These TWO Dividend ETFs Pay Weekly

2 years ago, two new ETFs burst onto the scene that promised something new: weekly dividends.

This was a change from the usual monthly or quarterly payouts. In theory, this could have been a boon for dividend investors.

Everyone likes to get paid more regularly right? What’s not to like?!

However, the nuance does matter, I personally think building a portfolio with 10–12 stocks would be a better use of your time (you can still get paid weekly dividends without the limitations I am about to discuss in this article).

For more information, you can read my article on Weekly Dividend Stocks

Before these ETFs, no one had thought of giving out dividends every week. They were so new that we didn’t have much data on how they performed. I know plenty of people who would like the idea, and it fits in well with the “passive income” bandwagon. The first one, the SoFi Weekly Income ETF (TGIF), started in October 2020. Another one came out in May 2021.

SoFi Weekly Income ETF (TGIF)

TGIF was the first. It pays out its weekly dividends every Friday. It aims to provide steady income by investing in high-yielding bonds. It has about 154 bond investments and is actively managed, meaning “experts” choose what goes in it.

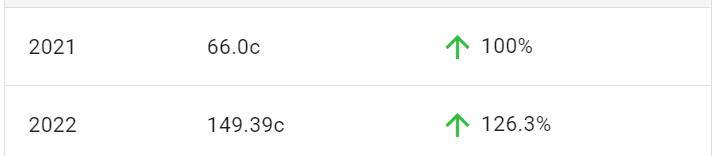

Last year TGIF cost $97.17 per share and was only paying out a $0.05 dividend every week. But in December, it gave out $1.49 per share, assuming as a special dividend.

This means in 2021-2 it’s dividend yield was about 2.67%. That’ was not very high for its price.

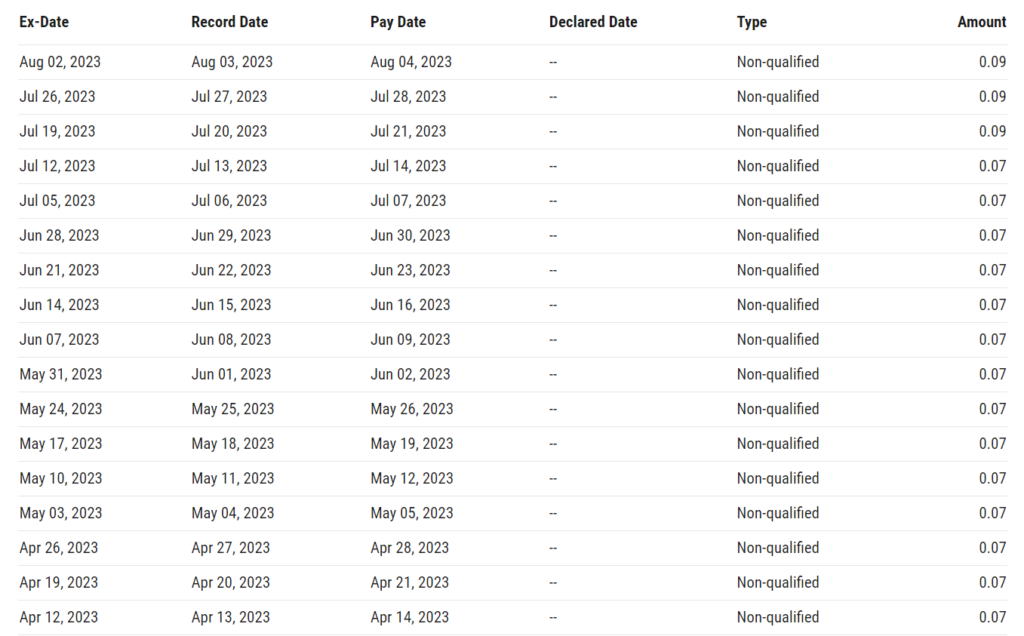

However, as of August 2023, it has increase it’s weekly dividend payout to $0.09 from $0.07 which is a significant increase. I expect this is due to rising interest rates, you can read more about this information here. That means one stock (currently sitting at $95 dollars) will pay you $4.68 dollars per year over every single week of the year. Not bad!

My main concern is the that all this income can be very easily wiped out by a dip in the share price (it went do $2 YoY, effectively wiping out half your returns). It also has risk around interest rates dropping back down.

SoFi Weekly Dividend ETF (WKLY)

WKLY came out in May 2021. It’s similar to TGIF but follows a different index. It’s passively managed, meaning it just follows the market. It has 446 different investments, including big companies from around the world. To me this is too many, but you may prefer this level of diversification.

It’s essential picked a load of high quality dividend paying companies (that have a “sustainable” dividend). Like many of you who have tried to build your own portfolio, they have created a framework and applied it to the entire market to find companies that pay a sustainable dividend regularly . They will charge you 0.49% for the pleasure (plus withholding fees in the UK).

It currently pays out $0.02 per week, on a cost of $48 dollars. Works out at around $1 per year in income (so just over a 2% yield). They do seem to pay a special dividend in December, last year it was $0.47 making up a significant portion of the returns, and increasing the yield to 3%. Given my savings account is paying 4.5% I’d be cautious investing in companies such as SoFi.

I’ve included a spreadsheet below, for those of you who are nerds like me and want to follow it’s underlying performance. I’ve included a table of it’s notable positions, you will see many favourites among dividend investors. Not a terrible place to start if you would like to build a weekly dividend portfolio!

| StockTicker | CUSIP | SecurityName | Shares | Price | MarketValue | Weightings |

| JPM | 46625H100 | JPMORGAN CHASE & CO. | 2515 | 156.02 | 392390.3 | 3.66% |

| JNJ | 478160104 | JOHNSON & JOHNSON | 2241 | 169.04 | 378818.64 | 3.53% |

| XOM | 30231G102 | EXXON MOBIL CORP | 3504 | 107.42 | 376399.68 | 3.51% |

| PG | 742718109 | PROCTER AND GAMBLE CO | 2029 | 155.28 | 315063.12 | 2.94% |

| AVGO | 11135F101 | BROADCOM INC | 351 | 881.65 | 309459.15 | 2.89% |

| NESN SW | 7123870 | NESTLE SA | 2293 | 104.16 | 273882.09 | 2.56% |

| CVX | 166764100 | CHEVRON CORP NEW | 1496 | 159.31 | 238327.76 | 2.22% |

| BAC | 60505104 | BANK AMERICA CORP | 6049 | 31.3 | 189333.7 | 1.77% |

| CSCO | 17275R102 | CISCO SYS INC | 3527 | 52.63 | 185626.01 | 1.73% |

| ROG SW | 7110388 | ROCHE HLDGS AG | 604 | 265.05 | 183579.15 | 1.71% |

| PFE | 717081103 | PFIZER INC | 4836 | 35.02 | 169356.72 | 1.58% |

| 7203 JP | 6900643 | TOYOTA MOTOR CORP | 9684 | 2437.5 | 166441.62 | 1.55% |

| CMCSA | 20030N101 | COMCAST CORP NEW | 3597 | 44.84 | 161289.48 | 1.51% |

| TXN | 882508104 | TEXAS INSTRS INC | 778 | 168.44 | 131046.32 | 1.22% |

| TTE FP | B15C557 | TOTAL SE | 1961 | 55.57 | 120121.22 | 1.12% |

| COP | 20825C104 | CONOCOPHILLIPS | 1049 | 113.71 | 119281.79 | 1.11% |

| VZ | 92343V104 | VERIZON COMMUNICATIONS INC | 3613 | 32.62 | 117856.06 | 1.10% |

| QCOM | 747525103 | QUALCOMM INC | 958 | 121.5 | 116397 | 1.09% |

| RY CN | 2754383 | Royal Bank of Canada | 1194 | 128.25 | 114605.77 | 1.07% |

| UPS | 911312106 | UNITED PARCEL SERVICE INC | 624 | 180.94 | 112906.56 | 1.05% |

| BMY | 110122108 | BRISTOL-MYERS SQUIBB CO | 1806 | 60.49 | 109244.94 | 1.02% |

Both ETFs have some things in common:

- Cost: Both are a bit more expensive than average. WKLY costs 0.49%, and TGIF costs 0.59%. The average ETF costs 0.23%.

- Share Price: Both have seen their prices drop a bit since they started.

The idea of weekly dividends is interesting. But looking at how these ETFs have done, they might not be the best choice. They cost more and haven’t given great returns. There are other dividend ETFs that have been around longer and might be a better choice. But it depends what you are after, sometimes the thrill of being paid a dividend every single week is worth it. When the yields are above 4% that it starts to feel a bit better. I think it’s endemic of our time. People have less patience, and this is the perfectly example.

Investing should be a long-term wealth build, if you cannot even be bothered to wait longer than a week to get paid you might need to look at other forms of income. Personally, I would prefer to use the data from the spreadsheet above to build a sustainable portfolio that suits my own goals. With all the new ways of using investment pies in trading212 (UK) and M1 Finance (US) you can build your own portfolio that pays you weekly without compromising on quality. Focus on stocks with dividend sustainability, and growth. Strong businesses will out perform any gimicky ETF by a factor of 10 over the long run.