Golden Butterfly Portfolio

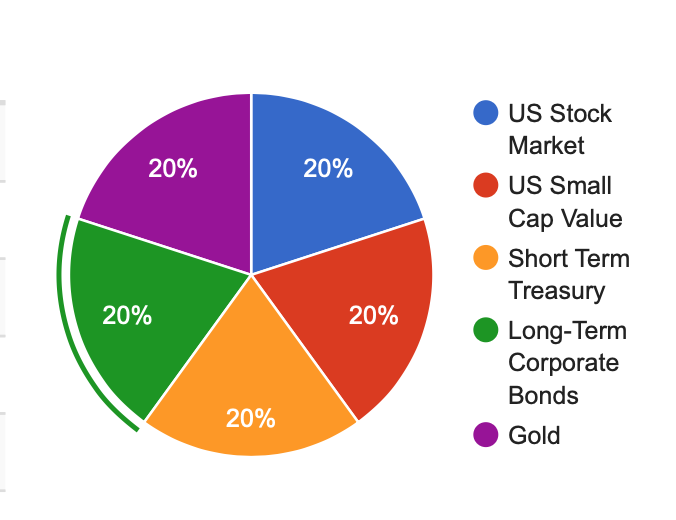

The Golden Butterfly Portfolio is designed to perform well in various economic conditions due to its diverse asset allocation. In layman’s terms this means it has very small drops in value compared to a portfolio made up of just equities Here are some specific historical performance details:

- Total Stock Market (20% of the portfolio): This portion of the portfolio is designed to capture the overall growth of the economy. Over the long term, the stock market has historically returned about 7-10% per year on average, but it can be quite volatile from year to year.

- Small Cap Value (20% of the portfolio): Small-cap value stocks have historically outperformed the broader market over the long term, but they can also be more volatile.

- Long Term Bonds (20% of the portfolio): Long-term bonds are generally less risky than stocks and can provide steady income. Historically, long-term government bonds have returned about 5-6% per year on average.

- Short Term Bonds (20% of the portfolio): Short-term bonds are even less risky than long-term bonds, and they provide regular income, though at a lower rate. Historically, short-term bonds have returned about 2-3% per year on average.

- Gold (20% of the portfolio): Gold is a hedge against inflation and economic uncertainty. Its price can be quite volatile, and it doesn’t provide income like bonds and stocks do. However, it can perform well when the rest of the market is struggling.

Why these investments?

Each of these investments behaves differently in different economic conditions. For example, when the stock market is doing well, your stock investments might increase in value. But if the stock market crashes, gold and bonds often hold their value better. So, by spreading your money across these different types of investments, you’re protecting yourself from big losses.

How can you invest in these?

There are things called ETFs (Exchange Traded Funds) that you can buy, which represent these different types of investments. Here are some examples:

- Gold: ETFs like GLD or SGOL

- Total Stock Market: ETFs like VTI or VT from a company called Vanguard

- Small Cap Value: ETFs like VIOV (from Vanguard) or AVUV (from a company called Advantist)

- Short Term Treasury Bonds: ETFs like VGSH (from Vanguard)

- Long Term Treasury Bonds: ETFs like VGLT (from Vanguard)

- How Much Passive Income I Made From Cloning My Voice on ElevenLabs (1st 48HOURS)This is one of the rare “actually passive” income streams, it won’t make you rich but it could just help you generate some free cash or Beer Money. I posted an article last week discussing the change ElevenLabs (an AI text-to-voice software) made to their system allowing anyone to make money by cloning their voice. This is… Read more: How Much Passive Income I Made From Cloning My Voice on ElevenLabs (1st 48HOURS)

- Make Money By Cloning Your Voice.Imagine generating revenue for years to come, just by uploading 30 minutes of audio online. Imagine being early to YouTube or TikTok? This could be the opportunity you’ve been waiting for!

- Does Salary Sacrifice affect My Mortgage?The short answer is, no, your salary sacrifice scheme should not affect your mortgage application. So long as the lender you are applying for takes into account your “gross” income (before deductions), rather than your net income, you shouldn’t need to worry. It’s been noted that Santander in the UK will look at net income… Read more: Does Salary Sacrifice affect My Mortgage?

- How to Make 10k on TikTok in 100 Days (A Detailed Guide):Disclaimer: This method is presented as a possibility and may not guarantee results. Success on TikTok depends on various factors, including content quality, consistency, niche selection, and luck. Be mindful of platform guidelines and responsible business practices. You’ve seen those folks making ridiculous money on TikTok, those screenshots are everywhere. You sit and work your… Read more: How to Make 10k on TikTok in 100 Days (A Detailed Guide):

- 60 Days of Making Money with my Faceless YouTube Account & AI.Some people are making $1000s a day on these channels, so I thought I would give it a try. The idea is that you don’t have to show your voice, and use stock videos and similar to produce content. If you’ve looked into making money with AI then you’ve probably seen these Faceless YouTube channels… Read more: 60 Days of Making Money with my Faceless YouTube Account & AI.

What does the data say?

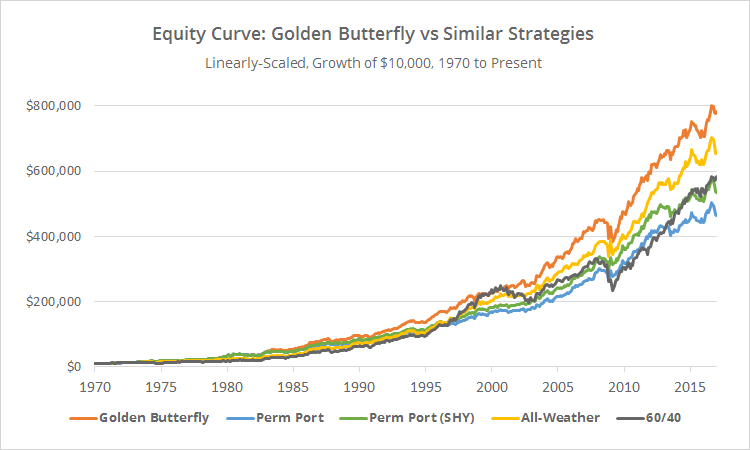

When we look at how this portfolio has performed in the past (which is called backtesting), we see that it doesn’t make as much money as if you put all your money in the stock market. But, it also doesn’t lose as much money when the stock market goes down. This makes it a safer choice, especially for people who can’t afford to lose a lot of money.

Golden Butterfly Portfolio Performance 2022

The Golden Butterfly Portfolio’s performance for the year 2022 was approximately 12.3%. Please note that this is an estimate and the actual performance can vary based on the specific assets held and their performance throughout the year. Source.

Golden Butterfly Portfolio Performance 2023:

In 2023, up until July, the portfolio continued to perform well. The year-to-date return was 8.18%, and the 10-year annualized return slightly decreased to 6.05%. The 1-month return as of June 2023 was 2.48%, and the 6-month return was 6.28%. The dividend yield for the last twelve months was 1.66%. Source.

The Golden Butterfly Portfolio is a way of investing that aims to balance risk and reward. It might not make you super rich, but it also won’t make you super poor. It’s a steady, safer way to invest, especially if you’re just starting out or if you’re more cautious with your money.

Remember, investing always comes with risks, and it’s important to do your research and consider your own financial situation and goals before making any decisions. And it’s never too early to start learning about investing and managing your money wisely!