Bank of England – Base Rate to 1.75% – Best Savings Rates for UK Savers?

The BOE increased their interest rate this morning by a whopping 0.50% (well, more like 40% increase, the largest rise in 27 years). This was not much of a shock, and most commentators had expected exactly this. Potentially, there is a further rise to 2% on the cards later in the year.

First off, this is a necessary evil. The main purpose of this hike is to get inflation under control, it’s passed my pay grade to say whether it will or not!

Secondly, this has me reflecting on the current savings rates in the UK. For example, I am currently only using Chase UK savings account (which has a rate of 1.5% and allows withdrawals anytime), but my head is thinking about turning. Let’s see what is out there currently, for both regular savings accounts, and easy access savings accounts:

Currently, there does not seem to be much reason to move. Virgin Money is the only one with enough of increase to turn my head, but I am unsure how long it takes to open an account with them (and whether there is a fee) I will have to do some more research.

What I did find on my travels around the internet, is the lovely regular savings account from Nationwide “Flex Regular Saver”. This allows you to:

- Deposit up to £200

- Receive 2.5% interest rate

- Allows 3 withdrawals per year

To me this is a nice compromise, you get a higher interest rate, and you can still withdraw whenever you want (but are limited to 3 times a year). Given the current economic climate, you may want to get easy access to your money, I feel this is a nice blend of both worlds. Ultimately, you should only be withdrawing from your savings when you have a good reason to (big purchase, new house, holiday). If anything this restriction will probably help you! You visit it here: https://www.nationwide.co.uk/savings/flex-regular-saver/

The downside, of course, is that you cannot put a lump sum in, so not suitable for larger investors.

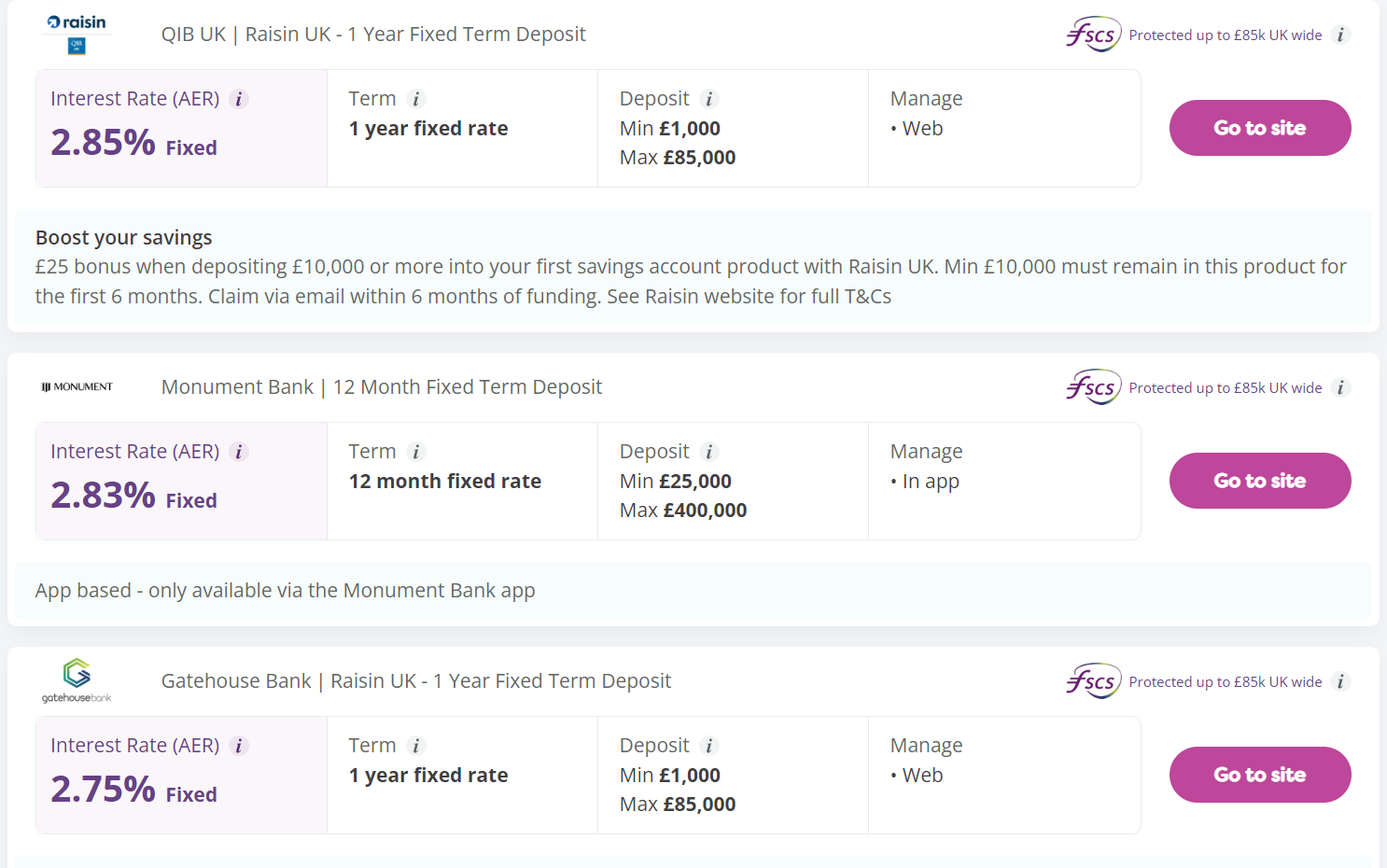

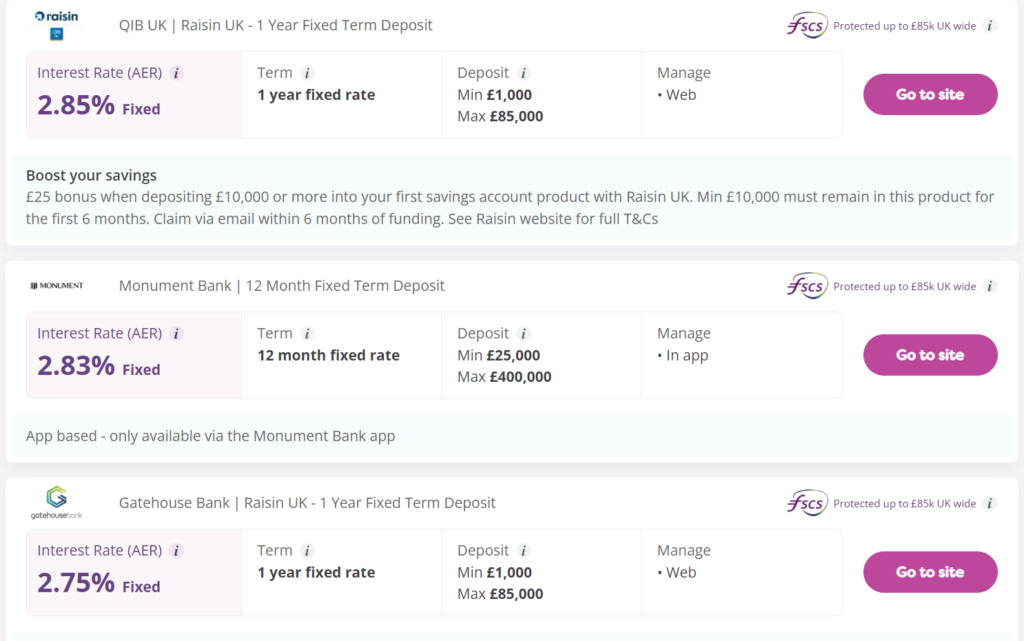

In the 1-year fixed category, you have the below:

My problem with the above, is I don’t really recognize any of these folks. However, the do claim to be FSCS protected, so that risk is mitigated.

Ultimately, it is probably too early to tell what is going on with savings rates in the UK. We should probably wait for the Bank of England’s decision to firmly settle into the market before making any rash decisions.

I would also suggest fixing for 1 year right now might not be the best course of action, given that rates may increase further.

I hope you enjoyed this little post. What are you planning to do after the rate increase? Switch to equities?