Inside Sam Parr’s $10million Dollar Portfolio & How The Rich Think

In today’s rapidly changing financial landscape, it’s essential to have not only a diversified investment strategy but also the willingness to adapt and learn from the success stories of others. I was recently listening to a podcast where he dug into his portfolio, I liked it so much I thought I would share some key takeaways here. I’ll be honest, the underlying assets he buys are not that the most exciting, but the frameworks he uses for making decisions about his life are quite refreshing.

My Net Worth Journey – Want To See How I’m Getting on in my Journey to Financial Independence?

Sam Parr’s financial journey offers valuable insights into the world of investment, macro-economic understanding, and personal financial planning.

Subscribe to our newsletter!

If you don’t know Sam he is the host of the “My First Million” Podcast. Which talks about the ups and downs of entrepreneurship, with plenty of interviews with people using weird and wonderful ways to get very rich.

The underlying principles of his approach can be distilled into several key takeaways.

1. Diversification Is Crucial:

At the heart of Sam Parr’s investment strategy lies diversification, which is evident from the various assets in his $10 million portfolio.

This includes investments in real estate, crypto, stocks, and private companies.

Diversification is not just a buzzword; it’s a means to minimize risks associated with any single investment class. By allocating assets across different types of investments, one can better shield their wealth from unforeseen market downturns.

Sam is in a point of his life when preserving wealth is goal number one (as buffet says, the first rule is not losing money), diversification makes sense. It may not make sense for you though. Warren Buffet once said that “Diversification is a hedge against ignorance”, meaning you if you really understand what you are investing in, and are confident that you are buying something under market value, then why wouldn’t you invest a lot.

In the 1980s Charlie Buffet and Munger where buying 30-50% of the volume of the Coca Cola stock. The stock price didn’t change much for a whole decade whilst they stocked up. Most of us wouldn’t buy the same thing for 10 years without much return, but they had no problem putting up to 40% of their net worth into it at the time.

The 80/20 rule is normally right (20% of your portfolio makes up 80% of your returns) and therefore if you really know what you are doing you should be looking to maximise these stocks. The difficult part, of course, is knowing what to go all in on!

2. Real Estate as a Tangible Asset:

Sam’s emphasis on real estate underscores its importance as a tangible, hard asset in an investor’s portfolio. Real estate offers several advantages, including potential rental income, tax benefits, and appreciation over time. It also serves as a hedge against inflation, providing a layer of security in uncertain economic times. In the ever-volatile world of stocks and cryptocurrencies, real estate often remains a steady, appreciating asset.

So far we have hedged against ignorance, and inflation. Risk On is the appropriate why to describe this portfolio!

3. The Role of Cryptocurrency:

Sam’s allocation to Bitcoin and Ethereum underscores the increasing acceptance of cryptocurrencies in mainstream financial planning. While the crypto market is notorious for its volatility, its potential for high returns is undeniable.

However, understanding the crypto market’s inherent risks and rewards is paramount. As Sam alluded to, the ‘Lindy Effect’—a concept that suggests that the older an idea or technology is, the longer it will likely continue to exist—might provide a guiding principle for evaluating the staying power of cryptocurrencies like Bitcoin. I really like this point by Sam, applying philosophical frameworks seems apt for Bitcoin. Nobody knows its future, and nobody knows how to exactly value it. But more general principles from life can be applied.

4. Stocks and Public Markets:

Sam advocates the use of ETFs over individual stocks. Preferring to invest in an “all world fund”.

Although the stock market can be unpredictable, it remains a central component of wealth accumulation for many. Sam’s diversification into various stocks signifies a balanced approach, ensuring that he isn’t overly exposed to any single sector.

By having stakes in companies that span different industries and regions, one can better ride the ebbs and flows of market cycles.

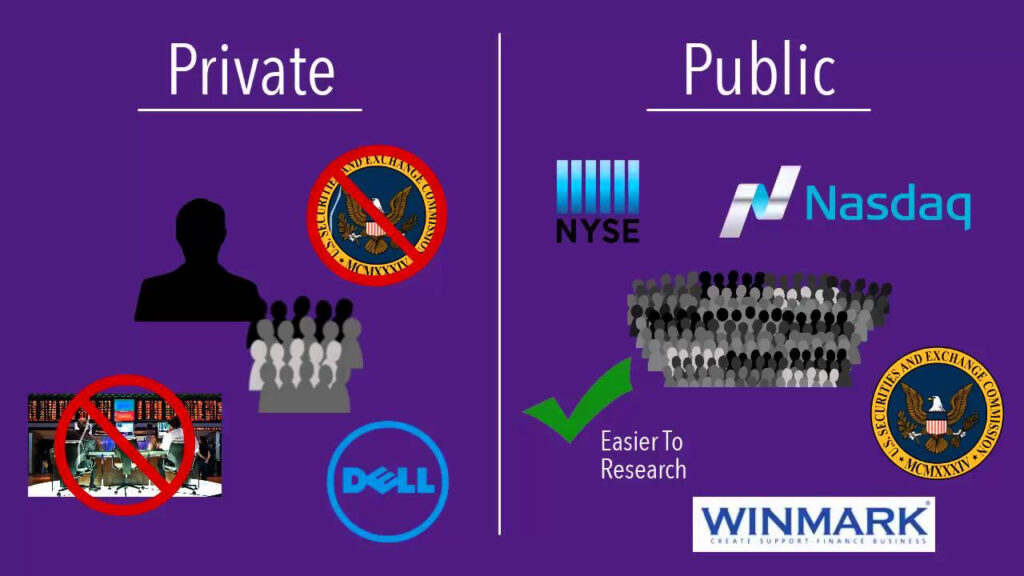

5. Private Company Investments:

Investing in private companies presents an avenue for significant growth, albeit with increased risks.

Sam’s investments in this space allow him to tap into the potential of startups and emerging companies before they might go public or get acquired.

It’s a long-term play, often requiring patience and a deep understanding of the industry in question.

6. Macro Understanding:

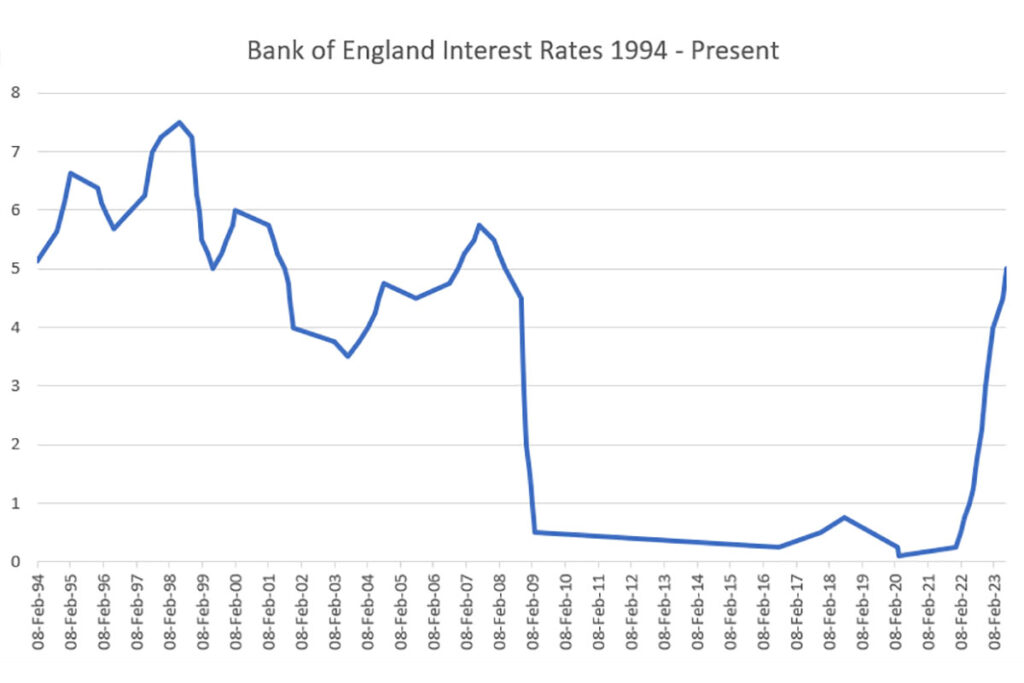

Sam’s foray into learning macroeconomics underscores the importance of understanding the broader financial landscape. By understanding macroeconomic environments he positions himself to make informed decisions based on global economic shifts. This macro view isn’t just about predicting market trends. It’s about understanding the interconnectedness of world economies, from inflation rates in one country to technological advancements in another.

I think we’ve all felt the impact more than ever before these past few years, and with the recent rise in interest rates a lot of people have had a harsh lesson in how global finance works, or at least, how it affects them!

7. Continual Learning and Adaptability:

One of the standout characteristics of Sam’s approach is his willingness to learn continuously. Whether it’s spending time on Wikipedia to understand new concepts or consulting with other experts in the field, Sam highlights the importance of remaining a perpetual student in the investment realm.

This is something I see from almost all successful people. People who are successful in more than just finances too. The ability to learn knew things, sometimes from people that you might not expect to be able to give you much is a great gift.

Steve Jobs famously gave a speech talking about “connecting the dots” looking backwards. He took a calligraphy class when he was an undergraduate, that seems to have no benefit to his career. In the end it helped him to design the best selling product of all time.

8. Evaluating Opinions and Theories:

Instead of immersing himself in every possible financial topic, Sam opts to understand the range of opinions on specific subjects. By identifying and evaluating different theories about financial trends, he’s able to form his own educated opinions. This approach underscores the importance of critical thinking and not just accepting popular narratives at face value.

This becomes clear when you notice the way he will apply seemingly random things (like the Lindy effect) to a new technology. Sometimes this randomness can have profound outcomes. The more points of randomness the more chance of success.

9. Recognizing and Mitigating Biases:

Sam’s introspection about the potential biases he might hold, like the ‘Lindy Effect,’ highlights the importance of self-awareness in investment decisions. Recognizing one’s biases can lead to more balanced and well-thought-out investment strategies.

10. Seeking Mentorship and Collaboration:

Collaboration and mentorship play pivotal roles in Sam’s financial journey. By seeking out mentors like Said from Awesome Corp and tapping into their wisdom, he’s able to leverage their experiences and avoid potential pitfalls.

Sam Parr’s $10 million portfolio offers a holistic view of modern investment strategies, emphasizing diversification, continual learning, and adaptability.

While the specifics of one’s investment journey might differ, the underlying principles of research, understanding, and self-awareness remain universally applicable.

Full Podcast:

As the financial landscape continues to evolve, so too should our strategies and approaches, always with an eye towards sustainable growth and wealth preservation.

Be Curious, Learn Lots and Apply Those Seemingly Disconnect Thoughts to New Things. You never know what you might achieve.