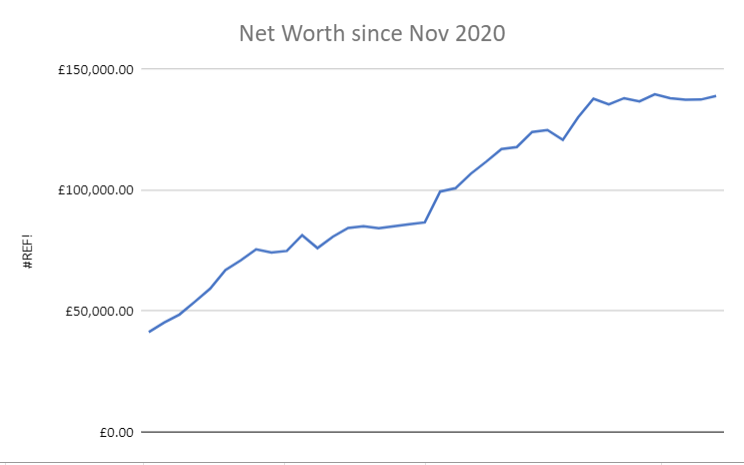

Finished the year without much of a bang, in total I reached £138,949.26 which is about a £1472 increase from last month, and an increase of 14k year on year from December 2022.

Want to follow my journey, get all my updates each month:

For those that are new here. I am Seaward, a 28-year-old living in the UK. Trying to be independently wealthy ASAP so I can focus on the things that bring me more joy. I still have a lot of fun and am not super frugal. Optimizing tax savings, and income rather than being frugal all the time.

Home equity still makes up the vast proportion of my net worth but it has been coming down in recent months. It currently stands at 83.77% (down from 90% at the end of December 2022). The single biggest factor in my net worth has been house price fluctuations. So with them declining slightly (on paper) this year, I am pretty happy that my net worth has improved and steadied over the last few months.

The biggest developments, for the first time in a while, have come from my income increases. It’s hard to track exactly but next year I should make a net income of at least £40k in 2024 which is equivalent to around a £60k gross salary (despite my actual income being around £48k). This is because I “rent a room” to my girlfriend who now lives with me. She gets very cheap rent, and this helps me save more (she also saves more now than she did in rented accommodation – her “rent” is very light for the area!).

The above excludes income from bonuses and RSUs, which should be around £5k gross this year. Bonuses are rare at the moment.

This ALSO excludes income from savings, dividends, blogging etc. Currently, these are minimal (around £100 a year), but I hope to balloon this to be worth at least one day of “normal” work. I’ve been trying a lot of things this year, and plan to sit down and focus on one or two that have worked well for me. This blog is really about documentation rather than any “real” money. Although I have heard of finance bloggers making a lot of money, I’m not sure anyone wants to hear from me.

Combining some of my finances with my partner, and talking to her about them, has been a revelation. You can read more about this topic here: FIRE Update – December 2022 – £124k – (Joint Finances and Life Changes) Working together makes the whole game of life a lot easier. It can be done as a single person, but the system is set up for a team of 2 or more.

Goals for 2024:

For 2024, I want to get this number to £166k, around a 20% increase. Even with house prices staying static, this should be achievable. I want to compound at close to 20% for as long as I can. I didn’t manage it this year, unfortunately (11%).

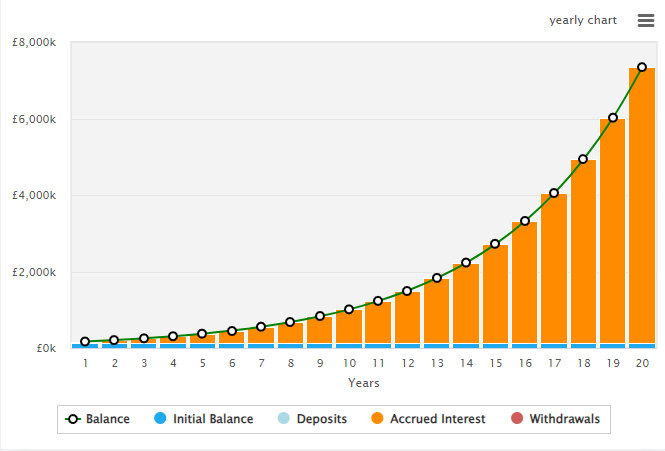

But if I can, I can follow the below chart:

Returning 20% a year is going to be tough in the future when I can’t just save my way there. House prices are unlikely to rise at that kind of rate, so I need the rest of my assets to compound fast or save/earn a lot more. Realistically it’ll be a combination of them all. They say the second 100k is easier than the first, but those people were living in a bull market.

My main concern is the cost of my mortgage going up with interest rates as they are. I could lose 200-300 a month in net cash. That’d hinder my life significantly.

Signing off for 2023. Good luck to all my readers in 2024. May they be healthy and prosperous for you and your loved ones.

Want to follow my journey, more blog posts below:

- Net Worth Update December 2024Finished the year without much of a bang, in total I reached £138,949.26 which is about a £1472 increase from last month, and an increase of 14k year on year from December 2022. For those that are new here. I am Seaward, a 28-year-old living in the UK. Trying to be independently wealthy ASAP so …

- Net Worth Update – November £137,387.68 (-0.5%)Not the prettiest of months, I had to write down my RSUs (which also vest next week and I will be paying tax on!), due to my company being at a 5 year low. Bit of a tough one as I was hoping these RSUs would give me the cash buffer I could do with …

- Net Worth Update – £138K – Oct ’23 (Down £1,573.49)If you are new here I update this blog with my net worth each month, tracking my progress to financial independence. Like many chasing FIRE (Financial Independence Retire Early) I mostly chasing this so I can focus my times on things that I love. To see how I got started you can look at all …

- September 2023 Net Worth Update (+£2935.51)This month was a long one, I feel like I achieved a lot of what I wanted to, and made some dents in my financial goals. There is a lot below, including a total breakdown of my assets and liabilities, and my side hustles / projects that I am hoping will accelerate my towards retirement. …

- August Net Worth Update: £136,923 (Down by £1,362.49)Hello, everyone! As we welcome a new month, it’s time to update you all on my financial journey. Even though August has seen a slight dip in my net worth, it has been a month full of learning and strategies for future growth. I am starting to see various side hustles tick up, albeit very …

- June 2023 Update – £138k – And Why I Am Moving Away From FreeTradeAs we find ourselves in the heart of summer, it’s the perfect time to take a step back and assess our financial journey. For those of us on the path to Financial Independence, Retire Early (FIRE), it’s crucial to regularly review our financial standing, make necessary adjustments, and celebrate our progress. Today, I’m excited to …

- March FIRE Update – +26% YoY £130,380.67 (+£9,381.51)Well, when they said the first 100k is the hardest, they really meant it. Since February, I’ve added £9,381.51 to my net worth. This is roughly 26% to my FIRE target. This year it has been tough to make headway but even in one of the toughest years on record, my net worth has increased …

- FIRE Update – December 2022 – £124k – (Joint Finances and Life Changes)Why it was tough? December was a tough month. Not only were the markets unkind to me (I have feelings too!), but it’s the most expensive month of the year. This was compounded by my decision to go skiing in the French Alps (cost over £1200) and buy very nice presents for the first Christmas …

- October Net Worth – £118,069.63 (+1% / +£840) – 23.61% to FIRE Not the most successful month, house prices seem to have stabilised, and I don’t expect many increases on this front (likely a sell-off in the short-mid term). Still, I am happy to keep forward momentum in a challenging macroeconomic environment. I’ve increased my pension contributions to 15% of my salary and 10% from my employer, …

- Net Worth – September 2022 – 22.40% to FIRE (8.5% yield, and a crashing pound)It has been a strange month. We’ve had some craziness going on in the UK economy that is pretty painful to watch. Interest rates are coming for us and many in FIRE are concerned that their plans may be thwarted. With interest rates going up, those of us that have mortgages are going to be …