Increase Your Pension By £250k

I recently moved company, and received a significant pay-rise. I really did not like the amount of money that was going towards my student loan, and it was having a very limited impact on the overall balance (being eaten away by interest). My options were either, decide to pay it off over the next few years (probably with a commercial loan) or taking money out of my house since I am at close to 20% equity, OR I could simply take the money that is going to the student loans company, and pour it into my pension.

FOR MORE ANSWERS TO SALARY SACRIFICE QUESTIONS, YOU CAN READ OUR FAQ HERE

Salary Sacrifice: What is it? And How does it Work?

Salary Sacrifice, also known as a ‘salary exchange’ or ‘pay sacrifice’, is a legal arrangement between an employee and their employer. In this agreement, the employee agrees to give up, or ‘sacrifice’, a part of their pre-tax salary in exchange for certain non-cash benefits.

The benefits that can be included in a salary sacrifice scheme are wide-ranging and can be tailored to the needs and preferences of the employee. Here are a few examples:

- Pension Contributions: This is one of the most common uses of salary sacrifice. The employee agrees to a lower salary, and the employer contributes the difference to the employee’s pension pot. This can have significant tax advantages, as both the employee and employer can save on National Insurance contributions.

- Mobile Phones: Some employers offer mobile phones as part of a salary sacrifice scheme. The cost of the phone is deducted from the employee’s pre-tax salary, potentially offering savings on income tax and National Insurance.

- Season Tickets for Commuting: If you commute to work by train or bus, a season ticket can be a significant expense. Some employers offer season tickets as part of a salary sacrifice scheme, which can make commuting more affordable.

- Childcare Vouchers: For employees with young children, childcare can be a significant expense. Some employers offer childcare vouchers as part of a salary sacrifice scheme, which can help make childcare more affordable.

The key advantage of a salary sacrifice scheme is its potential tax efficiency. Because the benefits are deducted from the employee’s salary before tax, the employee pays less income tax and National Insurance. Similarly, the employer also pays less in National Insurance contributions.

However, it’s important to note that salary sacrifice schemes aren’t suitable for everyone. If the salary sacrifice brings an employee’s earnings below the National Minimum Wage, it’s not a legal option. Additionally, a lower salary can affect an employee’s entitlement to certain benefits, like statutory maternity pay, or their ability to borrow money.

Working Example of Salary Sacrifice Using a Take Home Pay Calculator

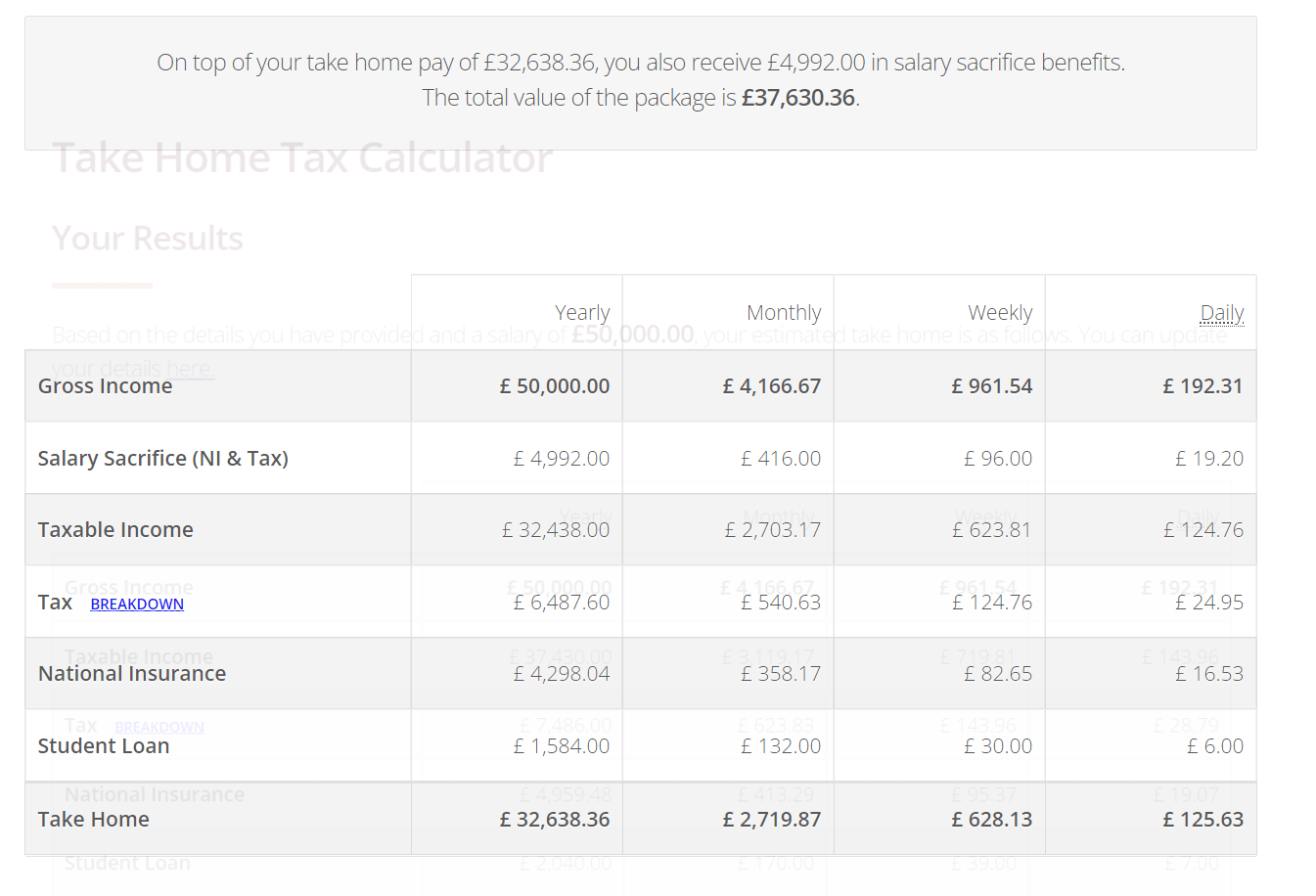

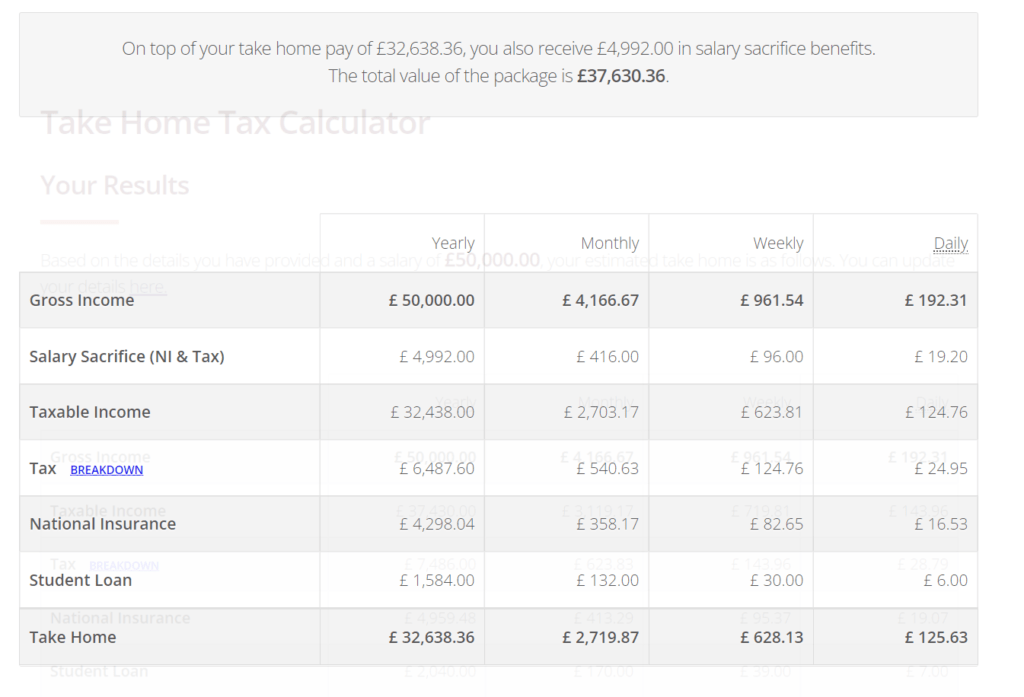

Let’s do a working example to show how the figures play out. Below is an example of someone on repayment plan 2, earning £50,000. Their typical take-home is £2959.55, with £170 going to student loans.

However, if I used a salary sacrifice scheme and put 10% into my pension (or any kind of other salary sacrifice scheme), my student loan repayments would be reduced:

In example one, you are paying £1207.12 in tax and student loans. In example 2, you are paying £1030.80 in tax and student loan (including NI as a tax, not getting into that argument today!).

Your take home pay would go down by £240, but you would receive £416 in pension capital returning roughly 170% on your money instantly. This extra £176 of value you are getting each month, over the course of 30 years (say you started at 25 and wanted to retire at 55), you would be significant.

Assuming an 8% S&P growth rate – relatively conservative – you would end up with an EXTRA £248,026.79. Of course this is only if you put this in your pension!

This is just the EXTRA, your £416 payments each month – without employer contributions would amount to about £576k. Again this is without an contributions from your employer.

Obviously the next few months may not be the time to increase pension contributions, we all need all the money we can get, but, for those that can afford it, this would be a fantastic way to secure their future.

If you like this you can join my newsletter below, to be notified when I post. 🙂

You may also like:

3 Replies to “Increase Your Pension By £250k”