Why I am (still) Buying Shopify Stock.

The stock is up nearly 100% in the past 1 year, is it now too expensive, with everything going on in the world?

I first looked at Shopify stock in the summer of 2017. I was in a sales interview in the City of London, and asked to “quantify” my interest in the financial markets. Being the precocious 21 year old i was, I decided to pitch the interviewers a stock.

I told them about this company that was going to allow anyone who wants to sell online get online with just a few clicks. They provide the real-estate, tools, and anything else that can go along with that to startups. Nobody else seemed to be doing it, and it seemed like a non-brainer.

Want more stock analysis, subscribe to our newsletter here:

It also seemed obviously to be quite sticky. Non-technical founders of ecommerce business couldn’t just uproot and leave if they had built a successful business on the platform – and why would they? If it was working they would happily pay the subscription fee.

Any like many of the stocks with my biggest conviction (!) I didn’t buy. To be fair to younger me there was no cheap way to buy US stocks in the UK in 2017, and I actually had negative money. Although I was living at home, so I could probably have found a bit of money to invest. It would have made quite the different to my life since it was trading at the equivalent of $5 (If I’ve done the split stock paths correctly).

OK so why am I a buyer:

Let’s break down where $SHOP first so we can all understand it.

Shopify’s business model is based on two primary revenue streams:

- Subscription Solutions

- Merchant Solutions

Subscription Solutions

Subscription Solutions is a recurring revenue stream that Shopify generates from its monthly subscription plans. These plans provide merchants with access to Shopify’s platform and tools, including a website builder, payment processing, shipping, and inventory management. Shopify offers five subscription plans, ranging from $29 to $299 per month.

Merchant Solutions

Merchant Solutions is a transaction-based revenue stream that Shopify generates from the additional services it offers to merchants, such as payment processing fees, Shopify Shipping fees, and Shopify Payments. Shopify Payments is Shopify’s own payment gateway, which allows merchants to accept and process credit and debit cards without having to set up a separate merchant account.

In 2022, Shopify generated $4.61 billion in revenue, of which $1.11 billion came from Subscription Solutions and $3.5 billion came from Merchant Solutions.

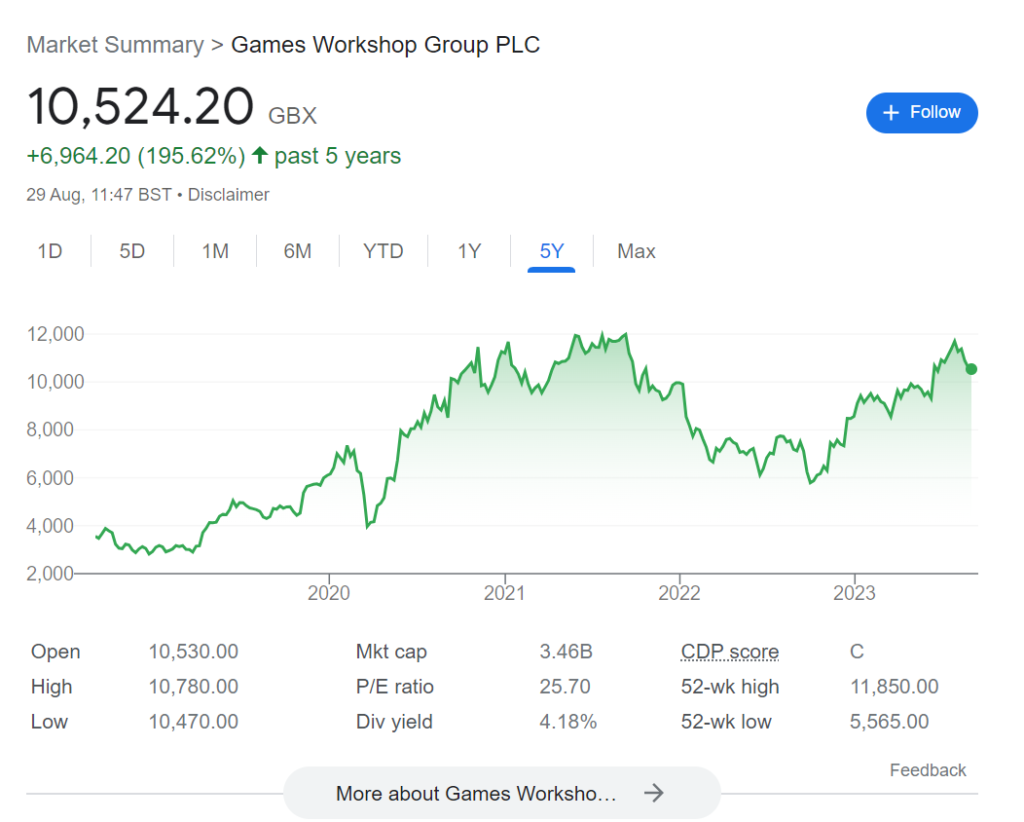

Revenue Numbers

Here is a breakdown of Shopify’s revenue by revenue stream in 2022:

- Subscription Solutions: $1.11 billion

- Merchant Solutions: $3.5 billion

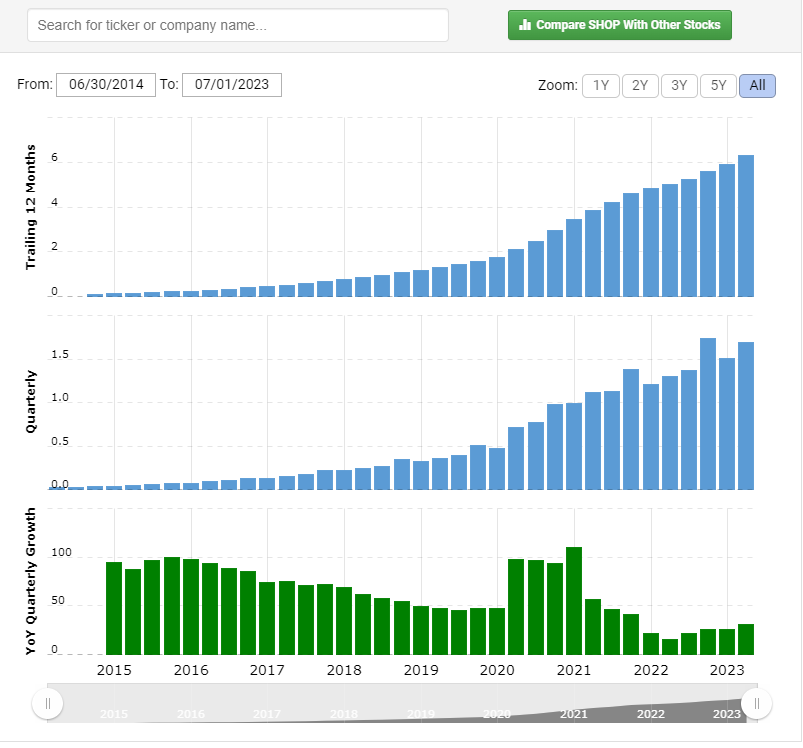

Shopify’s revenue has been growing rapidly in recent years, thanks to the growth of e-commerce. In 2022, Shopify’s revenue grew by 57% year-over-year.

Business Model: Fundamentally, it is a great business model. The team are focused on helping their customers get rich, and enabling people that might not have been successful without them. This is quite different to a lot of CRMs (the only comparison I can really think of) that tend to trade on very high multiplies. Their retention is currently 91% (slightly down from 92% in 2022), but very similar to Salesforce retention (93% in 2022 > 92% so far in 2022). If they can grow this quickly, whilst maintaining such good retention this is a very good sign.

Free Cash Flow: Salesforce trades on about 2.5% FCF to Market Cap, whereas the same number currently stands at around 1.36% for Shopify. Considering how much Shopify is investing in their future, and that they expect FCF to for the second half of the year to greatly exceed first half, they are in very good stead. Very good indeed. Their ROCE (Return on Invested Capital) is not great but I have to say I’m not sure how good a measure this is. The FCF seems to being spent in a sensible way from what I can read.

Data: More and more this company will become a data service. They will know exactly how to spend their FCF because they have a ridiculous amount of data on what sells well. These insights are going to allow it stay at the forefront of technology. It can inform their decision to acquire or invest in various businesses. Like their recent investment in Flexport.

Leadership: Co-Founder Tobi Lutke is a wonderful owner-operator. A limited ego, and someone who seems capable of evolution. I would never be able to write as well about this part as Mike at Non-Gaap Investing. The article I’ve linked is incredibly well-written and worth a read regardless of your investment thesis on $SHOP. I think the business can still thrive without him, but with a “superstar” in the company can thrive.

Growth: It’s CAGR from 2018-2022 was ~60% which is just crazy. The business has evolved and we are told to expect around 20% growth over the next few years.

According to my FCF model, I expect $SHOP to be worth $500B by the year 2030. It could far exceed that but this gives it a 7.1x upsides in the next 7 years. Which does sound outrageous now I write it down. I may need to go back to the model.

If I had to pick one company to hold (with a high risk tolerance) this would be it. It is currently 20% of my portfolio.

- Why I am (still) Buying Shopify Stock.

The stock is up nearly 100% in the past 1 year, is it now too expensive, with everything going on in the world?

I first looked at Shopify stock in the summer of 2017. I was in a sales interview in the City of London, and asked to “quantify” my interest in the financial markets. Being the precocious 21 year old i was, I decided to pitch the interviewers a stock.

I told them about this company that was going to allow anyone who wants to sell online get online with just a few clicks. They provide the real-estate, tools, and anything else that can go along with that to startups. Nobody else seemed to be doing it, and it seemed like a non-brainer.

Want more stock analysis, subscribe to our newsletter here:

It also seemed obviously to be quite sticky. Non-technical founders of ecommerce business couldn’t just uproot and leave if they had built a successful business on the platform – and why would they? If it was working they would happily pay the subscription fee.

Any like many of the stocks with my biggest conviction (!) I didn’t buy. To be fair to younger me there was no cheap way to buy US stocks in the UK in 2017, and I actually had negative money. Although I was living at home, so I could probably have found a bit of money to invest. It would have made quite the different to my life since it was trading at the equivalent of $5 (If I’ve done the split stock paths correctly).

OK so why am I a buyer:

Let’s break down where $SHOP first so we can all understand it.

Shopify’s business model is based on two primary revenue streams:

- Subscription Solutions

- Merchant Solutions

Subscription Solutions

Subscription Solutions is a recurring revenue stream that Shopify generates from its monthly subscription plans. These plans provide merchants with access to Shopify’s platform and tools, including a website builder, payment processing, shipping, and inventory management. Shopify offers five subscription plans, ranging from $29 to $299 per month.

Merchant Solutions

Merchant Solutions is a transaction-based revenue stream that Shopify generates from the additional services it offers to merchants, such as payment processing fees, Shopify Shipping fees, and Shopify Payments. Shopify Payments is Shopify’s own payment gateway, which allows merchants to accept and process credit and debit cards without having to set up a separate merchant account.

In 2022, Shopify generated $4.61 billion in revenue, of which $1.11 billion came from Subscription Solutions and $3.5 billion came from Merchant Solutions.

Revenue Numbers

Here is a breakdown of Shopify’s revenue by revenue stream in 2022:

- Subscription Solutions: $1.11 billion

- Merchant Solutions: $3.5 billion

Shopify’s revenue has been growing rapidly in recent years, thanks to the growth of e-commerce. In 2022, Shopify’s revenue grew by 57% year-over-year.

Business Model: Fundamentally, it is a great business model. The team are focused on helping their customers get rich, and enabling people that might not have been successful without them. This is quite different to a lot of CRMs (the only comparison I can really think of) that tend to trade on very high multiplies. Their retention is currently 91% (slightly down from 92% in 2022), but very similar to Salesforce retention (93% in 2022 > 92% so far in 2022). If they can grow this quickly, whilst maintaining such good retention this is a very good sign.

Free Cash Flow: Salesforce trades on about 2.5% FCF to Market Cap, whereas the same number currently stands at around 1.36% for Shopify. Considering how much Shopify is investing in their future, and that they expect FCF to for the second half of the year to greatly exceed first half, they are in very good stead. Very good indeed. Their ROCE (Return on Invested Capital) is not great but I have to say I’m not sure how good a measure this is. The FCF seems to being spent in a sensible way from what I can read.

Data: More and more this company will become a data service. They will know exactly how to spend their FCF because they have a ridiculous amount of data on what sells well. These insights are going to allow it stay at the forefront of technology. It can inform their decision to acquire or invest in various businesses. Like their recent investment in Flexport.

Leadership: Co-Founder Tobi Lutke is a wonderful owner-operator. A limited ego, and someone who seems capable of evolution. I would never be able to write as well about this part as Mike at Non-Gaap Investing. The article I’ve linked is incredibly well-written and worth a read regardless of your investment thesis on $SHOP. I think the business can still thrive without him, but with a “superstar” in the company can thrive.

Growth: It’s CAGR from 2018-2022 was ~60% which is just crazy. The business has evolved and we are told to expect around 20% growth over the next few years.

According to my FCF model, I expect $SHOP to be worth $500B by the year 2030. It could far exceed that but this gives it a 7.1x upsides in the next 7 years. Which does sound outrageous now I write it down. I may need to go back to the model.

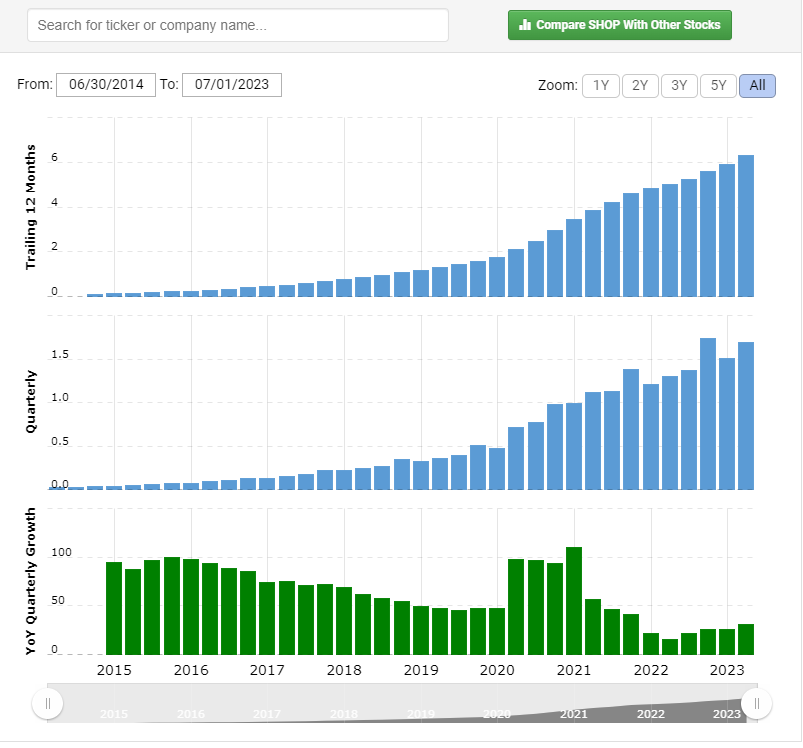

If I had to pick one company to hold (with a high risk tolerance) this would be it. It is currently 20% of my portfolio.

- Last Time This Stock Was Tipped It Went Up 40%

In January 2023, I wrote an article on why I thought this stock was undervalued. Since that article the share price increased by 40% at its peak, but has now come back down. If you’d bought when I published the below article and held to today, you would have made 21%.

Want Stock Updates, and net worth updates straight to your email? Sign up to our newsletter below:

My underlying thesis has not changed, you can read the below article if you’d like the detailed version but I will summarize my position here too.

They announce results on Thursday, so its a good time to look at this stock.

Why The City Pub Group is Undervalued Here are the numbers:

Share price: 86.50p (as of 19 September 2023)

Market capitalization: £104.5m

Net debt: £4m

Annual turnover: £57.6m

Book Value: £160million (an increase of circa 55% from these levels).

Subscribe to our newsletter!

Investment Thesis:

The City Pub Group (CPC) is a premium pub operator with a strong track record of growth. The company has a well-managed portfolio of pubs in desirable locations across southern England and Wales.

CPC sold a few underperforming pubs as per their last results, which gave them a much stronger balance sheet (net debt of just £4m, very low by industry standards). This is so they can be fast and take up opportunity to buy cheaper assets as real-estate goes down, and interest rates go up.

Cashflow: The group is cashflow generative, and only borrows to buy new assets, meaning even at a break even on the main business, the assets appreciate over time (and are the business trades far below its current assets).

Intrinsic Value Gap: The value of CPC’s estate in March 2022 was valued at £160million. The stock trades at around £100million today. You can argue for a fall in real estate prices of as high as 25% and it would still be significantly undervalued. You could probably argue this value has actually gone up since March 2022 in some of these locations. It should also be noted that because the company operates in “premium” markets, such as Oxford, Cambridge, Bristol and the City of London there is a great resistance to real estate prices. These place tend to be short of space and have earnings that allow people to go to the pub.

Headwinds Fading: Most of the problems faced by the group in the past few years have subsided from cost of energy (not entirely, I will grant you), the pandemic. There are new taxes coming in but I feel pricing power is fairly intact. People in these locations are currently shelling out £7 for a pint and I don’t see this changing much.

Risk: Recession is the big one. We know its coming, people tend to carry on drinking in a recession, and I don’t see this time being different. But there is a worry that that it’s going to get a lot worse in the UK before things get better.

Buy Backs: The company got rid of their dividend and switched to buy backs, this has seen their share prices increase. I did some maths. The company has been buying back around £5,600 of shares a day since their first buy back in April. This works out at around a 2.8% yield but is far more efficient than a dividend, especially if you agree that the business is significantly undervalued. They have not gone heavy on the buybacks just yet, as they want to keep gearing low. Makes sense, it will be interesting to see what they say about the valuation after the results on Thursday.

Potential Value Triggers:

- Results this week – 21st September City Pub Group will announce results, I personally think these will be better than expected if what I have seen in Cambridge and London is replicated across the portfolio.

- A resolution to the energy crisis: The rising cost of energy is a major headwind for the pub industry. However, if the energy crisis can be resolved, this will be a positive for CPC and other pub operators. It is somewhat improved this year vs last but it’s hard to say where things will go. An end to the war in Ukraine may very well help.

- Continuation or extension (increase) of buy-backs/dividends: CPC has a track record of returning capital to shareholders through buy-backs and dividends. If the company continues or extends these programs, this will also help to boost the share price.

If you like this form of content, consider sharing. I’d love to do more individual stock analysis and share it with the world. I do dive deeper than this, but I didn’t want to overload my usual readers.

Each month I post my net worth on here, as I strive towards financial independence. Here is my latest post:

- 4 Undervalued Stocks on Trading212

I recently moved to Trading212 from FreeTrade. If you want to read about the reasons they are here: June 2023 Update – £138k – And Why I Am Moving Away From FreeTrade

3 out of 4 of the following stocks are UK-based, and 3 also pay a growing dividend. The YouTube version of this article can be found here:

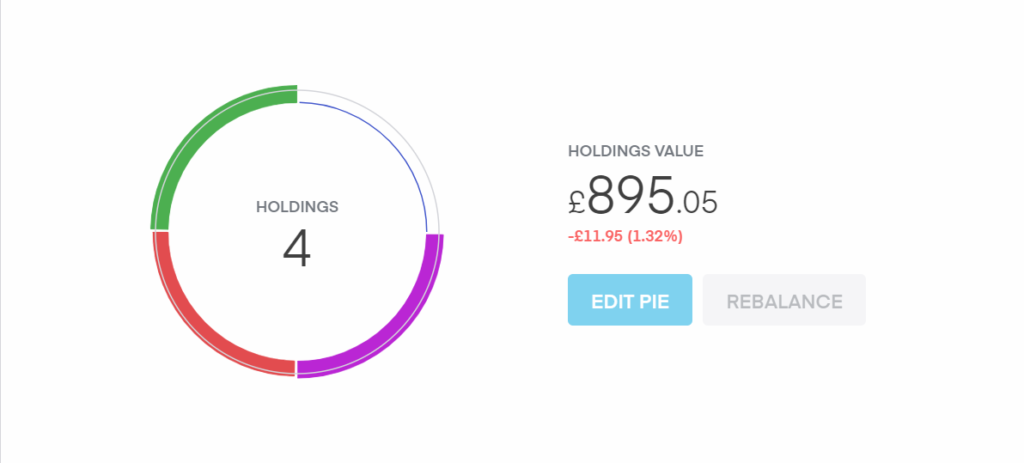

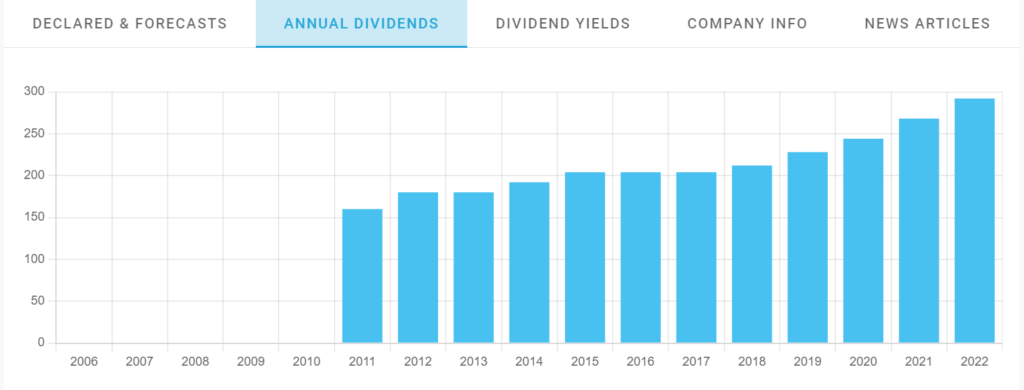

Games Workshop: GAW

First up is Games Workshop, the company behind Warhammer. They have solid financials and their share price has settled down over the past two years.

They have a lot of catalysts for growth, hey can expand through licensing and content exploration.

Amazon’s hunting for content, and Warhammer fits the bill. They’ve already produced films with Henry Cavill, I would not be surprised to see more. They own their content, and intellectual property, which is gold right now.

This could be a big growth opportunity, with a strong underlying business.

Their dividend used to be pretty low yield but its now at 4%, which in their case I believe to be a sign of stability. Trading a 25 PE makes me feel very comfortable with my investment over the long run. They aren’t cheap, but they are much cheaper than they have been for a long time.

Garmin: Navigating Steady Returns

Moving on to Garmin – masters of navigation gadgets. Their history spans 25-30 years, and they make top-notch products.

Their market cap is $20 billion, and essentially debt free.

They’re consistently profitable, generating around $3 billion last year. The dividend yield’s 2.79%, and there’s room to grow this significantly.

Their growth isn’t explosive, but they’re solid. They’re venturing into aviation and data licensing, offering more avenues for growth.

This stock blends stability with future potential.

GB Group: Cybersecurity and Upside

Their share price had a wild ride, but they did have some executives from AVEVA join. I will do a full write up on this company in the near future. But realised pretty quickly that following successful executives is a surefire way to find a great business. Yes I prefer a great company with a great operator but you don’t find them all the time in the UK, or just anymore.

They have the former CFO and CEO of AVEVA, one of the most successful SaaS companies in the UK (if not most successful), they know how to carefully grow partnerships and sell for many billions (for further examples, the former Chairman went to Ideagen and sold the business). Not just sold, but for £1.3billion.

“More positively, customer retention rates remain unchanged and revenue contributions from new logos were higher than normal – suggesting that contrary to market concerns, the business does not believe it is losing market share.

“The slowdown is a function of net retention, as clients saw lower volumes across their own customer bases. As suggested by the positive initial reaction to April’s trading update, we think the business simply needs to report that things have stopped getting worse to trigger a re-rating.”

Panmure Gordon, Analyst on April Trading UpdateIt’s the riskiest of my buys but given the amount of value they have lost, I see a lot of upside from the business. Sentiment may change very soon.

If the board were worried it’s unlikely they would have recommended a 5% dividend.

City Pub Group: Cheers to Real Estate Value

Last, meet City Pub Group – a different player in the pub game. I wrote a more in-depth analysis on CPC here: City Pub Group: Share Price should be double where it is currently

They own a lot of their pubs freehold., like a pub version of McDonald’s. They pick premium spots in high-end markets, like Cambridge, Oxford and the city of London.

They charge a lot but target the big spenders, keeping them full even in tough times.

Their market cap is lower than real estate value, making them an asset value gem. They’re buying back shares, showing confidence. With a robust market and growth potential, they’re solid.

- City Pub Group: Share Price should be double where it is currently

The City Pub Group ($CPC) announced their FY results for 2022. Below is our summary. My brief thesis on why this stock is so undervalued.

- The City Pub Group, a company that operates 44 premium pubs in southern England and Wales, has announced a trading update for the fourth quarter and full year of 2022.

- They reported accelerated like-for-like sales growth of 7.8% in Q4 2022, compared to 2019, due to improved planning for events such as the World Cup and Christmas. However, the strikes by rail workers caused them to lose an estimated £0.75m in revenue.

- The company’s annual turnover increased 63% from the prior year to £57.6m in 2022, reflecting a mostly normalised trading environment.

- The City Pub Group (CPG) has strict criteria for acquiring pubs, as they expect pub prices to continue to soften shortly. However, since September 2022, the Group has acquired two pubs, Potters in Newport and The Bridge in Barnes. The acquisition of Potters further strengthens CPG’s presence in South Wales and The Bridge benefits from 8 letting rooms, increasing the total number of letting rooms across the estate to 225, now an important revenue stream for the Group.

- Net debt has been reduced to £5m at the end of 2022 and the company intends to maintain its low level of debt given the risk factors facing the industry currently. CPG continues to have one of the strongest balance sheets in the sector, with £35m total borrowing facilities until June 2024 and £152m of net assets as of December 25, 2022.

My initial thoughts:

Although this was what I expected from the results, the above just strengthens my resolve and investment case in the City Pubs, I bought some more yesterday ahead of the results and now make up around 40% of my portfolio. These are a solid set of results, the net debt and cash position, combined with the valuation of their portfolio has left CPC in a unique position in the sector. If everything was sold off for parts today, we would get at least double the current share price. I’m not a corporate raider, but I know that value like that doesn’t go unnoticed forever.

The group is actively turning down offers, which shows a careful and mature approach in this environment. The softening of valuations in the sector will affect them, but also allow them to pick up some amazing deals and add to their already undervalued portfolio.

When will the value come through?

Value triggers can come from anywhere, and at any time. But here is where they could come for CPC:

- Better than expected results might help, as would a long run of consistent results post-pandemic, pubs are still a scary proposition to some who have been burned in the past

- A resolution to the energy crisis, pubs have been hit hard and it’s turning a lot of would-be investors away from investing in the sector

- Continuation or extension of buy-backs/dividends; I’d prefer buybacks in this instance as the shares are tightly held and buying their stock might be the best investment they can do with their current pile of cash they are also more tax-efficient (typically)

Our patience will be rewarded handsomely, it may take a 12 or 24 months but on an annualized basis this will still be an incredible return.

Please note the above is not financial advice, and I hold shares in City Pub Group Plc.

- This UK Stock Could Be 2.5x Undervalued

Value Investing – Dhando Investing (Low Risk High Reward Investing):

If you’ve followed this blow for a while, you will know I am someone who has followed Warren Buffet for all of my time investing. Not, as many might do, by following him blindly into investments that he has made, but by learning as much about his principles as I can and applying them to my strategy.

Buffet often mentions if he were managing a small amount of money he would be able to return 50% a year over the long run. If true, we have an advantage over him. We can buy thousands or tens of thousands of shares in small companies, without worrying that we are going to breach any threshold (I believe it is 3% ownership in the UK). This gives the small investor access to a much broader range of investments. This is the same reason Berkshire Hathaway loves buying Apple, they could buy hundreds of billions of dollars of stock and still not need to offer to acquire it (as Apple has such a massive market cap).

City Pubs Group Share Price has Fallen drastically this year, it has recently initiated a share buyback scheme My philosophy looks for opportunities that have a small downside risk without outsized upsides. Sounds simple enough, but if the chance of a company going into administration is 5% and they are trading below net cash, the risk to the shareholder is pretty limited. However, if the chance of recovery is anywhere to be seen at all, the upside is unlimited.

After all, a stock doesn’t stop after a 10% gain, it can go up 100% or 1000% in a matter of months or years.

Imagine a coin toss, heads you get your money back (or lose a very small amount) tails you win 2x your money. All you need to do is find a series of these bets, act, and wait patiently for the market to realize the same thing. The hardest part of this is probably the psychological more than anything else.

The Company: City Pubs Group

I believe that City Pubs Company (ticker CPC) offers an amazing opportunity either now, or very shortly. The company operates 40 pubs, predominantly freehold across regions that can support premium pubs. Think of places like central London, Bath, Bristol, and Cambridge. Whilst Wetherspoons goes after the average punter, CPC goes after the higher-end of pub goers, sometimes mixing in mini-golf and similar. Their prices reflect this, but they appear to have good pricing power in the market, and I don’t expect UK punters to stop going for a drink anytime soon.

At the last results, CPC had a very low debt-to-equity ratio and a current net asset value of around 145p. Just based on NAV we have a 250% upside before we have even factored in the potential of the underlying business. With a net cash flow from operations of £2m+ in the first half of the year.

I have invested £3.5k between my SIPP and ISA as of 13th October 2022.

The Tivoli – Cambridge – A Premium Pub by the City Pub Group Comparison to McDonald’s Model:

The above means that CPC owns real estate in some of the most financially resilient parts of the UK, similar to McDonald’s (who own most of the real estate of their leaseholders), which also happen to be areas that have seen some of the most ridiculous value growth over the past 20 years. Although there will be a real-estate drop in the coming months, the company managed to sell assets in April 2022 raising £17million in cash to use to buffer the balance sheet and to take advantage of opportunities that will come into the market.

I like this approach, if we treat this as purely a property investment the upside is massive. The company also believes they are significantly undervalued and have scrapped its dividend in lieu of a share buyback scheme worth up to £3 million over the next 12 months. The free float is around £ 10 million, this is a substantial buyback for the size of the company (around 4% of the company). It has the added benefit of not being taxed unlike dividends.

The Product:

In my home town, City Pub Group is seen as synonymous with quality. My parent’s generation (recently retired 60+) are happy to go eat there and the beer has something for all generations (real ale vs craft beer etc). The food, which tends to have a higher margin in hospitality than drink, tends to be very good. It’s a really nice alternative to a restaurant, especially for those that like their beer.

10 years from now, if nothing else was to change the underlying assets would have to be at least twice what they are now. This being the starting point means that over the long run if the business can thrive too, CPC should do very well – and eventually, the share price will reflect this.

Headwinds:

The main headwinds are recession > reduced consumer spending and increasing gas and electric prices. But this will effect most people and businesses, and considering the share price has fallen more than 50% I think these factors are priced in. Also, their strong cash position and property in resilient parts of the country with higher disposable income put them in a much safer position than those at the other end of the market, with large and less selective portfolios.

I will be buying and holding City Pub Group stock over the long-run. My first target is 145p. The above is not financial advice, please do your own research.

Subscribe to our newsletter!