Hey there, fellow money tree growers! As we navigate the stormy seas of the 2023 recession, it’s more crucial than ever to keep our eyes on the horizon and our hands firmly on the wheel. Recently, I came across a video by New Money taking a lot at what the super investors are buying at the moment. I’ve summarised and added my thoughts below.

- How Much Passive Income I Made From Cloning My Voice on ElevenLabs (1st 48HOURS)

- Make Money By Cloning Your Voice.

- Does Salary Sacrifice affect My Mortgage?

- How to Make 10k on TikTok in 100 Days (A Detailed Guide):

- 5 Things That Will Compound Faster than the Stock Market in 2024

If you are in a hurry, I would suggest that companies that have really been in focus, are mostly, the safer big techs with large moats. However, Meta has had a rough 12 months so I’m not sure we can call it a stupidly “safe” company.

Inuit

First up is Intuit, the fifth most bought stock by super investors in Q1 of 2023. Despite the economic headwinds, seven super investors saw potential in this provider of financial management software to small and medium-sized businesses. I haven’t done much research on Inuit myself, but financial software tends to be two things, sticky, and expensive. Both things you want from your product in a recession. I expect financial management to be something many companies are wanting to better understand in this climate, if you are working at corporate company at the moment you will have noticed the OPEX scrutiny.

Meta

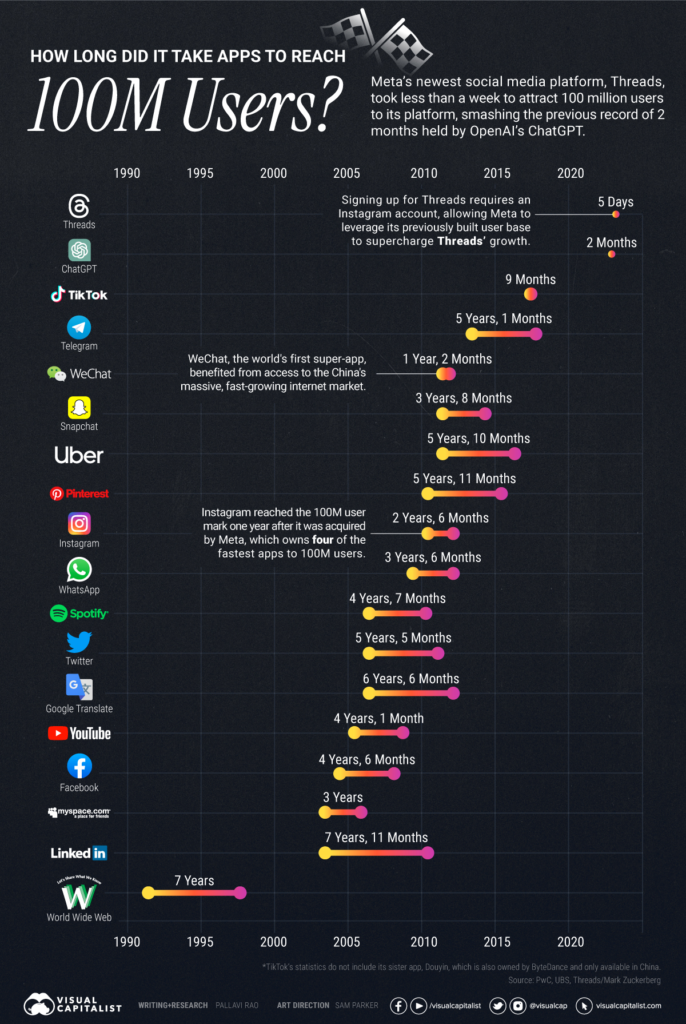

Next, we have Meta, a name that’s been under a lot of pressure due to its massive spending on metaverse development and the reduction in profitability of its advertising. Despite these challenges, the stock has seen a significant rebound in 2023, and the smart money seems confident in its long-term prospects. With the recently announced of “Threads” the Twitter competitor, reaching 100million users reached within 5 days according to Zuckerberg. This would make the threads the fastest growing network of all-time.

Microsoft is in the third spot, with nine super investors buying in Q1. The video highlights Microsoft’s significant stake in OpenAI and the potential impact of AI on the company’s future. However, it also emphasizes the strength of Microsoft’s core business, which includes software like Windows, Office 365, Azure, Xbox’s Game Pass, LinkedIn, OneDrive, and Microsoft Teams.

Amazon, bought by 13 super investors, is the second most bought stock. Despite facing rising costs due to inflation, the video suggests that Amazon’s period of investment could set it up for long-term gain. The company’s commitment to growth is highlighted as a positive sign.

Finally, Google is revealed as the most bought stock in Q1 of 2023. Despite the challenges of the macroeconomic environment, Google’s strong moat in internet search, steady revenue, growing cloud business, and robust balance sheet make it a favorite among super investors.

On the whole I don’t think there is much exciting going on at the moment, and frankly, the super investors don’t seem to know any better than the rest of us.

About New Money

New Money is a YouTube channel that provides valuable insights into investing and personal finance. The channel’s content ranges from stock analysis to discussions on broader financial topics. The video “Top 5 Stocks the Smart Money is Buying for the 2023 Recession” is a prime example of the channel’s commitment to helping viewers navigate the complex world of investing.

You can watch the full video here.