Subscribe to our newsletter!

As we find ourselves in the heart of summer, it’s the perfect time to take a step back and assess our financial journey. For those of us on the path to Financial Independence, Retire Early (FIRE), it’s crucial to regularly review our financial standing, make necessary adjustments, and celebrate our progress. Today, I’m excited to share with you my mid-year financial review, where I’ll be discussing my current net worth, my investment strategies, and some changes I’ve made to my portfolio.

The Current State of Affairs

Let’s start with a snapshot of my current financial standing. My house equity stands at a robust £120,035. This is a significant chunk of my net worth and a testament to the power of real estate as a wealth-building tool.

In terms of liquid assets, my current account holds £900, and I have £3557 in CHIP, a smart savings app that automatically puts money aside for you. I also have £757 in a NatWest 6% Digital Saver, a high-interest savings account that’s been a reliable place to park my emergency fund.

My investments in shares, specifically in FreeTrade, have been written down to £2.65 a share, totalling £371. Additionally, I have Restricted Stock Units (RSUs) worth £5000.

My pension pot is divided between a Self-Invested Personal Pension (SIPP) with £2700 and a Scottish Widows pension scheme with £11,200.

After accounting for a slightly expensive month and some investments coming down in value, my total net assets (excluding the house) come to £24,476, a decrease of £200 from the previous month.

The FreeTrade Saga

Now, let’s talk about FreeTrade. They decided to put their fees up at the worst possible time and, despite being user number 1000ish, I have decided to move on to more cost efficient paths. I will be moving my SIPP to Scottish Widows (for ease as my employer provided one and it allows easy ETF access at relatively low fees) and my ISA most likely to Vanguard, it’s currently being held in cash.

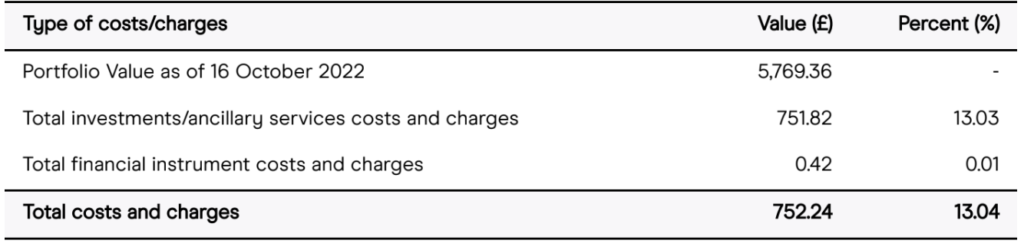

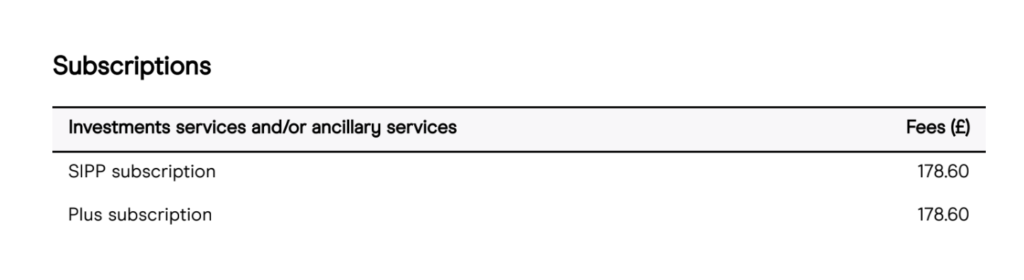

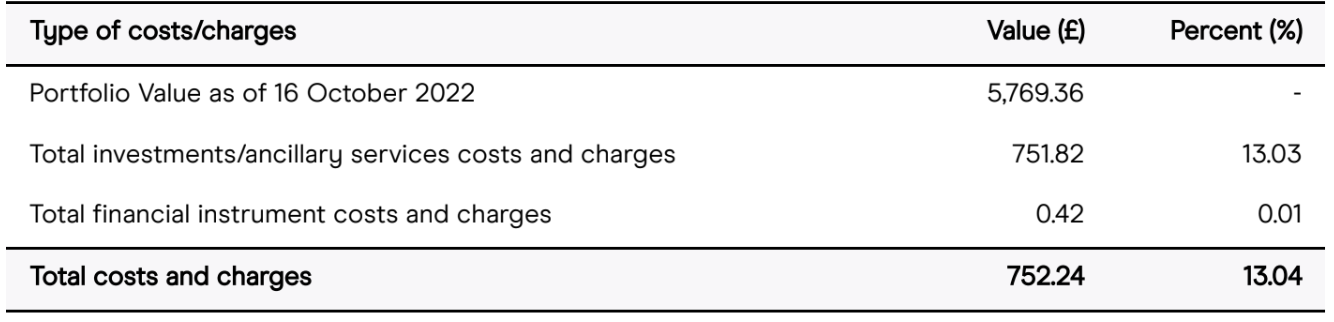

I don’t like being taken advantage of and the costs were already quite high to hold my SIPP their, with their 20% increase in fees I feel it’s time to cut my losses. You will see below that my costs were £752!

While I may have traded a bit too much, the subscription fee alone accounts for nearly £400! I thought FreeTrade were meant to help the little guy, but I feel more likely they are looking for older folks with bigger portfolios. It does seem a shame and I wish them all the best. I believe they could do more to engage with a fantastic community they have around them. But also appreciate times are tough, we all have to do things we don’t want to, but the same applies to me.

Below you will see proof of such costs:

- How Much Passive Income I Made From Cloning My Voice on ElevenLabs (1st 48HOURS)

- Make Money By Cloning Your Voice.

- Does Salary Sacrifice affect My Mortgage?

- How to Make 10k on TikTok in 100 Days (A Detailed Guide):

- 5 Things That Will Compound Faster than the Stock Market in 2024

The Bottom Line

So, where does all this leave me in terms of net worth? After adding up all the numbers, my total net worth comes to £138,286. This is an increase of £2578 from last May, which is a solid step forward on my journey to FIRE.

In fact, this puts me at 27.66% of the way to my FIRE goal. While there’s still a long way to go, I’m proud of the progress I’ve made so far. It’s a testament to the power of consistent saving, smart investing, and the magic of compound interest.

Looking Ahead

As we move into the second half of the year, the financial landscape is riddled with uncertainties. The threat of redundancy looms large, and there are whispers of potential house price crashes. Despite the numbers in my net worth continuing to rise, the anxiety is palpable. It’s a stark reminder that the journey to financial independence is not just about growing our wealth, but also about managing risks and navigating uncertainties.

In these uncertain times, it’s crucial to stay vigilant, make informed decisions, and adapt our financial strategies as necessary. The path to financial independence is not always smooth, but with careful planning and prudent decision-making, we can navigate the bumps along the way.

Despite the uncertainties, I remain committed to my journey towards financial independence. The numbers may go up and down, but the goal remains the same: to build a secure financial future and achieve the freedom to live life on my own terms.

Stay tuned for more updates on my journey to financial independence. And as always, keep growing those money trees, even in the face of adversity!

Pingback: How I Am Saving in this Cost of Living Crisis – Growing Money Trees