ConAgra, have been impacted by inflation over the past year. However, they are now beginning to generate higher earnings and are considered value stocks. Currently, ConAgra is trading at 16.8 times earnings, a 10% discount to its five-year average.

ConAgra typically goes ex-dividend in the fourth week of January, April, August, and October. Analysts have set a target price as high as $40 per share, with an average of $36 each.

Stay tuned as we still have eight more dividend stocks to complete your portfolio and generate those weekly dividends.

NYCB – New York Community Bank Court

Next on our list of dividend stocks is New York Community Bank, with the ticker NYCB, known for its impressive 6.8% yield, one of the highest in the banking sector. NYCB, a leading producer of multi-family loans in New York with a 50-year market presence, is aggressively expanding nationally, as evidenced by its recent Flagstar bank acquisition.

NYCB now operates over 400 branches and holds $87 billion in assets across eight states. The stock typically goes ex-dividend in the first week of February, May, August, and November, so you can expect it to hit your account about a month later.

As interest rates climb higher, bank stocks like NYCB are worth watching closely. Higher rates mean banks make more money on their loans, and NYCB already generates an excess capital of $500 million a year after paying dividends.

While the share price has been relatively stagnant over the past few years, it now trades for just 0.72 times its price-to-book value, well below most banks and firmly in the value territory.

Arbor Reality

Next on our list is Arbor Realty Trust, ticker ABR, another strong real estate company offering an 8.25% dividend. Arbor is a direct lender to multi-family senior housing, healthcare, and other commercial real estate sectors.

While multi-family projects make up about 83% of the portfolio, which may seem high, these are all agency-backed loans, providing the safety you want in a mortgage REIT. Arbor has grown its dividend by 16% annually over the last five years on sales growth of 20% a year.

With the rise in residential prices, rents on multi-family properties should be rising as well, and loan growth should continue to increase. The stock typically goes ex-dividend around the middle of the month in February, May, August, and November.

To ensure we double up on some of the weeks, I’ve included a few monthly dividend stocks in our list. Analysts have a target price of just under $21 a share for Arbor Realty Trust, which would be almost a 20% upside to the current price.

Southern Company – SO

Southern Company, ticker SO, is our first utility company on the list, offering a 3.6% dividend yield. The company operates as a regulated electric utility, serving over 4 million customers in Georgia, Alabama, and Mississippi, in addition to 4.4 million natural gas customers.

Southern is at the forefront of the industry’s push into clean energy. In 2000, nearly 80% of the company’s electricity generation came from coal. Today, it’s just over 20%, and the company is pushing further into nuclear, natural gas, and renewables more than any other utility company.

While utility companies, like banks, may not offer the highest dividend yields, it’s crucial to include a few of them in your portfolio for diversification. Southern Company typically goes ex-dividend in the third week of February, May, August, and November.

Although the shares have seen a recent uptick and analyst targets average around $73 each, Southern Company continues to provide stable returns along with its dividend, making it a reliable addition to any dividend-focused portfolio.

Newell Brands – NWL

New Brands, ticker NWL, is another dividend stock selected for its stability and cash flow, offering a 4.1% yield. The company is more than just its Rubbermaid brand, with over 25 brands and $10 billion in sales across 10 countries. It’s a strong consumer goods leader with some international diversification for your portfolio. Shares typically go ex-dividend in the last week of February, May, August, and November, and the average analyst target of $28 leaves room for a 22% upside to the price.

Dividend stocks pay out each year on extremely consistent schedules, which dividend investors appreciate for the certainty and consistency. Directors of these companies try to declare and pay those dividends on the same week every three months. This means you can compile a list of your top dividend stocks and then use a site like Yahoo Finance or any investing platform to see the ex-dividend date of every dividend payment over the last five years. This allows you to plan out your investments so you have stocks going ex-dividend at different weeks of the month, ensuring a steady cash flow.

Devon Energy (DVN)

Returning to our dividend stocks list, Devon Energy, ticker DVN, has been a favorite in the energy space for years, now offering a 7.3% dividend yield. Devon is a leading oil producer in North Dakota, Texas, and Delaware. With oil prices spiking over the last two years, these assets have become cash flow powerhouses. Like most oil companies right now, Devon is choosing to return that cash to shareholders rather than acquiring assets at higher prices.

Devon’s free cash flow has quadrupled since its merger with WPX last year, and it’s forecasting even stronger cash flow this year. At $95 per barrel of oil, the company is set to grow its free cash flow by 17% this year. Prices could fall to $30 a barrel before the company operates at a loss. This has helped Devon increase its share buyback program to $1.6 billion, nearly triple what it bought back last year, and continue its history of dividend growth.

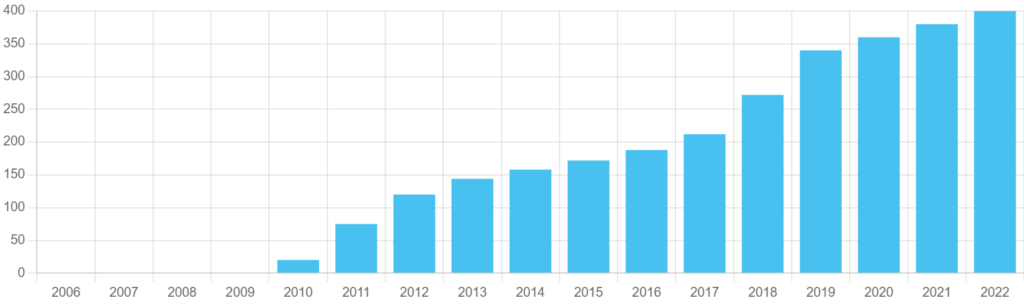

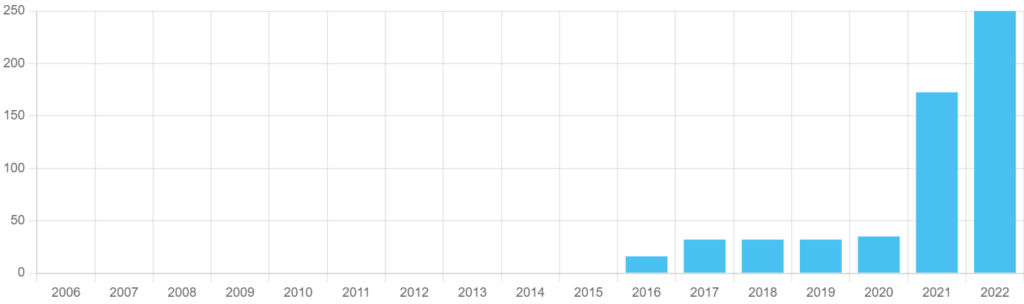

Devon Energy not only pays a strong 7% dividend yield, but it’s increased it from just 6 cents to $1 a share in the last five years, an increase of nearly 1600%. It typically goes ex-dividend in the first week of March, June, September, and December. Despite the recent surge in oil prices and the stock, analysts have an average price target of $72 a share, which is 28% higher, indicating a strong potential for dividend payments.

Camping World Holdings

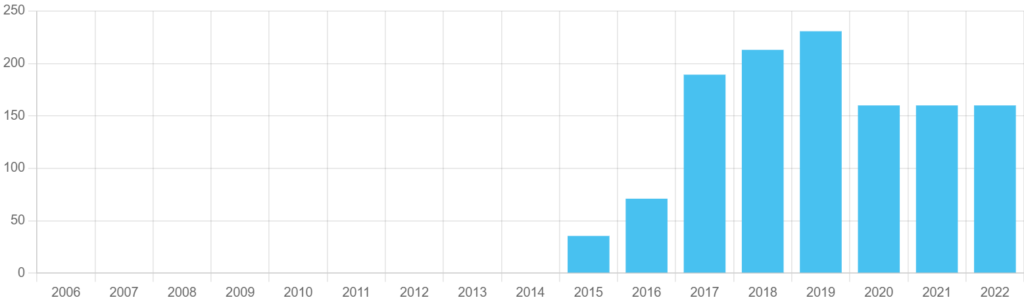

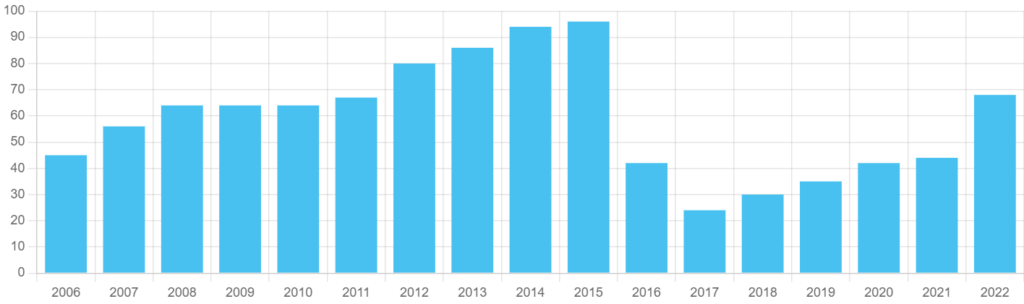

Camping World Holdings, ticker CWH, is another stock we’ve recently highlighted due to its significant dividend growth. Now offering a 9.6% yield, CWH has seen steady dividend growth despite stock price volatility. Dividend payments have increased from just over 7 cents per share in 2017 to 62 cents each, representing a 756% increase over the last five years. The stock typically goes ex-dividend around the second week of March, June, September, and December.

Camping World Holdings has been serving RV consumers since 1966 through its network of dealers and service centers and has achieved 14% annualized revenue growth since 2016. New vehicles account for about half of the revenue, but the company also has a reliable source of recurring revenue from services, finance, and insurance programs.

With a 20% market share in the RV market, Camping World Holdings has a commanding lead in a market that’s growing by 10% annually. This growth is driven by retirements in the baby boomer generation and the trend towards RV living among younger generations. More than 11 million US households now own an RV.

Camping World Holdings also has one of the highest potential upsides on our dividend stocks list, with an average target of $42 per share, representing about a 64% return from its current price.

Altria Group – MO

Altria Group, ticker MO, is a somewhat controversial pick, but it’s hard to overlook its 6.5% dividend yield and stable cash flows. While cigarette volumes are trending downward, pricing has remained steady, ensuring stable cash flows. Moreover, the company’s investments in vaping and cannabis offer potential for future growth.

For instance, Altria has a $1.8 billion stake in cannabis company Cronos Group, which equates to a 45% share of the company, positioning it well for a potential future acquisition. Additionally, Altria owns 10% of Anheuser-Busch, providing steady growth into the alcoholic beverage market.

Shares typically go ex-dividend around the third week of March, June, September, and December, with the dividend payout following a few weeks later. Analysts are not as bullish on the stock, with an average target of $55 per share, roughly around the current stock price.

Realty Income – O

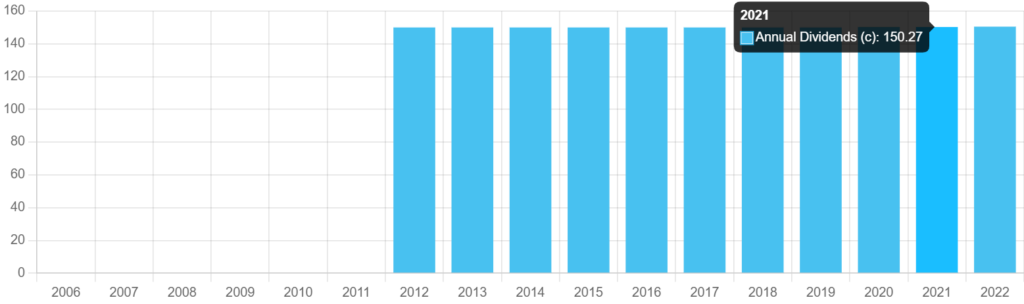

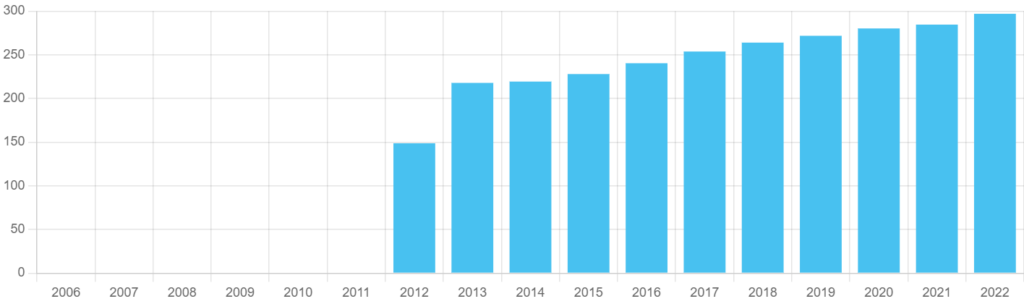

Realty Income, ticker O, may not be a stock that will make you rich, but its high dividend yield is one of the most stable in the market. It’s one of the most popular dividend stocks among investors, offering a monthly payout and a 4% dividend yield.

With 50 years of operating history, Realty Income owns over 6,000 properties across 49 states, Puerto Rico, and the United Kingdom. This stock is expected to continue its consistent payouts. It typically goes ex-dividend in the last week of the month, ensuring that you’ll always have a dividend check coming in to cover the first of the month’s rent payment.

Join Our Newsletter to Follow Along for More like this

Pingback: How to Reduce your Student Loan Repayments and add an EXTRA £250k to your Pension. – Growing Money Trees

Pingback: How to Get Paid Dividend Every Day of the Year – Growing Money Trees

Pingback: These TWO Dividend ETFs Pay Weekly - Growing Money Trees