It has been a strange month. We’ve had some craziness going on in the UK economy that is pretty painful to watch. Interest rates are coming for us and many in FIRE are concerned that their plans may be thwarted. With interest rates going up, those of us that have mortgages are going to be paying a significant portion of our income to the banks rather than into investments in the market.

I expect the allocation of capital for most with sense to be this, income > savings (high rate) > pay down the principal on mortgages at the end of the current fix. Practically speaking if interest rates are 5-6% I would rather put my money into that (a so-called guaranteed return) and pay down the debt. The market might return 10% but it is not guaranteed, I’d like to take the option with the most certainty in this current environment.

My fix is up for renewal in 2024 August, hopefully, the outlook is clearer and rosier by then.

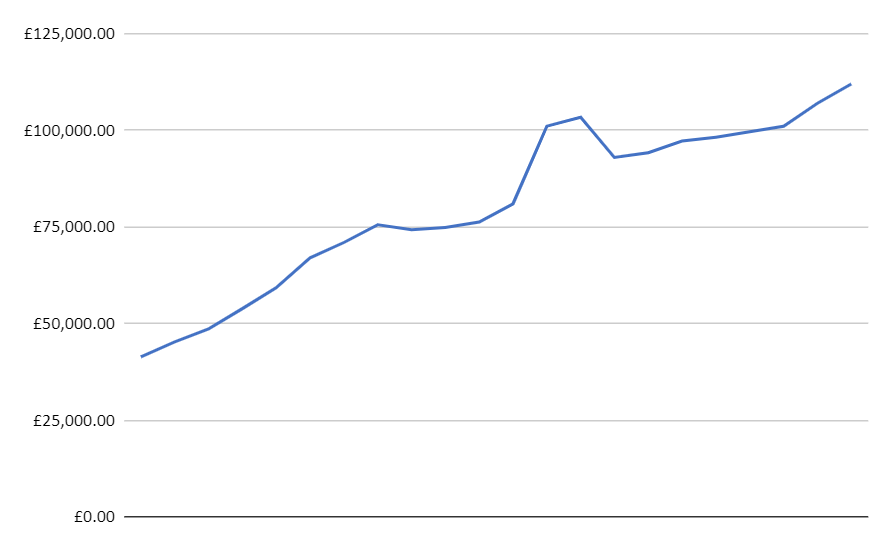

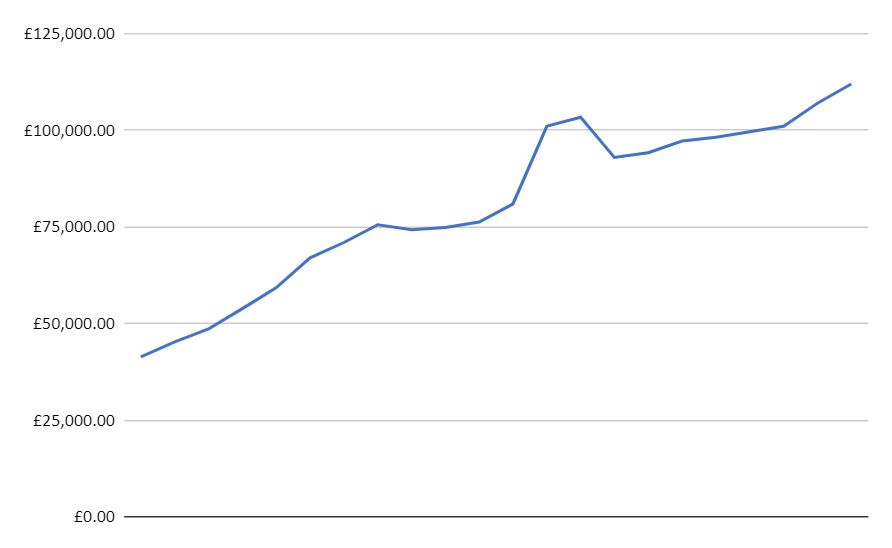

Net Worth Update

My net worth reached a new high this month: £111,994.61 a mixture of reduced spending, a bonus at work, paying down my mortgage and (the important one) house prices drastically increasing – about £3k). Goes to show, it doesn’t matter what you do, your unearned wealth will probably beat your earned wealth. My cash and savings increased to the north of £1,000 for the first time since 2020 as I try and make sure I have a safety net to fall back on in the coming months.

My savings are in a blend of easy access, and slightly riskier peer-to-peer lending. With a sprinkle stashed in Blockfi. This pays me, 8.5% and is paid out monthly. This is evidently high for a “stable” coin so I’ve only allocated a small amount to this. They are backed by Gemini and this money is returned out of profits, but I would treat it as investing in Coinbase or similar. You don’t make an 8.5% return without ANY risk. I like the hedge as it also pays out in dollars, so is worth a heck of a lot more than at the start of the year. BlockFi is great for someone living in the UK.

Likely to do well long-term, but there is a chance it all blows up as well. This chance is small but please don’t put all your eggs in one basket! Having said all that, you can sign up via my ref link here: https://app.blockfi.com/signup/?ref=005efaf1 or non-referral https://app.blockfi.com

Increasing my savings is the number one priority for now, trying to get as much money aside for the winter months, and for the mortgage refinance in August 2024. This seems like a long time away, but creating a comfortable financial situation will allow me to focus on my building out my various (but very small!) streams of income.

Future Net Worth

Currently increasing my net worth at around 1% of my FIRE target per month, so it should take another 78 months, IE 6.5 years – exactly the age of 35 that I wanted to retire at. However, I don’t see this increasing in the medium term at the same rate as most of my net worth has come from my house. I need to live in it, the cost of borrowing is going up, and the price of my house is likely to go down in the short to medium term. I will reflect that in my monthly newsletter. You may well see a few months of horrific decline on this blog.

Niche Sites Update:

I also launched a new niche site this month, more information to follow. The idea is to focus on certain underserved segments that are not worth the big company’s time, but worth it for a side or full-time personal income. My site is ranking in google, but very low, and a lot more content needs to be generated, not sure if I should go down the path of paying someone or doing it myself.

I guess at some point I will need to learn about backlinks!

If you want to read last months here it is:

- How Much Passive Income I Made From Cloning My Voice on ElevenLabs (1st 48HOURS)

- Make Money By Cloning Your Voice.

- Does Salary Sacrifice affect My Mortgage?

- How to Make 10k on TikTok in 100 Days (A Detailed Guide):

- Test