Renting vs. Buying (Martin Shkreli’s Thoughts)

In the realm of real estate investment, a question that often arises is whether it’s more beneficial to rent or buy property. This debate is as old as the concept of property ownership itself. Many people believe that buying a property is inherently superior due to the potential for building equity and ownership. However, Martin Shkreli, a renowned financial expert, challenges this commonly held belief and provides a fresh perspective on this age-old debate.

In both the UK and US, buying can have other advantages such as house hacking, I’ve written a couple of pieces on this below that may be worth considering before concluding your decision on this debate:

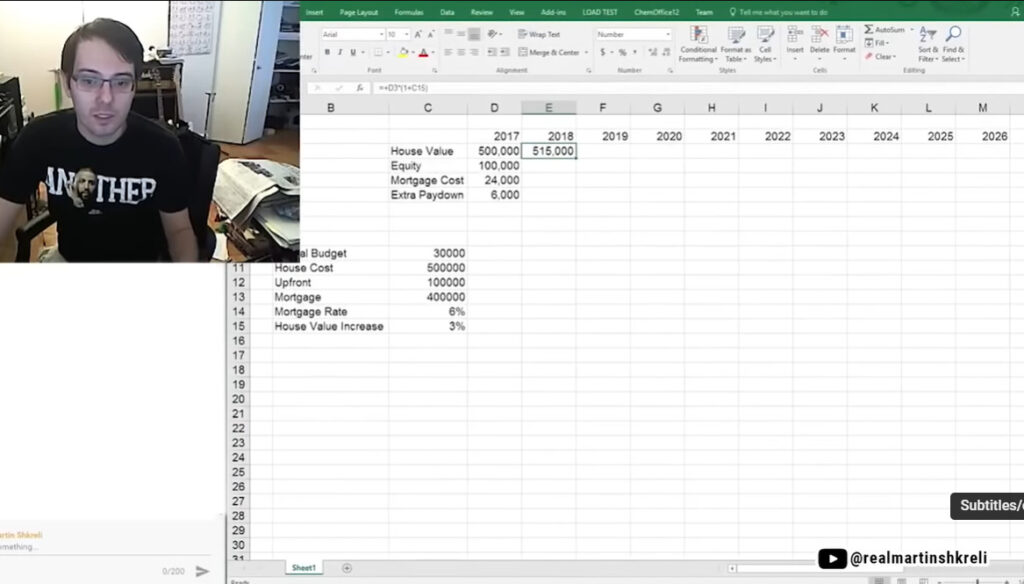

Shkreli introduces a simple model to effectively illustrate his points. Let’s consider a hypothetical scenario where a house is valued at $500,000 with an annual appreciation rate of 3%. This is a scenario often cited by advocates of buying real estate. However, Shkreli promptly emphasizes the unpredictable nature of the housing market, cautioning against assuming perpetual appreciation.

When it comes to the financial aspects, Shkreli highlights the risks associated with leveraging when buying property. Leveraging can indeed amplify returns in prosperous times, but it can also lead to substantial losses if the investment doesn’t perform well. This underscores the significance of understanding the risks involved when taking on large mortgages and investing a considerable portion of one’s net worth in a single asset.

Countering the common perception of real estate as a guaranteed win, Shkreli advocates for a more pragmatic approach. He posits that renting may be a more sensible choice for certain individuals, especially those who value flexibility and seek to avoid the financial burden and speculation linked with home ownership.

To reinforce his viewpoint, Shkreli reminds us of the uncertainty that surrounds real estate markets. While housing prices have historically shown an upward trend, past performance does not ensure future success. Therefore, he urges individuals to exercise caution and avoid overcommitting to a single property without careful evaluation.

In conclusion, Shkreli encourages us to analyze our personal financial circumstances and risk tolerance before making a decision on renting or buying real estate. He cautions against treating property as a foolproof investment, emphasizing that making informed choices based on individual situations and financial goals is essential for long-term financial security. Ultimately, the decision to rent or buy should be approached thoughtfully, with due consideration given to one’s unique circumstances and aspirations.

So, the next time you find yourself contemplating whether to rent or buy, remember Shkreli’s advice: don’t just follow the crowd. Instead, make a decision that aligns with your financial goals, risk tolerance, and lifestyle preferences. After all, the best investment strategy is one that works for you.

- How Much Passive Income I Made From Cloning My Voice on ElevenLabs (1st 48HOURS)

- Make Money By Cloning Your Voice.

- Does Salary Sacrifice affect My Mortgage?

- How to Make 10k on TikTok in 100 Days (A Detailed Guide):

- 60 Days of Making Money with my Faceless YouTube Account & AI.

Subscribe to our newsletter!