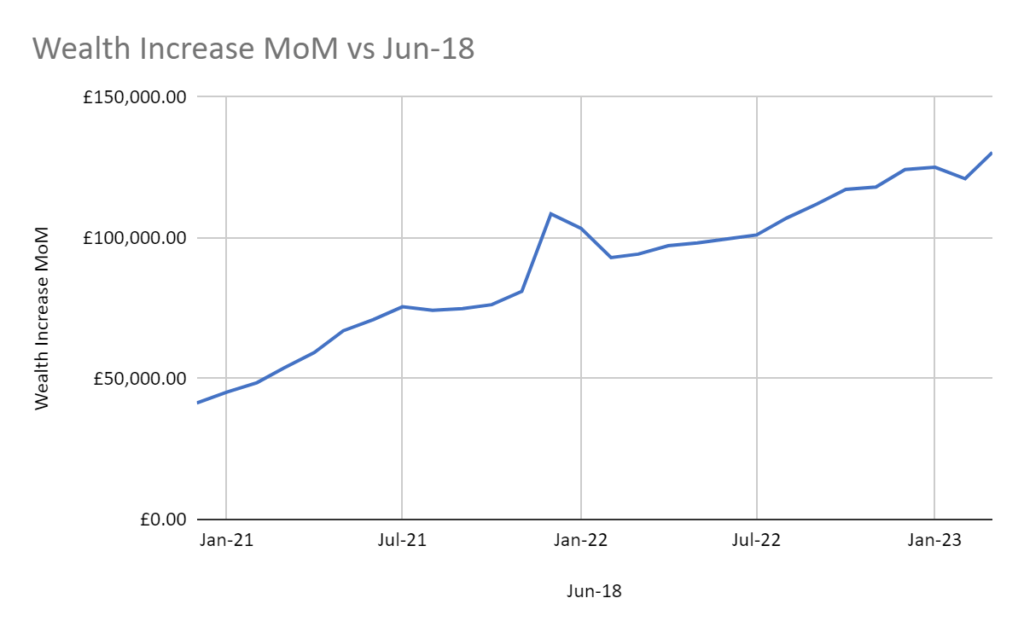

Well, when they said the first 100k is the hardest, they really meant it. Since February, I’ve added £9,381.51 to my net worth. This is roughly 26% to my FIRE target. This year it has been tough to make headway but even in one of the toughest years on record, my net worth has increased about 5% since the start of the year, with dips in house price and investment valuations. All things considered this is amazing.

When I look back to March 2022 my YoY increase is around £35,000 or 26%. If I can compound my net worth at this continued growth rate I will reach my goals much quicker than anticipated (1million in 10 years!). I suspect I may need to adjust my exact target depending on what my partner decides to do, and the kind of support she needs. It’s took me about 5 years of work to reach £100k, and yet it has taken me about 1 year to reach £130k. The compounding effect is really in full flow, and I’m not even earning over £50k yet.

Here is my net worth overtime starting in Dec 2020 and finishing this month (March 2023). When you zoom out it looks smooth, but I promise you it is anything but that! I’ve felt pretty poor during this whole period, but managed to keep forward momentum and I am very happy with my progress. I’ve also managed to do a whole host of things, adventures, hobbies, and holidays so don’t feel I’ve missed out on much (if at all!).

These increase are attributed to:

- Pension contributions (reduced tax burden + employer contributions)

- House price increase (hopefully becoming less reliant on this as I will come on to later)

- Pay increases

- Side hustles (minimal so far)

- RSUs from work

- Cohabiting – reducing outgoings and partner contributions to house

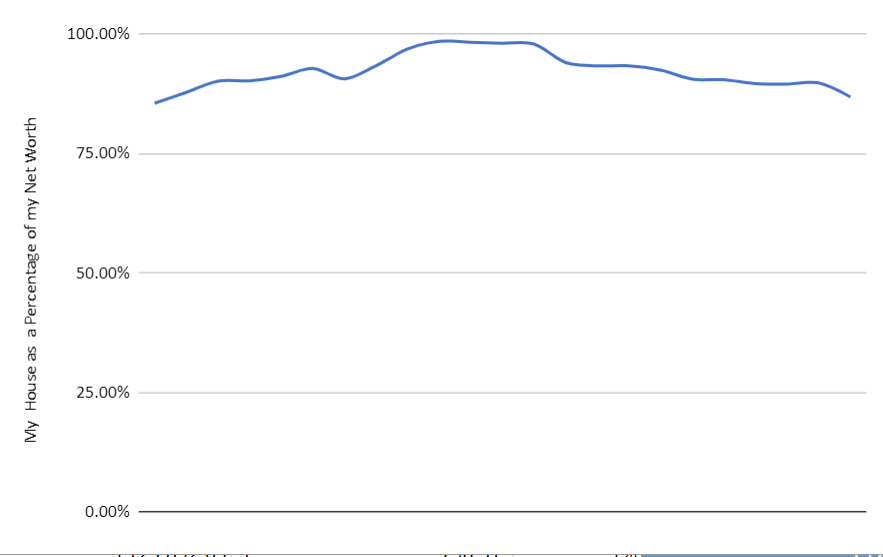

I’m also very happy to note that that my net worth is made up of significantly less real estate (as a percentage) that this time a year ago. Partly, due to house prices coming down, but also mainly due to my other assets growing. This is welcome as I’d like to have options available to me rather than have all my money tied into my house!

Ultimately, a good month in tricky conditions. I’ve budgeted better, exercised more, no drank alcohol, and manage to increase my NW by £9k. I feel no richer, but I guess that is the aim of the game!

I hope you are all doing well out there