Building a Daily Dividend Portfolio (Trading212)

This concept, while seemingly straightforward, requires a deep understanding of the stock market, the nature of dividends, and the power of compounding. I explained how it was going in the last video, which you can find here: Daily Dividend Portfolio Update and here: How to Get Paid Dividend Every Day of the Year

If you are looking to get paid every week I’ve also got you covered here: 12 Dividend Stocks to Get Paid Weekly

Subscribe to my newsletter below to get sent the full daily dividend excel spreadsheet

Understanding Dividends

Before we dive into the specifics of building a daily dividend portfolio, let’s take a moment to understand what dividends are. Dividends are a portion of a company’s earnings that are distributed to shareholders. They represent a way for you, as an investor, to reap the benefits of a company’s success. Dividends can be a significant source of income, especially for investors who have a large amount of capital invested in dividend-paying stocks.

The Power of Compounding

The idea behind a daily dividend portfolio is rooted in the magic of compounding. The more frequently something compounds, the faster it grows. Let’s illustrate this with an example.

Imagine you start with £10,000 at an interest rate of 5%. If you compound once per year, you’ll have £10,500. But if you compound every day, you’ll have £10,512.67. The difference might seem insignificant in a year, but over a long investment period, say 45 years, it adds up to an extra £5,000.

But the real charm of this portfolio isn’t just the extra money. It’s the ability to see exactly how much you get per day and watch it increase with every payout. We live in a society where people’s attention spans are getting worse and worse. So, if being paid everyday is what it is going to take to stick with investing,it seems like a great path. It’s about the thrill of seeing your money grow every single day.

It’s about the satisfaction of knowing that your money is working for you, even while you sleep.

Building a daily dividend portfolio isn’t something you do on a whim. It requires careful planning and a bit of research. I started by creating a grid with each month of the year and the days of each month. The goal was to find companies that would fill in as many dates as possible.

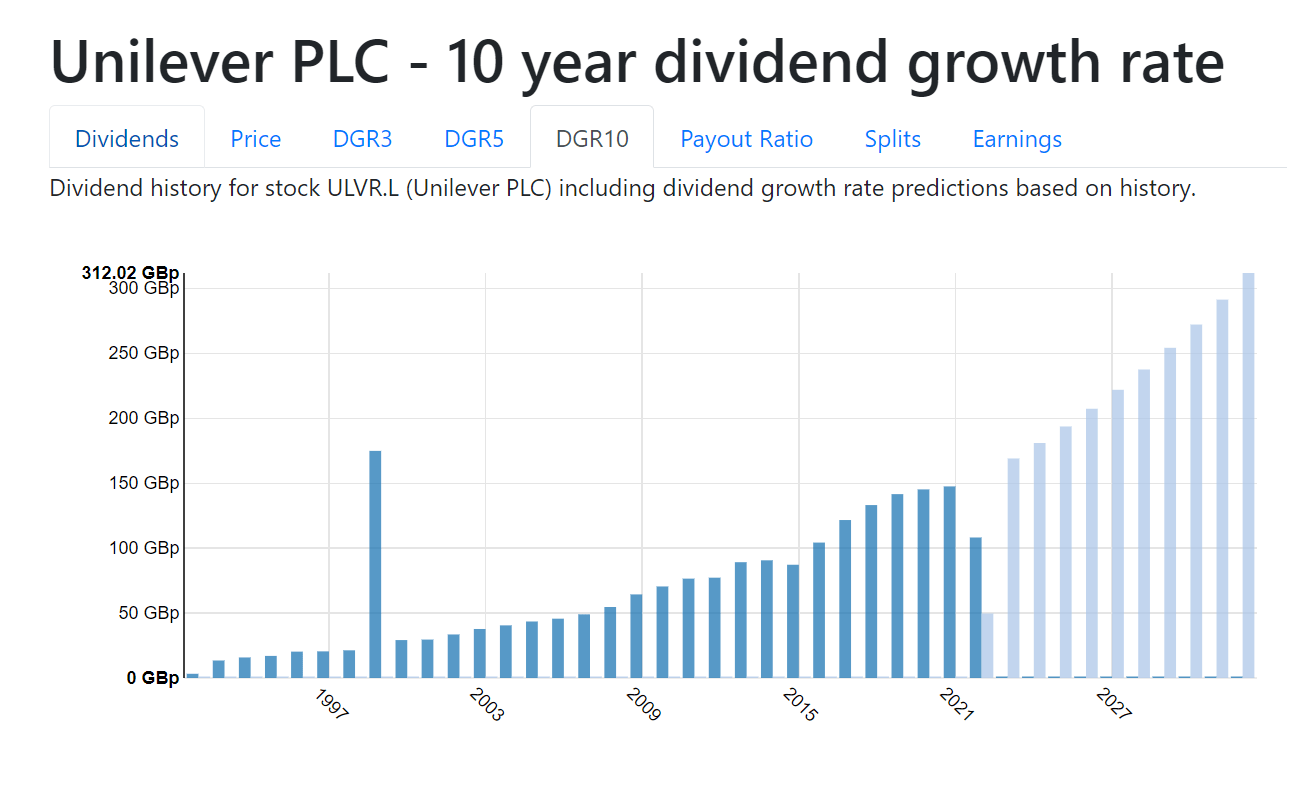

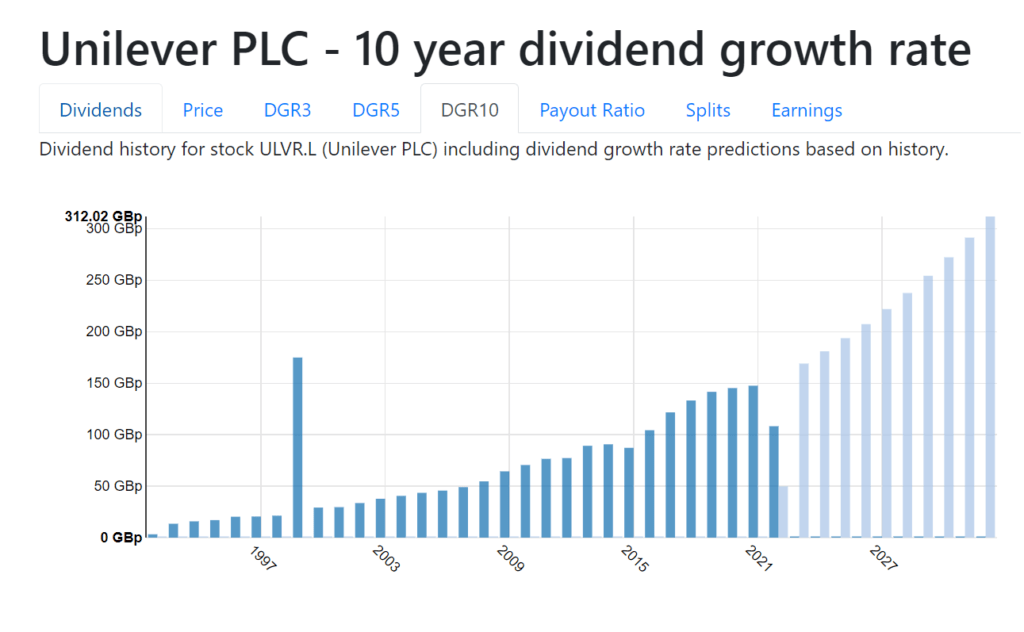

I used DividendMax and DividendData.com to find companies with reliable dividend histories and projected payout dates.

The aim was to find safe, reliable companies that wouldn’t cut their dividend unexpectedly. After all, the last thing you want in a portfolio like this is to have to rearrange everything because a company decided to stop paying dividends.

I will share the full list in my newsletter, subscribe here:

The Selection: Choosing the Right Stocks

The selection process was a balancing act. I wanted to find companies that not only paid dividends regularly but also offered a decent yield.

I started by focusing on stable monthly payers, as they offer 12 payments per year. This was important because there’s a limit to how many stocks you can hold in a portfolio, so you want to make sure each one is pulling its weight.

Next, I looked for stable quarterly payers. Unfortunately, the US does both monthly and quarterly payments better than the UK, which usually pays semi-annually or occasionally annually. This meant that the portfolio ended up being heavily weighted towards US stocks.

I also tried to find a range of sectors and industries to ensure the portfolio was diversified. And, of course, I aimed for the highest yield available. Some stocks were discarded for not paying enough, others for low yield, and some just because they kept paying on the same day.

Final Product

The final portfolio consists of 260 payments over the course of the year, covering 70% of the days. It’s not quite a daily dividend, but it’s pretty close. And the best part? With Trading 212’s new pie feature, the portfolio should take care of itself. You just fund it and let it do its thing.

If you wanted to, you could rebalance at the end of each quarter or year, but this is completely up to you. I would personally let the runners run, and the losers lose.

What to Keep in Mind

Now, it’s important to note that this portfolio won’t actually pay a dividend every day. There are only 260 payments, after all. And sometimes, brokers might delay payments, so you might get a few payments on the same day. But think of this portfolio more like a fun experiment than a serious investing strategy.

The Joy of Daily Dividends

Building a daily dividend portfolio is a fun and exciting way to watch your money grow every day. It takes a bit of planning and research, but the payoff can be worth it. Just remember, this is not financial advice, so invest at your own risk.

So, are you ready to start building your daily dividend portfolio? It’s a journey, not a destination. And every journey begins with a single step. So, take that step today. And remember, the magic of compounding is on your side.

If you like this, you may also like the below articles: