I recently moved to Trading212 from FreeTrade. If you want to read about the reasons they are here: June 2023 Update – £138k – And Why I Am Moving Away From FreeTrade

3 out of 4 of the following stocks are UK-based, and 3 also pay a growing dividend. The YouTube version of this article can be found here:

Games Workshop: GAW

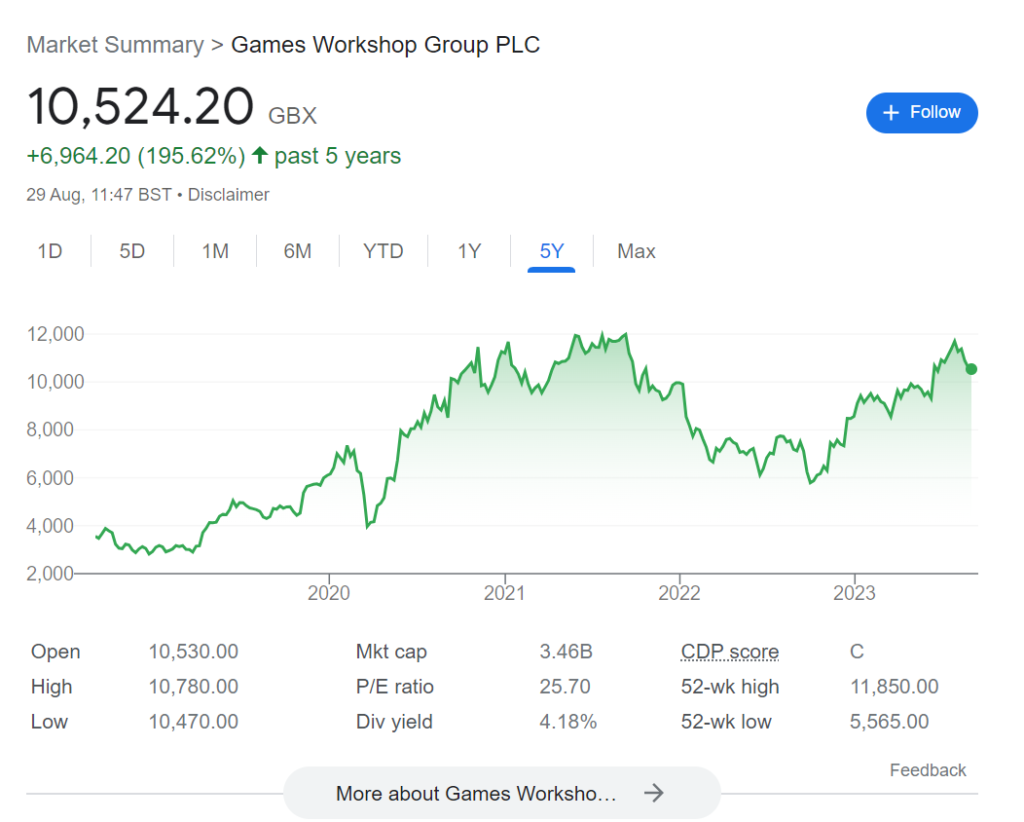

First up is Games Workshop, the company behind Warhammer. They have solid financials and their share price has settled down over the past two years.

They have a lot of catalysts for growth, hey can expand through licensing and content exploration.

Amazon’s hunting for content, and Warhammer fits the bill. They’ve already produced films with Henry Cavill, I would not be surprised to see more. They own their content, and intellectual property, which is gold right now.

This could be a big growth opportunity, with a strong underlying business.

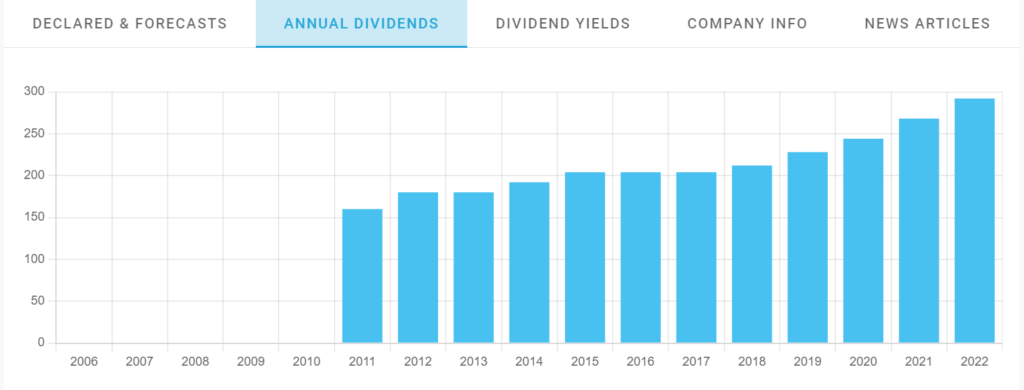

Their dividend used to be pretty low yield but its now at 4%, which in their case I believe to be a sign of stability. Trading a 25 PE makes me feel very comfortable with my investment over the long run. They aren’t cheap, but they are much cheaper than they have been for a long time.

Garmin: Navigating Steady Returns

Moving on to Garmin – masters of navigation gadgets. Their history spans 25-30 years, and they make top-notch products.

Their market cap is $20 billion, and essentially debt free.

They’re consistently profitable, generating around $3 billion last year. The dividend yield’s 2.79%, and there’s room to grow this significantly.

Their growth isn’t explosive, but they’re solid. They’re venturing into aviation and data licensing, offering more avenues for growth.

This stock blends stability with future potential.

GB Group: Cybersecurity and Upside

Their share price had a wild ride, but they did have some executives from AVEVA join. I will do a full write up on this company in the near future. But realised pretty quickly that following successful executives is a surefire way to find a great business. Yes I prefer a great company with a great operator but you don’t find them all the time in the UK, or just anymore.

They have the former CFO and CEO of AVEVA, one of the most successful SaaS companies in the UK (if not most successful), they know how to carefully grow partnerships and sell for many billions (for further examples, the former Chairman went to Ideagen and sold the business). Not just sold, but for £1.3billion.

“More positively, customer retention rates remain unchanged and revenue contributions from new logos were higher than normal – suggesting that contrary to market concerns, the business does not believe it is losing market share.

“The slowdown is a function of net retention, as clients saw lower volumes across their own customer bases. As suggested by the positive initial reaction to April’s trading update, we think the business simply needs to report that things have stopped getting worse to trigger a re-rating.”

Panmure Gordon, Analyst on April Trading Update

It’s the riskiest of my buys but given the amount of value they have lost, I see a lot of upside from the business. Sentiment may change very soon.

If the board were worried it’s unlikely they would have recommended a 5% dividend.

City Pub Group: Cheers to Real Estate Value

Last, meet City Pub Group – a different player in the pub game. I wrote a more in-depth analysis on CPC here: City Pub Group: Share Price should be double where it is currently

They own a lot of their pubs freehold., like a pub version of McDonald’s. They pick premium spots in high-end markets, like Cambridge, Oxford and the city of London.

They charge a lot but target the big spenders, keeping them full even in tough times.

Their market cap is lower than real estate value, making them an asset value gem. They’re buying back shares, showing confidence. With a robust market and growth potential, they’re solid.