-

Make Money By Cloning Your Voice.

Imagine generating revenue for years to come, just by uploading 30 minutes of audio online. Imagine being early to YouTube or TikTok? This could be the opportunity you’ve been waiting for!

-

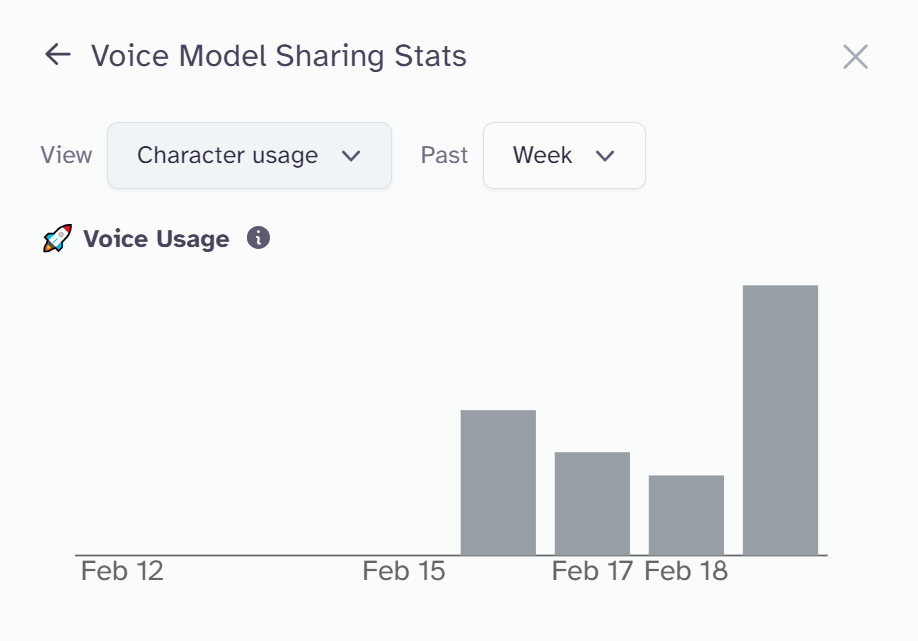

How Much Passive Income I Made From Cloning My Voice on ElevenLabs (1st 48HOURS)

This is one of the rare “actually passive” income streams, it won’t make you rich but it could just help you generate some free cash or Beer Money. I posted an article last week discussing the change ElevenLabs (an AI text-to-voice software) made to their system allowing anyone to make money by cloning their voice. This is…

-

Does Salary Sacrifice affect My Mortgage?

The short answer is, no, your salary sacrifice scheme should not affect your mortgage application. So long as the lender you are applying for takes into account your “gross” income (before deductions), rather than your net income, you shouldn’t need to worry. It’s been noted that Santander in the UK will look at net income…